[ Tue, Jul 01st 2025 ]: WHTM

[ Tue, Jul 01st 2025 ]: deseret

[ Tue, Jul 01st 2025 ]: WPXI

[ Tue, Jul 01st 2025 ]: Bravo

[ Tue, Jul 01st 2025 ]: WTXF

[ Tue, Jul 01st 2025 ]: Patch

[ Tue, Jul 01st 2025 ]: WAVE3

[ Tue, Jul 01st 2025 ]: ThePrint

[ Tue, Jul 01st 2025 ]: Variety

[ Tue, Jul 01st 2025 ]: Reuters

[ Tue, Jul 01st 2025 ]: Deadline

[ Tue, Jul 01st 2025 ]: People

[ Tue, Jul 01st 2025 ]: TechRadar

[ Tue, Jul 01st 2025 ]: WIFR

[ Tue, Jul 01st 2025 ]: KCBD

[ Tue, Jul 01st 2025 ]: Impacts

[ Tue, Jul 01st 2025 ]: RepublicWorld

[ Tue, Jul 01st 2025 ]: Fortune

[ Tue, Jul 01st 2025 ]: KY3

[ Tue, Jul 01st 2025 ]: Eurogamer

[ Tue, Jul 01st 2025 ]: 13abc

[ Tue, Jul 01st 2025 ]: Semafor

[ Tue, Jul 01st 2025 ]: KDFW

[ Tue, Jul 01st 2025 ]: Flightglobal

[ Tue, Jul 01st 2025 ]: WDBJ

[ Tue, Jul 01st 2025 ]: PBS

[ Tue, Jul 01st 2025 ]: Forbes

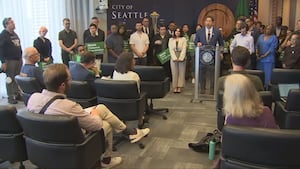

[ Tue, Jul 01st 2025 ]: KIRO

[ Tue, Jul 01st 2025 ]: CNN

[ Tue, Jul 01st 2025 ]: BBC

[ Tue, Jul 01st 2025 ]: LancasterOnline

[ Tue, Jul 01st 2025 ]: WBAY

[ Mon, Jun 30th 2025 ]: Fortune

[ Mon, Jun 30th 2025 ]: KITV

[ Mon, Jun 30th 2025 ]: ABC12

[ Mon, Jun 30th 2025 ]: WHIO

[ Mon, Jun 30th 2025 ]: ThePrint

[ Mon, Jun 30th 2025 ]: CNBC

[ Mon, Jun 30th 2025 ]: deseret

[ Mon, Jun 30th 2025 ]: krtv

[ Mon, Jun 30th 2025 ]: Politico

[ Mon, Jun 30th 2025 ]: Investopedia

[ Mon, Jun 30th 2025 ]: Invezz

[ Mon, Jun 30th 2025 ]: TMCnet

[ Mon, Jun 30th 2025 ]: CNN

[ Mon, Jun 30th 2025 ]: BBC

[ Mon, Jun 30th 2025 ]: Forbes

[ Mon, Jun 30th 2025 ]: purewow

Proposal to lower taxes for small and medium businesses may head to voters

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

A new proposal to lower taxes for most businesses in Seattle could be coming to voters later this year.

The proposal outlines several key measures to lower taxes for SMEs. Firstly, it suggests reducing the corporate tax rate for businesses with annual revenues below a certain threshold. This threshold is set at $50 million, which aims to encompass a broad range of SMEs. The proposed reduction would lower the corporate tax rate from the current 21% to 15% for qualifying businesses. This significant reduction is intended to leave more capital in the hands of business owners, allowing them to reinvest in their operations, expand their workforce, or improve their products and services.

In addition to the corporate tax rate reduction, the proposal includes provisions for increasing the threshold for the small business deduction. Currently, businesses can deduct up to 20% of their qualified business income, but this deduction phases out for higher-income earners. The new proposal would raise the income threshold at which the deduction begins to phase out, allowing more SMEs to benefit from the full deduction. This change is expected to provide additional tax relief to businesses that are just above the current threshold, helping them to retain more of their earnings.

Another aspect of the proposal is the introduction of a new tax credit for businesses that invest in research and development (R&D). The credit would be available to SMEs that spend a certain percentage of their revenue on R&D activities. This measure is designed to encourage innovation and technological advancement among SMEs, which are often at the forefront of developing new products and services. By providing a financial incentive for R&D investment, the proposal aims to foster a more competitive and innovative business environment.

The article also discusses the potential economic impacts of the proposed tax changes. Proponents of the proposal argue that lowering taxes for SMEs will lead to increased economic activity and job creation. They point to studies that show a correlation between lower tax rates and higher levels of business investment and employment. By reducing the tax burden on SMEs, the proposal is expected to stimulate economic growth, particularly in sectors that are heavily reliant on small and medium-sized businesses.

However, the article also presents the views of critics who express concerns about the potential fiscal impact of the proposal. Some argue that the tax cuts could lead to a significant reduction in government revenue, which could necessitate cuts to public services or increases in other taxes. Critics also question whether the benefits of the tax cuts will be passed on to employees and consumers, or if they will primarily benefit business owners and shareholders. They call for a more comprehensive analysis of the proposal's long-term effects on the economy and society.

The article includes reactions from various stakeholders, including business owners, industry associations, and economic experts. Many business owners express support for the proposal, citing the challenges they face in a competitive market and the need for tax relief to help them grow and sustain their operations. Industry associations, such as the National Federation of Independent Business, also endorse the proposal, arguing that it will level the playing field for SMEs and enable them to compete more effectively with larger corporations.

Economic experts offer a range of opinions on the proposal. Some believe that the tax cuts could have a positive impact on economic growth, particularly if they lead to increased investment and job creation. Others caution that the benefits may be short-lived and that the long-term effects on government revenue and public services need to be carefully considered. They suggest that the proposal should be accompanied by measures to ensure that the tax cuts are used to stimulate economic activity rather than simply increasing profits for business owners.

The article also discusses the political context of the proposal, noting that it has been introduced by a bipartisan group of lawmakers. This bipartisan support is seen as a positive sign for the proposal's chances of passing, as it suggests a broad consensus on the need to support SMEs. However, the article notes that the proposal will still face scrutiny and debate in the legislative process, with lawmakers likely to propose amendments and modifications to address concerns and improve the proposal's effectiveness.

In conclusion, the article provides a comprehensive overview of the proposal to lower taxes for small and medium-sized enterprises. It outlines the key measures of the proposal, including the reduction of the corporate tax rate, the increase in the small business deduction threshold, and the introduction of a new R&D tax credit. The article also discusses the potential economic impacts of the proposal, presenting the views of proponents and critics, as well as reactions from various stakeholders. The political context of the proposal is also examined, highlighting the bipartisan support and the challenges it may face in the legislative process. Overall, the article offers a detailed and balanced analysis of a significant policy proposal aimed at supporting the growth and success of SMEs.

Read the Full KIRO Article at:

[ https://www.yahoo.com/news/proposal-lower-taxes-small-medium-020052573.html ]

Similar Business and Finance Publications

[ Sat, Jun 28th 2025 ]: montanarightnow

[ Sun, Apr 20th 2025 ]: CNN

[ Wed, Mar 19th 2025 ]: WJCL

[ Thu, Feb 20th 2025 ]: MSN

[ Tue, Feb 11th 2025 ]: cnbctv18

[ Tue, Jan 14th 2025 ]: Investopedia