Axon Stock Soars After Beating Earnings

CNBC

CNBCLocales: Virginia, Maryland, UNITED STATES

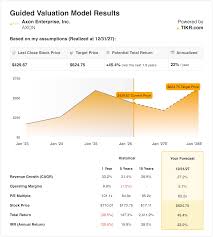

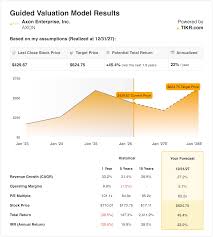

SCOTTSDALE, AZ - February 25th, 2026 - Axon Enterprise (AXON) experienced a significant boost in after-hours trading today, following the release of a fourth-quarter earnings report that exceeded analyst expectations and optimistic guidance for the full year 2026. The company, a leading provider of technology solutions for law enforcement, demonstrated robust financial performance, driven by strong demand for its body-worn cameras, tasers, and increasingly important cloud-based software services.

Axon reported earnings of 37 cents per share, excluding certain items, on revenue of $179.8 million. This result comfortably surpassed the Refinitiv consensus estimate of 32 cents per share on revenue of $170.4 million. CEO Casey Shillings attributed the success to "strong fourth-quarter performance and the continued momentum we are seeing across our product portfolio," signaling a sustained trajectory of growth for the company.

The standout performance within Axon's financial results was the 36% year-over-year growth in its software and cloud services revenue. This highlights the company's successful transition towards a subscription-based revenue model - a strategic shift that is proving highly effective in generating predictable, recurring income. While the hardware business, encompassing body-worn cameras and Conducted Electrical Weapons (CEWs, commonly known as tasers), remains a crucial component of Axon's revenue stream, the emphasis on software is reshaping the company's financial profile.

Looking ahead, Axon anticipates revenue between $760 million and $800 million for the full year 2026. This optimistic forecast exceeds analyst expectations of $743.5 million, further cementing investor confidence in the company's future prospects. The guidance suggests Axon is effectively navigating the evolving landscape of law enforcement technology and is well-positioned to capitalize on growing demand.

A Pivotal Role in Modern Policing

Axon's success is deeply intertwined with the significant shifts occurring within the law enforcement sector. In recent years, a confluence of factors - including rising violent crime rates in some areas and heightened public scrutiny of police practices - has created an urgent need for greater transparency and accountability. Axon's products directly address these concerns. Body-worn cameras provide a crucial record of interactions between officers and the public, fostering trust and offering a valuable resource for investigations. CEWs offer a less-lethal alternative to traditional firearms, allowing officers to de-escalate potentially dangerous situations. And the Evidence.com cloud platform provides a secure and centralized system for managing digital evidence, streamlining investigations and improving efficiency.

The demand for these technologies isn't merely reactive to current events; it represents a fundamental change in the expectations placed on law enforcement agencies. Communities are increasingly demanding accountability, and agencies are proactively adopting technologies that can demonstrate transparency and build public trust. This dynamic is expected to continue driving demand for Axon's solutions in the coming years.

Beyond Hardware: A Software-Driven Future

While the initial appeal of Axon's products was rooted in hardware, the company's strategic focus on software is proving to be a game-changer. Evidence.com, Axon's cloud-based digital evidence management platform, is becoming an increasingly integral part of law enforcement workflows. It not only stores and manages vast amounts of video and digital evidence but also offers advanced analytics and investigative tools. This allows agencies to quickly search, analyze, and share critical information, improving investigative outcomes and enhancing public safety.

The subscription-based model for Evidence.com provides Axon with a stable and predictable revenue stream, reducing reliance on cyclical hardware purchases. This model also fosters long-term relationships with law enforcement agencies, creating opportunities for upselling and cross-selling of additional software solutions. Axon is actively expanding its software offerings, incorporating features such as records management, dispatch systems, and computer-aided dispatch (CAD) integration.

Market Performance and Future Outlook

Axon's strong financial performance has been reflected in its stock price. Shares have risen roughly 40% in the past year, significantly outpacing the broader market. This impressive growth demonstrates investor confidence in the company's long-term potential. Analysts predict that Axon will continue to benefit from the growing demand for law enforcement technology and its successful transition towards a software-driven business model. The company's strong balance sheet and commitment to innovation further position it for sustained growth in the years ahead. Investors will be closely watching Axon's continued development and adoption of AI technologies within their platforms, potentially offering new levels of insight and efficiency to law enforcement agencies.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2026/02/25/axon-enterprise-axon-q4-2025-earnings.html ]