[ Today @ 11:05 AM ]: Irish Examiner

[ Today @ 11:04 AM ]: Cleveland.com

[ Today @ 11:02 AM ]: Impacts

[ Today @ 11:02 AM ]: bjpenn

[ Today @ 10:02 AM ]: AZ Central

[ Today @ 09:43 AM ]: Jerusalem Post

[ Today @ 09:41 AM ]: Finbold | Finance in Bold

[ Today @ 09:01 AM ]: CoinTelegraph

[ Today @ 08:45 AM ]: The Citizen

[ Today @ 08:43 AM ]: Seeking Alpha

[ Today @ 08:42 AM ]: Fortune

[ Today @ 08:41 AM ]: reuters.com

[ Today @ 08:22 AM ]: Seeking Alpha

[ Today @ 08:03 AM ]: BBC

[ Today @ 08:02 AM ]: CNN

[ Today @ 07:44 AM ]: syracuse.com

[ Today @ 07:43 AM ]: Reading Eagle, Pa.

[ Today @ 07:41 AM ]: Forbes

[ Today @ 07:21 AM ]: CNN

[ Today @ 07:01 AM ]: Milwaukee Journal Sentinel

[ Today @ 06:21 AM ]: South Bend Tribune

[ Today @ 05:21 AM ]: The Scotsman

[ Today @ 04:42 AM ]: reuters.com

[ Today @ 04:22 AM ]: USA TODAY

[ Today @ 04:01 AM ]: moneycontrol.com

[ Today @ 02:22 AM ]: Business Today

[ Today @ 02:21 AM ]: Impacts

[ Today @ 02:01 AM ]: BBC

[ Today @ 01:23 AM ]: moneycontrol.com

[ Today @ 12:41 AM ]: rnz

[ Today @ 12:21 AM ]: Daily Record

[ Yesterday Evening ]: The Globe and Mail

[ Yesterday Evening ]: AFP

[ Yesterday Evening ]: Reuters

[ Yesterday Evening ]: yahoo.com

[ Yesterday Evening ]: Toronto Star

[ Yesterday Evening ]: WKBN Youngstown

[ Yesterday Evening ]: The Herald Bulletin, Anderson, Ind.

[ Yesterday Evening ]: SB Nation

[ Yesterday Evening ]: Seeking Alpha

[ Yesterday Evening ]: Bill Williamson

[ Yesterday Afternoon ]: Business Insider

[ Yesterday Afternoon ]: WSFA

[ Yesterday Afternoon ]: HousingWire

[ Yesterday Afternoon ]: The Independent US

[ Yesterday Afternoon ]: NBC Chicago

[ Yesterday Afternoon ]: The Independent

[ Yesterday Afternoon ]: PC Magazine

[ Yesterday Afternoon ]: PC Magazine

[ Yesterday Afternoon ]: Anfield Watch

[ Yesterday Afternoon ]: The Advocate

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: The Irish News

[ Yesterday Afternoon ]: WKBN Youngstown

[ Yesterday Afternoon ]: The Financial Express

[ Yesterday Afternoon ]: Bill Williamson

[ Yesterday Morning ]: Fortune

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: The New York Times

[ Yesterday Morning ]: Ghanaweb.com

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: Ghanaweb.com

[ Yesterday Morning ]: Seeking Alpha

[ Yesterday Morning ]: Daily Inter Lake, Kalispell, Mont.

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: The Financial Express

[ Yesterday Morning ]: The Motley Fool

[ Yesterday Morning ]: Simply Recipes

[ Yesterday Morning ]: The Scotsman

[ Yesterday Morning ]: CNN

[ Yesterday Morning ]: The West Australian

[ Yesterday Morning ]: London Evening Standard

[ Yesterday Morning ]: KFDX Wichita Falls

[ Yesterday Morning ]: The Independent

[ Yesterday Morning ]: MLB

[ Last Sunday ]: Seeking Alpha

[ Last Sunday ]: FOX 10 Phoenix

[ Last Sunday ]: Utah News Dispatch

[ Last Sunday ]: Ghanaweb.com

[ Last Sunday ]: Seeking Alpha

[ Last Sunday ]: CNN

[ Last Sunday ]: ThePrint

[ Last Sunday ]: MLB

[ Last Sunday ]: Toronto Star

[ Last Sunday ]: The Cult of Calcio

[ Last Sunday ]: Business Today

[ Last Sunday ]: Impacts

[ Last Sunday ]: CNN

[ Last Sunday ]: BBC

[ Last Sunday ]: Cleveland.com

[ Last Sunday ]: Reuters

[ Last Sunday ]: St. Louis Post-Dispatch

[ Last Sunday ]: BBC

[ Last Sunday ]: ESPN

[ Last Sunday ]: Ghanaweb.com

[ Last Saturday ]: PC Magazine

[ Last Saturday ]: Cumberland Times News, Md.

[ Last Saturday ]: Zee Business

[ Last Saturday ]: Ghanaweb.com

[ Last Saturday ]: Fortune

[ Last Saturday ]: This is Money

[ Last Saturday ]: The Financial Express

[ Last Saturday ]: The Jamestown Sun, N.D.

[ Last Saturday ]: Forbes

[ Last Saturday ]: The Honolulu Star-Advertiser

[ Last Saturday ]: Reuters

[ Last Saturday ]: BBC

[ Last Saturday ]: The Globe and Mail

[ Last Saturday ]: inforum

[ Last Saturday ]: Ghanaweb.com

[ Last Saturday ]: NBC 7 San Diego

[ Last Saturday ]: The Straits Times

[ Last Saturday ]: BBC

[ Last Saturday ]: Sky News Australia

[ Last Saturday ]: Channel NewsAsia Singapore

[ Last Friday ]: firstalert4.com

[ Last Friday ]: Detroit Free Press

[ Last Friday ]: CBSSports.com

[ Last Friday ]: WMUR

[ Last Friday ]: Sports Illustrated

[ Last Friday ]: Business Insider

[ Last Friday ]: The Daily Caller

[ Last Friday ]: Patch

[ Last Friday ]: CoinTelegraph

[ Last Friday ]: 13abc

[ Last Friday ]: Reuters

[ Last Friday ]: Forbes

[ Last Friday ]: fox6now

[ Last Friday ]: TechRadar

[ Last Friday ]: Daily Record

[ Last Friday ]: CNN

[ Last Friday ]: Sports Illustrated

[ Last Friday ]: Maryland Matters

[ Last Friday ]: London Evening Standard

[ Last Friday ]: Forbes

[ Last Friday ]: reuters.com

[ Last Friday ]: The 74

[ Last Friday ]: Toronto Star

[ Last Friday ]: Washington State Standard

[ Last Friday ]: Finbold | Finance in Bold

[ Last Friday ]: WISH-TV

[ Last Friday ]: Seeking Alpha

[ Last Friday ]: KSTP-TV

[ Last Friday ]: Impacts

[ Last Friday ]: Canary Media

[ Last Friday ]: The Irish News

[ Last Friday ]: Chicago Sun-Times

[ Last Friday ]: NBC Los Angeles

[ Last Friday ]: Seeking Alpha

[ Last Friday ]: The Independent

[ Last Friday ]: BBC

[ Last Friday ]: Associated Press

[ Last Friday ]: KTAL Shreveport

[ Last Thursday ]: CBSSports.com

[ Last Thursday ]: KOTA TV

[ Last Thursday ]: The Financial Express

[ Last Thursday ]: Louisiana Illuminator

[ Last Thursday ]: Fox News

[ Last Thursday ]: Knoxville News Sentinel

[ Last Thursday ]: CNN

[ Last Thursday ]: Seeking Alpha

[ Last Thursday ]: This is Money

[ Last Thursday ]: The Economist

[ Last Thursday ]: Buffalo News

[ Last Thursday ]: Reuters

[ Last Thursday ]: Observer

[ Last Thursday ]: KUTV

[ Last Thursday ]: Associated Press

[ Last Thursday ]: The Independent

[ Last Thursday ]: The Hans India

[ Last Thursday ]: The Globe and Mail

[ Last Thursday ]: TechRadar

[ Last Thursday ]: CBS News

[ Last Thursday ]: Ghanaweb.com

[ Last Thursday ]: BBC

[ Last Thursday ]: legit

[ Last Thursday ]: stacker

[ Last Thursday ]: AZ Central

[ Last Thursday ]: The Indianapolis Star

[ Last Thursday ]: moneycontrol.com

[ Last Thursday ]: Toronto Star

[ Last Thursday ]: The Salt Lake Tribune

[ Last Thursday ]: Daily Record

[ Last Thursday ]: Forbes

[ Last Thursday ]: reuters.com

[ Last Thursday ]: Artemis

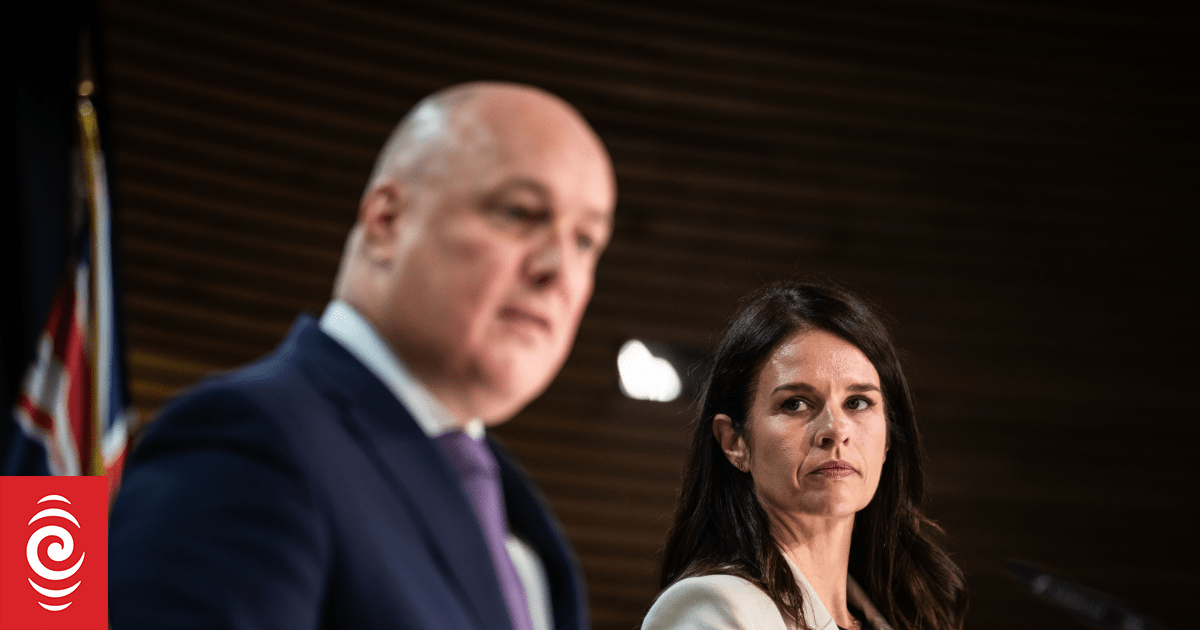

Watch: Changes to business investor visa announced

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Immigration lawyers have been worried by a dramatic drop in the number of millionaires receiving so-called golden visas.

Major Overhaul Announced for New Zealand's Business Investor Visa Scheme

In a significant move aimed at bolstering New Zealand's economy and ensuring that foreign investment delivers tangible benefits, the government has unveiled sweeping changes to the Active Investor Plus Visa program. Immigration Minister Erica Stanford made the announcement during a press conference in Wellington, emphasizing the need to attract "high-value" investors who actively contribute to job creation, innovation, and economic growth rather than those engaging in passive financial placements. The reforms, set to take effect immediately, represent a pivot from previous policies that critics argued allowed wealthy migrants to gain residency through low-risk investments without substantial local impact.

At the heart of the changes is a heightened focus on directing investments toward productive sectors of the New Zealand economy. Under the revised scheme, applicants for the Active Investor Plus Visa must commit a minimum of NZ$5 million in direct investments into New Zealand-based businesses or ventures. This is a marked increase from the previous threshold, which allowed for a broader range of investment options, including government bonds and property funds. Stanford highlighted that the old system often resulted in funds being funneled into passive assets, such as bonds, which provided residency perks but minimal economic stimulus. "We're shifting the emphasis to investments that create jobs, support startups, and drive innovation," she stated, underscoring the government's commitment to a more dynamic immigration policy.

One of the key stipulations in the new framework is the prohibition of passive investments. Previously, investors could qualify by placing funds in managed funds or bonds, which required little ongoing involvement. Now, the visa mandates that at least 50% of the investment be allocated to "active" opportunities, such as equity stakes in New Zealand companies, venture capital funds focused on local tech or agribusiness, or direct funding for infrastructure projects. This change is designed to ensure that investor capital circulates within the domestic economy, fostering entrepreneurship and regional development. For instance, investments in high-growth sectors like renewable energy, biotechnology, and digital technology will be prioritized, aligning with New Zealand's broader economic strategy to transition toward a sustainable, knowledge-based economy.

To further refine the applicant pool, the government has introduced stricter eligibility criteria. Prospective investors must now demonstrate proficiency in English, with a minimum IELTS score of 5.0 or equivalent, to ensure they can integrate effectively into New Zealand society and business environments. Additionally, there will be a cap on the number of visas issued annually, though exact figures were not disclosed during the announcement. Stanford explained that this measure prevents an influx of applications that could overwhelm administrative resources and dilute the program's quality. "We want quality over quantity," she remarked, noting that the changes draw inspiration from successful investor programs in countries like Australia and Canada, which have similarly tightened rules to maximize economic returns.

The announcement comes amid growing scrutiny of New Zealand's immigration policies, particularly in the wake of post-pandemic economic challenges. Critics of the previous investor visa scheme, including opposition parties and economic analysts, have long argued that it functioned more as a "golden visa" for the ultra-wealthy, enabling them to secure residency without meaningful contributions. For example, data from Immigration New Zealand has shown that a significant portion of past approvals involved investments in government bonds, which, while safe, did little to spur job growth or innovation. By contrast, the reformed visa aims to emulate models where investors are required to establish or expand businesses, potentially creating hundreds of new employment opportunities.

Stanford elaborated on the potential benefits during the press conference, painting a picture of a revitalized economy. "Imagine foreign capital helping to scale up our clean energy projects or boosting our agritech exports," she said. "These changes will ensure that every dollar invested works harder for New Zealanders." The minister also addressed concerns about housing affordability, a hot-button issue in the country, by confirming that property investments—often blamed for inflating real estate prices—will no longer qualify under the scheme unless they involve commercial developments that generate jobs.

Background on the Active Investor Plus Visa reveals its evolution from earlier iterations. Introduced in 2022 as a replacement for the Investor 1 and Investor 2 categories, the program was initially designed to lure high-net-worth individuals amid global competition for talent and capital. However, uptake has been lower than anticipated, with only a handful of approvals in recent years. Analysts attribute this to the high investment thresholds and global economic uncertainties, including inflation and geopolitical tensions. The government's decision to overhaul the visa now reflects a broader policy shift under the current administration, which has prioritized economic recovery, border security, and targeted migration.

Stakeholder reactions to the announcement have been mixed but largely positive. Business leaders, such as those from the New Zealand Institute of Directors, welcomed the reforms, arguing that they will attract genuine entrepreneurs who can mentor local startups and transfer valuable skills. "This is a step toward making New Zealand a hub for innovation," said Simon Arcus, chief executive of the institute. On the other hand, immigration advocates expressed cautious optimism, urging the government to monitor the changes to avoid deterring legitimate investors from diverse backgrounds. "We need to ensure the language requirements don't create unnecessary barriers," noted one advocate, highlighting potential equity issues.

Economists have weighed in on the potential impacts, suggesting that the reforms could inject billions into the economy over the next decade if successful. By mandating active investments, the scheme could lead to the creation of new ventures in underserved regions, such as rural areas dependent on agriculture and tourism. For example, an investor funding a sustainable farming initiative could not only meet visa requirements but also address environmental challenges like water management and carbon emissions. Furthermore, the emphasis on job creation aligns with the government's employment goals, particularly in light of recent labor shortages in sectors like healthcare and construction.

Looking ahead, the implementation of these changes will involve close collaboration between Immigration New Zealand, the Ministry of Business, Innovation and Employment, and private sector partners. Applicants will need to submit detailed business plans outlining how their investments will benefit the local economy, with independent assessments to verify viability. Stanford assured that transitional arrangements would be in place for those already in the application pipeline, minimizing disruptions.

In a global context, New Zealand's reforms mirror a worldwide trend toward more stringent investor migration programs. Countries like the United Kingdom and Portugal have recently scaled back or eliminated similar "golden visa" schemes due to concerns over money laundering and economic inequality. By contrast, New Zealand's approach seeks to balance openness to investment with safeguards, positioning the country as an attractive destination for ethical, high-impact capital.

The announcement also ties into broader immigration reforms under Stanford's portfolio. Since taking office, the minister has overseen adjustments to work visas, family reunification policies, and skilled migration pathways, all aimed at addressing skill gaps while protecting local workers. "Immigration should be a tool for prosperity, not a loophole," she emphasized.

As the changes roll out, monitoring their effectiveness will be crucial. Will they succeed in drawing the right kind of investors, or could they inadvertently reduce overall interest? Early indicators suggest optimism, with inquiries from potential applicants already spiking following the announcement. For New Zealand, a small island nation reliant on global trade and innovation, getting this right could mean the difference between stagnation and sustained growth.

In summary, these visa changes represent a bold recalibration of New Zealand's approach to investor migration. By prioritizing active, productive investments, the government hopes to harness foreign wealth for domestic benefit, creating a win-win scenario that strengthens the economy while upholding the integrity of the immigration system. As Stanford concluded her remarks, "This is about building a brighter future for all Kiwis through smart, strategic investment." The full details of the reforms are available on the Immigration New Zealand website, with applications under the new criteria opening soon. (Word count: 1,128)

Read the Full rnz Article at:

[ https://www.rnz.co.nz/news/political/541340/watch-changes-to-business-investor-visa-announced ]