[ Yesterday Evening ]: Reuters

[ Yesterday Evening ]: yahoo.com

[ Yesterday Evening ]: Toronto Star

[ Yesterday Evening ]: WKBN Youngstown

[ Yesterday Evening ]: The Herald Bulletin, Anderson, Ind.

[ Yesterday Evening ]: SB Nation

[ Yesterday Evening ]: Seeking Alpha

[ Yesterday Evening ]: Bill Williamson

[ Yesterday Afternoon ]: Business Insider

[ Yesterday Afternoon ]: WSFA

[ Yesterday Afternoon ]: HousingWire

[ Yesterday Afternoon ]: The Independent US

[ Yesterday Afternoon ]: NBC Chicago

[ Yesterday Afternoon ]: The Independent

[ Yesterday Afternoon ]: PC Magazine

[ Yesterday Afternoon ]: PC Magazine

[ Yesterday Afternoon ]: PC Magazine

[ Yesterday Afternoon ]: Anfield Watch

[ Yesterday Afternoon ]: The Advocate

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: The Irish News

[ Yesterday Afternoon ]: WKBN Youngstown

[ Yesterday Afternoon ]: The Financial Express

[ Yesterday Afternoon ]: Bill Williamson

[ Yesterday Morning ]: Fortune

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: The New York Times

[ Yesterday Morning ]: Ghanaweb.com

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: Ghanaweb.com

[ Yesterday Morning ]: Seeking Alpha

[ Yesterday Morning ]: Daily Inter Lake, Kalispell, Mont.

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: The Financial Express

[ Yesterday Morning ]: The Motley Fool

[ Yesterday Morning ]: Simply Recipes

[ Yesterday Morning ]: The Scotsman

[ Yesterday Morning ]: CNN

[ Yesterday Morning ]: The West Australian

[ Yesterday Morning ]: London Evening Standard

[ Yesterday Morning ]: KFDX Wichita Falls

[ Yesterday Morning ]: The Independent

[ Yesterday Morning ]: MLB

[ Last Sunday ]: Seeking Alpha

[ Last Sunday ]: FOX 10 Phoenix

[ Last Sunday ]: Utah News Dispatch

[ Last Sunday ]: Ghanaweb.com

[ Last Sunday ]: Seeking Alpha

[ Last Sunday ]: CNN

[ Last Sunday ]: ThePrint

[ Last Sunday ]: MLB

[ Last Sunday ]: Toronto Star

[ Last Sunday ]: The Cult of Calcio

[ Last Sunday ]: Business Today

[ Last Sunday ]: Impacts

[ Last Sunday ]: CNN

[ Last Sunday ]: BBC

[ Last Sunday ]: Cleveland.com

[ Last Sunday ]: Reuters

[ Last Sunday ]: St. Louis Post-Dispatch

[ Last Sunday ]: BBC

[ Last Sunday ]: ESPN

[ Last Sunday ]: Ghanaweb.com

[ Last Saturday ]: PC Magazine

[ Last Saturday ]: Cumberland Times News, Md.

[ Last Saturday ]: Zee Business

[ Last Saturday ]: Ghanaweb.com

[ Last Saturday ]: Fortune

[ Last Saturday ]: This is Money

[ Last Saturday ]: The Financial Express

[ Last Saturday ]: The Jamestown Sun, N.D.

[ Last Saturday ]: Forbes

[ Last Saturday ]: The Honolulu Star-Advertiser

[ Last Saturday ]: Reuters

[ Last Saturday ]: BBC

[ Last Saturday ]: The Globe and Mail

[ Last Saturday ]: inforum

[ Last Saturday ]: Ghanaweb.com

[ Last Saturday ]: NBC 7 San Diego

[ Last Saturday ]: The Straits Times

[ Last Saturday ]: BBC

[ Last Saturday ]: Sky News Australia

[ Last Saturday ]: Channel NewsAsia Singapore

[ Last Friday ]: firstalert4.com

[ Last Friday ]: Detroit Free Press

[ Last Friday ]: CBSSports.com

[ Last Friday ]: WMUR

[ Last Friday ]: Sports Illustrated

[ Last Friday ]: Business Insider

[ Last Friday ]: The Daily Caller

[ Last Friday ]: Patch

[ Last Friday ]: CoinTelegraph

[ Last Friday ]: 13abc

[ Last Friday ]: Reuters

[ Last Friday ]: Forbes

[ Last Friday ]: fox6now

[ Last Friday ]: TechRadar

[ Last Friday ]: Daily Record

[ Last Friday ]: CNN

[ Last Friday ]: Sports Illustrated

[ Last Friday ]: Maryland Matters

[ Last Friday ]: London Evening Standard

[ Last Friday ]: Forbes

[ Last Friday ]: reuters.com

[ Last Friday ]: The 74

[ Last Friday ]: Toronto Star

[ Last Friday ]: Toronto Star

[ Last Friday ]: Washington State Standard

[ Last Friday ]: Finbold | Finance in Bold

[ Last Friday ]: WISH-TV

[ Last Friday ]: Seeking Alpha

[ Last Friday ]: KSTP-TV

[ Last Friday ]: Impacts

[ Last Friday ]: Canary Media

[ Last Friday ]: The Irish News

[ Last Friday ]: Chicago Sun-Times

[ Last Friday ]: NBC Los Angeles

[ Last Friday ]: Seeking Alpha

[ Last Friday ]: The Independent

[ Last Friday ]: BBC

[ Last Friday ]: Associated Press

[ Last Friday ]: KTAL Shreveport

[ Last Thursday ]: CBSSports.com

[ Last Thursday ]: moneycontrol.com

[ Last Thursday ]: KOTA TV

[ Last Thursday ]: The Financial Express

[ Last Thursday ]: Louisiana Illuminator

[ Last Thursday ]: Fox News

[ Last Thursday ]: Knoxville News Sentinel

[ Last Thursday ]: CNN

[ Last Thursday ]: Seeking Alpha

[ Last Thursday ]: This is Money

[ Last Thursday ]: The Economist

[ Last Thursday ]: Buffalo News

[ Last Thursday ]: Reuters

[ Last Thursday ]: Observer

[ Last Thursday ]: KUTV

[ Last Thursday ]: Associated Press

[ Last Thursday ]: The Independent

[ Last Thursday ]: The Hans India

[ Last Thursday ]: The Globe and Mail

[ Last Thursday ]: TechRadar

[ Last Thursday ]: Ghanaweb.com

[ Last Thursday ]: CBS News

[ Last Thursday ]: Ghanaweb.com

[ Last Thursday ]: BBC

[ Last Thursday ]: legit

[ Last Thursday ]: stacker

[ Last Thursday ]: AZ Central

[ Last Thursday ]: The Indianapolis Star

[ Last Thursday ]: moneycontrol.com

[ Last Thursday ]: Toronto Star

[ Last Thursday ]: The Salt Lake Tribune

[ Last Thursday ]: Daily Record

[ Last Thursday ]: Daily Record

[ Last Thursday ]: Forbes

[ Last Thursday ]: reuters.com

[ Last Thursday ]: Artemis

[ Last Thursday ]: Forbes

[ Last Thursday ]: Idaho Capital Sun

[ Last Thursday ]: Impacts

[ Last Thursday ]: Business Today

[ Last Thursday ]: Grist

[ Last Thursday ]: Business Today

[ Last Thursday ]: Toronto Star

[ Last Thursday ]: Fox News

[ Last Thursday ]: CNN

[ Last Thursday ]: The Topeka Capital-Journal

[ Last Thursday ]: MLive

[ Last Thursday ]: reuters.com

[ Last Thursday ]: Associated Press

[ Last Thursday ]: BBC

[ Last Thursday ]: Neowin

[ Last Wednesday ]: Seeking Alpha

[ Last Wednesday ]: WPTV-TV

[ Last Wednesday ]: The Jerusalem Post Blogs

[ Last Wednesday ]: moneycontrol.com

[ Last Wednesday ]: Richmond

[ Last Wednesday ]: CNN

[ Last Wednesday ]: The Sporting News

[ Last Wednesday ]: National Hockey League

[ Last Wednesday ]: The Motley Fool

[ Last Wednesday ]: CBSSports.com

[ Last Wednesday ]: The Motley Fool

[ Last Wednesday ]: 12onyourside.com

[ Last Wednesday ]: WJHG

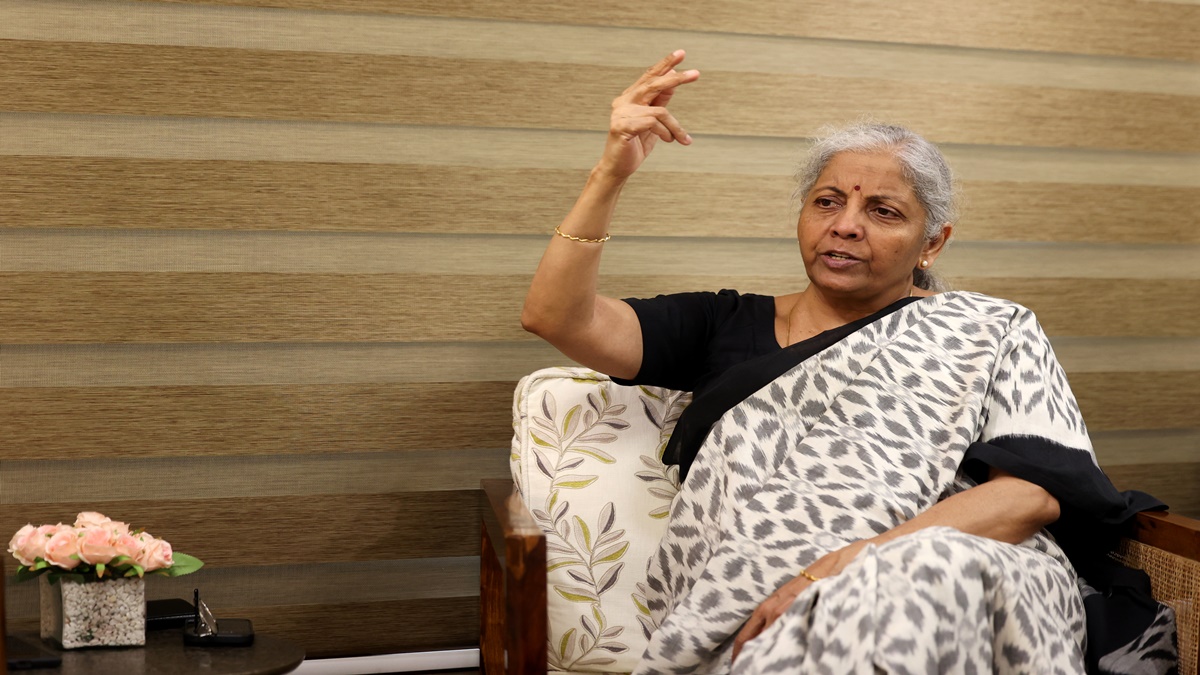

100% FDI to help unlock full potential of insurance sector: Finance Minister

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Finance minister backs 100% FDI in insurance to unlock sector potential and boost capital inflows. Move aims to ease foreign entry, attract sustained investment, enhance competition, and improve insurance penetration. Bill may be tabled in winter session of Parliament.

Finance Minister Champions 100% FDI as Key to Unleashing India's Insurance Sector Potential

In a significant push towards liberalizing India's financial landscape, Finance Minister Nirmala Sitharaman has underscored the transformative impact of allowing 100% Foreign Direct Investment (FDI) in the insurance sector. Speaking at a recent industry forum, the minister emphasized that this policy shift is not merely a regulatory tweak but a strategic move designed to unlock the full potential of an industry that has long been constrained by capital limitations and outdated frameworks. By opening the doors to full foreign ownership, the government aims to infuse fresh capital, cutting-edge technology, and global best practices into the sector, ultimately benefiting millions of Indian consumers through enhanced product offerings, improved efficiency, and greater financial inclusion.

The announcement comes at a time when India's insurance market, one of the fastest-growing in the world, is poised for exponential expansion. With a population exceeding 1.4 billion and a burgeoning middle class, the demand for insurance products—ranging from life and health coverage to property and casualty policies—has been surging. However, penetration rates remain dismally low compared to global standards. According to industry estimates, life insurance penetration in India hovers around 3-4% of GDP, while non-life insurance is even lower at about 1%. This gap represents a massive untapped opportunity, and the Finance Minister believes that 100% FDI will be the catalyst to bridge it.

Sitharaman elaborated on how foreign investors, unhindered by ownership caps, can bring in substantial funds to scale operations. Historically, the FDI limit in insurance was capped at 26% until 2015, when it was raised to 49%. A further increase to 74% was implemented in 2021, but the minister argued that these incremental steps, while helpful, were insufficient to fully energize the sector. "Allowing 100% FDI will enable insurance companies to access global capital markets more effectively, fostering innovation and competition," she stated. This influx of investment is expected to drive down costs, introduce advanced risk assessment tools like artificial intelligence and big data analytics, and expand distribution networks into underserved rural and semi-urban areas.

One of the key benefits highlighted by the Finance Minister is the potential for job creation. The insurance sector already employs millions directly and indirectly, but with increased FDI, new players could enter the market, leading to the establishment of more branches, call centers, and tech-driven operations. This could generate employment opportunities for skilled professionals in actuarial science, data analysis, and customer service, contributing to the government's broader agenda of economic growth and skill development. Moreover, foreign insurers bring with them expertise in niche areas such as cyber insurance, climate risk coverage, and health tech integrations, which are increasingly relevant in a digitalizing India facing environmental challenges.

The minister also addressed concerns about foreign dominance potentially sidelining domestic players. She reassured stakeholders that safeguards would remain in place, including requirements for Indian management control in certain strategic decisions and adherence to local regulations enforced by the Insurance Regulatory and Development Authority of India (IRDAI). "This is not about handing over the sector to foreigners; it's about partnering with them to build a robust, resilient insurance ecosystem," Sitharaman asserted. She pointed to successful precedents in other sectors like telecommunications and retail, where higher FDI limits have led to market expansion without compromising national interests.

Delving deeper into the economic implications, the policy is seen as a boon for India's overall financial services industry. Insurance plays a pivotal role in mobilizing long-term savings, which can be channeled into infrastructure projects and other productive investments. With 100% FDI, insurers could diversify their investment portfolios, potentially increasing returns for policyholders and stabilizing the economy. The Finance Minister cited examples from countries like Singapore and the UK, where liberal FDI regimes have resulted in highly efficient insurance markets with high penetration rates. In India, this could translate to better protection against unforeseen events, reducing the financial burden on households during crises such as health emergencies or natural disasters.

Furthermore, the move aligns with the government's Atmanirbhar Bharat (Self-Reliant India) initiative by encouraging technology transfer and local innovation. Foreign firms are likely to collaborate with Indian startups and fintech companies, fostering a hybrid model that combines global scale with local insights. For instance, partnerships could lead to the development of affordable micro-insurance products tailored for low-income groups, thereby advancing financial inclusion goals. The minister highlighted ongoing reforms, such as the digitization of insurance processes and the introduction of sandbox environments for testing new products, which will complement the FDI liberalization.

Critics, however, have raised valid points about potential risks, including capital flight during economic downturns or the concentration of market power in a few global giants. Sitharaman countered these by emphasizing the IRDAI's robust oversight mechanisms, including solvency margins and consumer protection norms. She also noted that the policy would be rolled out in phases, allowing for monitoring and adjustments based on real-time feedback from the industry.

Industry leaders have largely welcomed the announcement. Representatives from major insurers like LIC, HDFC Life, and international players such as Allianz and AXA have expressed optimism about the growth prospects. "This is a game-changer," said a senior executive from a leading private insurer. "With full FDI, we can accelerate our expansion plans and introduce innovative products that meet evolving customer needs." Analysts predict that the sector could see an influx of $10-15 billion in foreign capital over the next five years, propelling the insurance market to a valuation exceeding $500 billion by 2030.

The Finance Minister also tied this reform to broader economic recovery efforts post the COVID-19 pandemic. The health crisis exposed vulnerabilities in India's insurance coverage, with many families struggling due to inadequate health policies. By enabling 100% FDI, the government aims to strengthen the health insurance segment, making it more accessible and comprehensive. Initiatives like the Ayushman Bharat scheme could be bolstered through private sector participation, ensuring that even the most vulnerable populations have access to quality coverage.

In her address, Sitharaman drew parallels with the aviation and defense sectors, where higher FDI has spurred modernization and self-sufficiency. She envisioned a similar trajectory for insurance, where foreign investment acts as a springboard for indigenous growth. "The ultimate goal is to create an insurance sector that is not only world-class but also deeply integrated with India's development story," she concluded.

This policy shift is part of a larger suite of reforms aimed at making India an attractive destination for global investors. With the economy rebounding and inflation under control, the timing seems opportune. As the details of implementation unfold, stakeholders will be watching closely to see how this bold move translates into tangible benefits for consumers, businesses, and the economy at large.

Looking ahead, the success of 100% FDI in insurance will depend on several factors, including regulatory agility, technological adoption, and consumer education. The government has already initiated dialogues with industry bodies to iron out any teething issues. Educational campaigns to raise awareness about insurance benefits could further amplify the impact, encouraging more Indians to secure their futures.

In essence, the Finance Minister's endorsement of 100% FDI represents a forward-looking vision for India's insurance sector. By dismantling barriers to foreign capital, the policy promises to catalyze growth, innovation, and inclusion, positioning the industry as a cornerstone of India's economic aspirations. As the sector evolves, it could well become a model for other regulated industries, demonstrating how strategic liberalization can drive sustainable development in a globalized world. (Word count: 1,056)

Read the Full The Financial Express Article at:

[ https://www.financialexpress.com/policy/economy-100-fdi-to-help-unlock-full-potential-of-insurance-sector-finance-minister-3929320/ ]

Similar Business and Finance Publications