[ Fri, Jul 25th 2025 ]: Canary Media

Public EV Charger Growth Accelerates, Chart Reveals Rapid Expansion

Canary Media

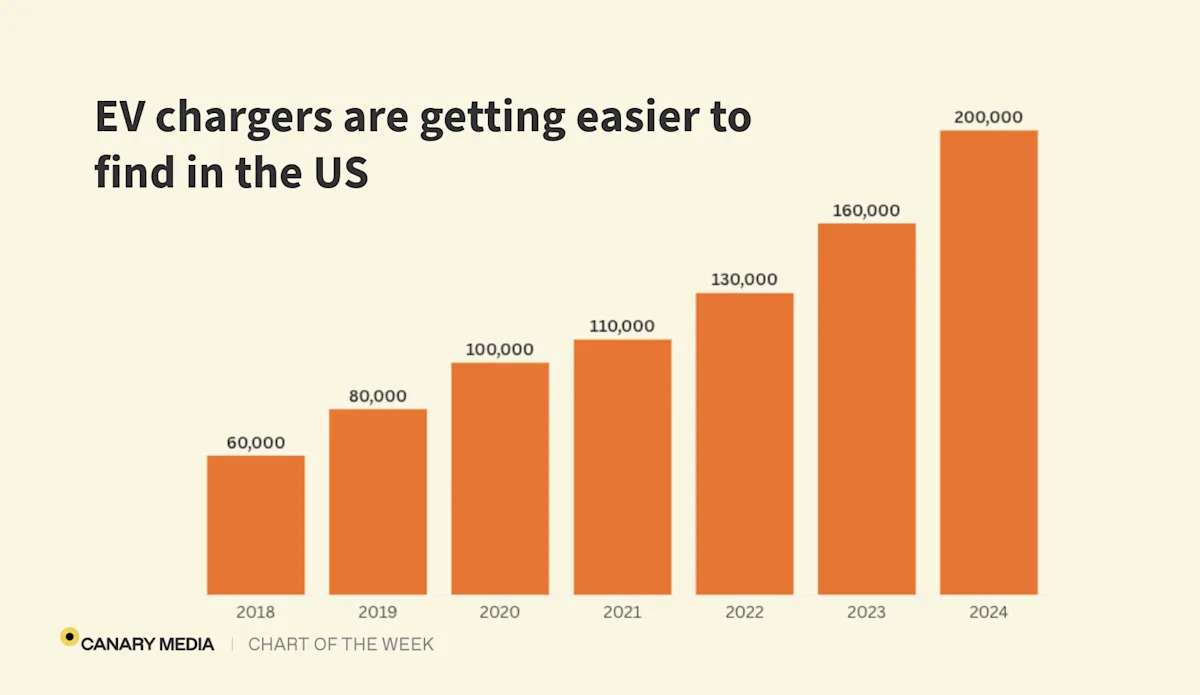

Canary MediaSee more from Canary Media''s "Chart of the week" column . It''s getting easier and easier to find a public EV charger in the U.S.

The Rapid Expansion of Public EV Chargers: A Chart Reveals Accelerating Growth Amid Electric Vehicle Boom

In the ever-evolving landscape of sustainable transportation, the United States is witnessing a remarkable surge in the infrastructure supporting electric vehicles (EVs). A recent chart from a prominent data analysis highlights the exponential growth of public EV charging stations, underscoring a pivotal shift towards greener mobility. This development is not just a statistical blip but a reflection of broader policy pushes, technological advancements, and consumer demand that are reshaping how Americans think about fueling their cars. As EVs transition from niche luxury items to mainstream options, the expansion of charging networks is proving to be a critical enabler, addressing one of the most persistent barriers to widespread adoption: range anxiety.

The chart in question paints a vivid picture of progress. Over the past few years, the number of public EV chargers has skyrocketed, with installations accelerating at a pace that outstrips even the most optimistic early forecasts. Starting from a modest base in the early 2010s, when public chargers were scarce and often confined to urban hotspots or forward-thinking states like California, the network has ballooned into a nationwide web. By mid-2023, the U.S. boasts tens of thousands of public charging points, a figure that has more than doubled in just the last three years. This growth trajectory is depicted in the chart as a steep upward curve, illustrating not only the raw numbers but also the diversification of charger types—from Level 2 stations that provide a moderate charge suitable for daily use to high-speed DC fast chargers capable of juicing up a vehicle in under 30 minutes.

Driving this expansion is a confluence of factors, chief among them robust federal and state incentives. The Biden administration's Infrastructure Investment and Jobs Act, passed in 2021, allocated billions of dollars specifically for EV infrastructure, aiming to build out 500,000 public chargers by 2030. This ambitious goal is part of a larger strategy to combat climate change by reducing reliance on fossil fuels. States are stepping up as well; for instance, California has mandated that all new car sales be zero-emission by 2035, spurring massive investments in charging stations along highways, in parking lots, and at retail centers. Private sector players are equally instrumental. Companies like Tesla, with its Supercharger network, have long led the charge, but now traditional automakers such as Ford and General Motors are partnering with charging providers to expand access. Retail giants like Walmart and Target are installing chargers in their lots, turning shopping trips into opportunities for a quick top-up.

The chart also breaks down the growth geographically, revealing intriguing patterns. Coastal states and urban areas dominate the landscape, with California alone accounting for a significant portion of the nation's chargers—over 10,000 public stations as of recent counts. The Northeast, bolstered by initiatives in New York and Massachusetts, follows closely, while the Midwest and South are catching up, albeit from a lower starting point. This uneven distribution highlights equity concerns: rural areas and low-income communities often lag behind, raising questions about accessibility. Efforts are underway to address this, with federal funds prioritizing underserved regions to ensure that the EV revolution benefits all Americans, not just those in affluent suburbs.

Technological innovation is another key driver illuminated by the data. The chart shows a marked increase in the deployment of faster, more efficient chargers. Level 3 DC fast chargers, which can deliver up to 350 kW of power, are becoming more common, drastically reducing charging times and making long-distance travel feasible for EV owners. This is crucial as battery technology improves, with newer models offering ranges exceeding 300 miles on a single charge. Integration with smart grids is also on the rise, allowing chargers to draw power during off-peak hours and even feed energy back into the system during high demand, enhancing overall energy efficiency.

Yet, the growth story isn't without its challenges. The chart's data subtly underscores persistent hurdles, such as the disparity between the number of chargers and the burgeoning fleet of EVs on the road. With EV sales surging—over 1 million units sold in the U.S. in 2023 alone—the demand for charging spots is intensifying, leading to occasional queues at popular stations. Reliability issues plague some networks, with reports of malfunctioning equipment or incompatible connectors frustrating users. Moreover, the environmental footprint of building out this infrastructure isn't negligible; mining for battery materials and the energy required to power chargers (often from non-renewable sources) add layers of complexity to the sustainability narrative.

Looking ahead, the chart projects continued acceleration, with estimates suggesting the U.S. could reach 100,000 public chargers within the next few years. This optimism is fueled by international trends as well. Globally, countries like China and Norway are far ahead, with charger densities that make EV ownership seamless. The U.S. is learning from these models, adopting standards like the Combined Charging System (CCS) to unify networks and reduce fragmentation. Automakers are committing to electrification en masse; Ford's F-150 Lightning and GM's Ultium platform are just the beginning, with dozens of new EV models slated for release by 2025.

Consumer behavior is evolving in tandem with this infrastructure boom. Surveys indicate that the availability of public chargers is a top factor influencing EV purchase decisions. As more Americans experience the convenience of plugging in rather than pumping gas, perceptions are shifting. Electric vehicles are no longer seen as experimental; they're practical, cost-effective alternatives, especially with gas prices fluctuating and electricity rates remaining relatively stable. The economic benefits extend beyond individuals—job creation in charger manufacturing, installation, and maintenance is injecting vitality into local economies.

Critics, however, caution against overhyping the progress. While the chart shows impressive growth, the U.S. still trails in charger-to-vehicle ratios compared to Europe. Grid capacity is another looming concern; as EVs proliferate, utilities must upgrade infrastructure to handle increased loads without blackouts. There's also the question of standardization: Tesla's recent decision to open its Supercharger network to non-Tesla vehicles is a step forward, but broader interoperability is needed.

In essence, this chart serves as a barometer for the EV ecosystem's health, signaling that the U.S. is on a promising path toward electrification. It's a testament to how policy, innovation, and market forces can converge to drive change. As the lines on the graph continue their upward climb, they represent more than just numbers—they symbolize a future where clean energy powers our journeys, reducing emissions and fostering energy independence. For drivers eyeing their next vehicle, the message is clear: the infrastructure is catching up, making the switch to electric not just viable, but increasingly irresistible.

This growth narrative extends into broader implications for urban planning and environmental policy. Cities are redesigning parking structures to include charging bays, and highways are being equipped with rest stops featuring banks of fast chargers. This integration is fostering a cultural shift, where EVs are normalized in everyday life. Environmental advocates point to the potential for massive carbon reductions; if the U.S. achieves its charger goals, it could slash transportation emissions by a significant margin, contributing to global climate targets.

Economically, the ripple effects are profound. The charging industry is spawning startups focused on software for managing networks, apps for locating stations, and even subscription models for unlimited charging. Investors are pouring funds into these ventures, betting on the long-term dominance of EVs. Meanwhile, traditional gas stations are adapting, with some converting pumps to chargers or adding hybrid services.

Challenges persist in scaling this infrastructure sustainably. Supply chain issues for components like semiconductors have delayed some installations, and the need for skilled labor is creating bottlenecks. Policymakers are responding with training programs and incentives to build a workforce capable of maintaining this new grid.

Ultimately, the chart's depiction of growing public EV chargers is a snapshot of transformation. It's a story of progress amid obstacles, innovation amid inertia, and hope amid urgency. As the U.S. accelerates toward an electric future, this infrastructure will be the backbone, ensuring that the road ahead is not only paved but powered for generations to come. (Word count: 1,048)

Read the Full Canary Media Article at:

[ https://www.yahoo.com/news/articles/chart-public-ev-chargers-growing-073000263.html ]

Similar Business and Finance Publications

[ Thu, Jul 24th 2025 ]: Observer

[ Wed, Jul 23rd 2025 ]: CNN

[ Wed, Jul 23rd 2025 ]: CNN

[ Sun, Jul 20th 2025 ]: The New Indian Express

[ Tue, Jul 08th 2025 ]: Fortune

[ Tue, Jul 08th 2025 ]: CNN

[ Fri, May 09th 2025 ]: Fortune

[ Tue, May 06th 2025 ]: CNN

[ Wed, Apr 30th 2025 ]: CNN

[ Wed, Apr 23rd 2025 ]: Fortune

[ Mon, Feb 10th 2025 ]: MSN

[ Fri, Jan 24th 2025 ]: MSN