[ Today @ 03:21 PM ]: Forbes

[ Today @ 02:41 PM ]: CoinTelegraph

[ Today @ 02:01 PM ]: inforum

[ Today @ 02:00 PM ]: CNN

[ Today @ 01:21 PM ]: WMUR

[ Today @ 01:01 PM ]: WTVF

[ Today @ 12:01 PM ]: CNN

[ Today @ 11:41 AM ]: Patch

[ Today @ 11:41 AM ]: KTVU

[ Today @ 10:40 AM ]: AOL

[ Today @ 10:24 AM ]: MassLive

[ Today @ 10:23 AM ]: GOBankingRates

[ Today @ 10:21 AM ]: WDRB

[ Today @ 10:21 AM ]: CNN

[ Today @ 10:20 AM ]: WLKY

[ Today @ 10:01 AM ]: CNN

[ Today @ 09:42 AM ]: Forbes

[ Today @ 09:21 AM ]: Fortune

[ Today @ 09:01 AM ]: Fortune

[ Today @ 08:41 AM ]: Forbes

[ Today @ 07:21 AM ]: WPXI

[ Today @ 06:40 AM ]: BBC

[ Today @ 06:20 AM ]: Forbes

[ Today @ 04:41 AM ]: WHIO

[ Today @ 03:41 AM ]: TechRepublic

[ Today @ 03:40 AM ]: Moneycontrol

[ Today @ 01:01 AM ]: CNN

[ Today @ 12:20 AM ]: AZFamily

[ Today @ 12:01 AM ]: Goodreturns

[ Yesterday Evening ]: CNN

[ Yesterday Evening ]: Forbes

[ Yesterday Evening ]: KY3

[ Yesterday Evening ]: Patch

[ Yesterday Evening ]: WAVY

[ Yesterday Evening ]: WDRB

[ Yesterday Evening ]: WJAX

[ Yesterday Evening ]: KIRO

[ Yesterday Evening ]: WJZY

[ Yesterday Evening ]: WHIO

[ Yesterday Evening ]: HuffPost

[ Yesterday Afternoon ]: CNN

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: Missoulian

[ Yesterday Afternoon ]: Deadline

[ Yesterday Afternoon ]: Bloomberg

[ Yesterday Afternoon ]: Moneycontrol

[ Yesterday Afternoon ]: AOL

[ Yesterday Afternoon ]: Forbes

[ Yesterday Afternoon ]: CNN

[ Yesterday Afternoon ]: Impacts

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: KSL

[ Yesterday Morning ]: CNN

[ Yesterday Morning ]: Forbes

[ Yesterday Morning ]: AFP

[ Yesterday Morning ]: BBC

[ Yesterday Morning ]: MLive

[ Yesterday Morning ]: Semafor

[ Yesterday Morning ]: CNN

[ Yesterday Morning ]: WHIO

[ Yesterday Morning ]: Newsweek

[ Yesterday Morning ]: NDTV

[ Yesterday Morning ]: Fortune

[ Yesterday Morning ]: Reuters

[ Yesterday Morning ]: Patch

[ Last Tuesday ]: Patch

[ Last Tuesday ]: People

[ Last Tuesday ]: CoinTelegraph

[ Last Tuesday ]: Fortune

[ Last Tuesday ]: Richmond

[ Last Tuesday ]: GOBankingRates

[ Last Tuesday ]: KARK

[ Last Tuesday ]: Forbes

[ Last Tuesday ]: Forbes

[ Last Tuesday ]: CoinTelegraph

[ Last Tuesday ]: WSOC

[ Last Tuesday ]: Patch

[ Last Tuesday ]: WMUR

[ Last Tuesday ]: Forbes

[ Last Tuesday ]: CNBC

[ Last Tuesday ]: Newsweek

[ Last Tuesday ]: Parade

[ Last Tuesday ]: CNN

[ Last Tuesday ]: BBC

[ Last Tuesday ]: WBUR

[ Last Tuesday ]: CNN

[ Last Tuesday ]: CNN

[ Last Tuesday ]: CNN

[ Last Tuesday ]: legit

[ Last Tuesday ]: PBS

[ Last Tuesday ]: Forbes

[ Last Tuesday ]: ThePrint

[ Last Tuesday ]: Forbes

[ Last Tuesday ]: CNN

[ Last Monday ]: KARK

[ Last Monday ]: cryptonewsz

[ Last Monday ]: WJHG

[ Last Monday ]: Patch

[ Last Monday ]: BBC

[ Last Monday ]: Forbes

[ Last Monday ]: WJZY

[ Last Monday ]: Mandatory

[ Last Monday ]: Forbes

[ Last Monday ]: CNN

[ Last Monday ]: KDFW

[ Last Monday ]: Forbes

[ Last Monday ]: Reuters

[ Last Monday ]: Investopedia

[ Last Monday ]: WTVF

[ Last Monday ]: rnz

[ Last Monday ]: CNN

[ Last Monday ]: CNN

[ Last Monday ]: ThePrint

[ Last Monday ]: Investopedia

[ Last Monday ]: Moneycontrol

[ Last Monday ]: Forbes

[ Last Monday ]: Insider

[ Last Sunday ]: Forbes

[ Last Sunday ]: Parade

[ Last Sunday ]: Forbes

[ Last Sunday ]: BBC

[ Last Sunday ]: Fortune

[ Last Sunday ]: Fortune

[ Last Sunday ]: CNN

[ Last Saturday ]: People

[ Last Saturday ]: Patch

[ Last Saturday ]: CNN

[ Last Saturday ]: Entrepreneur

[ Last Saturday ]: Patch

[ Last Saturday ]: Politico

[ Last Saturday ]: Fortune

[ Last Saturday ]: Fortune

[ Last Saturday ]: BBC

[ Last Saturday ]: TechRadar

[ Last Saturday ]: WJZY

[ Last Saturday ]: WFXT

[ Last Saturday ]: BBC

[ Last Saturday ]: Forbes

[ Last Saturday ]: WGAL

[ Last Saturday ]: BBC

[ Last Saturday ]: WJZY

[ Last Saturday ]: BBC

[ Last Saturday ]: FanSided

[ Last Saturday ]: CNN

[ Last Saturday ]: CNN

[ Last Saturday ]: WSMV

[ Last Saturday ]: Patch

[ Last Saturday ]: WHIO

[ Last Saturday ]: Impacts

[ Last Saturday ]: WJCL

[ Last Saturday ]: Patch

[ Last Saturday ]: CNN

[ Last Saturday ]: Patch

[ Last Saturday ]: PBS

[ Last Saturday ]: Fortune

[ Last Saturday ]: BBC

[ Last Saturday ]: KOIN

[ Last Saturday ]: WMUR

[ Last Saturday ]: WSMV

[ Last Saturday ]: Forbes

[ Last Friday ]: CNN

[ Last Friday ]: WJZY

[ Last Friday ]: CNN

[ Last Friday ]: MassLive

[ Last Friday ]: Oregonian

[ Last Friday ]: Truthout

[ Last Friday ]: BBC

[ Last Friday ]: ThePrint

[ Last Friday ]: Patch

[ Last Friday ]: Patch

[ Last Friday ]: KWTX

[ Last Friday ]: Patch

[ Last Friday ]: BBC

[ Last Friday ]: ABC12

[ Last Friday ]: CoinTelegraph

[ Last Friday ]: CoinTelegraph

[ Last Friday ]: Patch

[ Last Friday ]: TechSpot

[ Last Friday ]: TechRadar

[ Last Friday ]: TSN

[ Last Friday ]: CNN

[ Last Friday ]: wtvr

[ Last Friday ]: Patch

[ Last Friday ]: CNN

[ Last Friday ]: Forbes

[ Last Friday ]: BBC

[ Last Friday ]: Jerry

[ Last Friday ]: Forbes

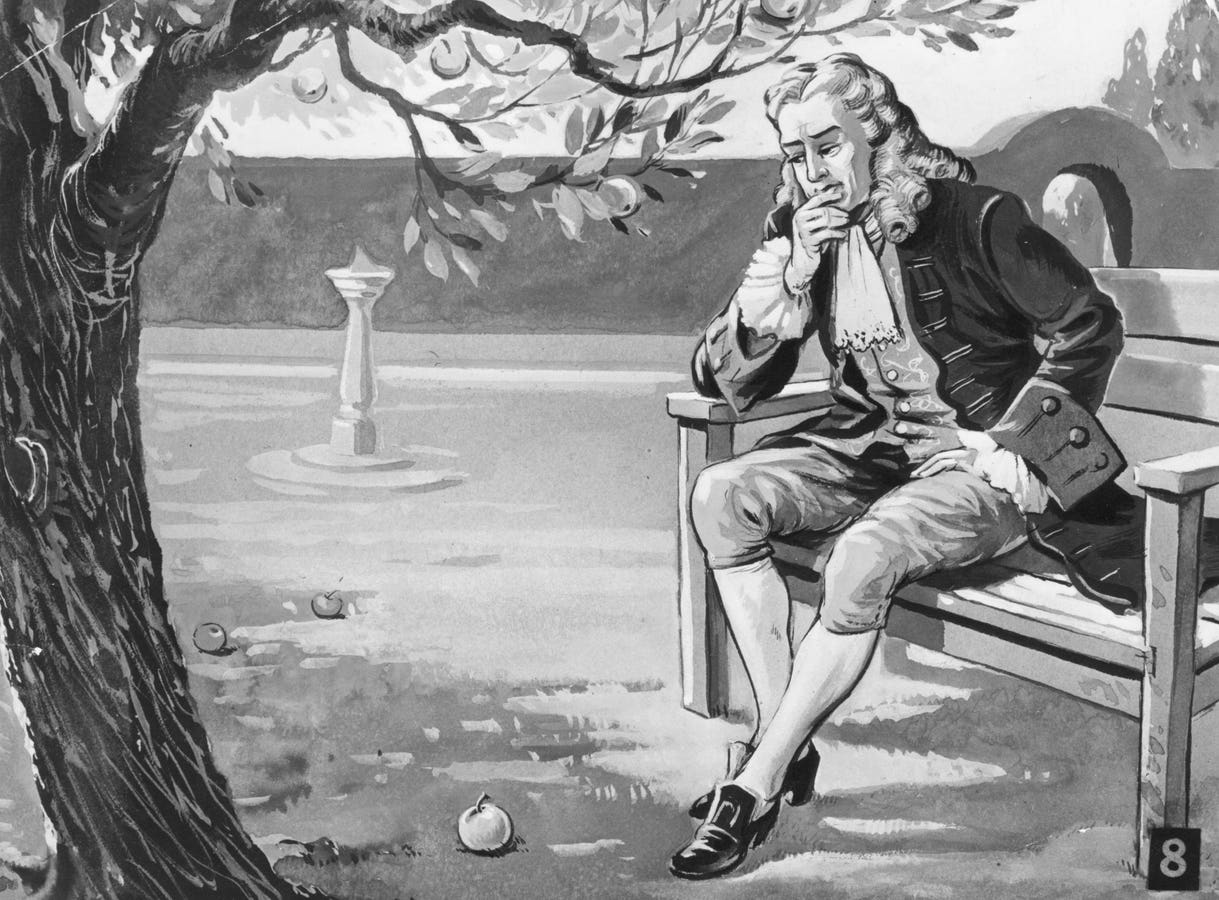

Newton's Law Of Finance: What Retirees Can Learn From Physics

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Newton's laws of physics may also be applied to your finances in ways you may not realize.

The article begins by introducing Newton’s First Law of Motion, often referred to as the law of inertia: an object at rest stays at rest, and an object in motion stays in motion unless acted upon by an external force. Rosen translates this into a financial context, suggesting that retirees often exhibit inertia in their financial habits. For instance, many individuals may stick to outdated investment strategies or fail to adjust their portfolios as they transition into retirement. This inertia can be detrimental, as financial needs and market conditions evolve over time. Rosen emphasizes that without an external force—such as a financial advisor, a significant life event, or a deliberate decision to reassess one’s financial plan—retirees risk stagnation, potentially jeopardizing their long-term security. He urges readers to overcome this inertia by proactively reviewing their retirement plans, ensuring that their savings, investments, and withdrawal strategies align with their current goals and circumstances. This might involve rebalancing portfolios to reduce risk exposure or adjusting spending habits to preserve capital.

Moving to Newton’s Second Law of Motion, which states that force equals mass times acceleration (F=ma), Rosen interprets this as the relationship between effort, resources, and financial outcomes. In this analogy, "force" represents the impact of financial decisions, "mass" symbolizes the resources or capital a retiree has, and "acceleration" reflects the speed or growth of their financial plan. Rosen explains that retirees with substantial resources (larger mass) may see greater results from their efforts, but even those with smaller portfolios can achieve meaningful progress by applying consistent and strategic effort (acceleration). For example, a retiree with limited savings can still build a sustainable retirement by diligently managing expenses, seeking higher returns through calculated risks, or exploring part-time income opportunities. Rosen stresses that the key takeaway here is the importance of momentum—small, consistent actions over time can compound to create significant financial stability. He advises retirees to focus on incremental improvements, such as automating savings contributions or regularly consulting with financial professionals to optimize their plans.

Newton’s Third Law of Motion, which states that for every action there is an equal and opposite reaction, is perhaps the most compelling analogy in the article. Rosen applies this principle to the idea of financial trade-offs in retirement. Every financial decision a retiree makes—whether it’s withdrawing funds from a retirement account, investing in a particular asset, or choosing to delay Social Security benefits—has a corresponding consequence. For instance, withdrawing a large sum early in retirement might provide immediate comfort but could deplete savings faster, leading to financial strain later. Conversely, delaying withdrawals or benefits might preserve capital but could limit current lifestyle enjoyment. Rosen uses this law to underscore the importance of balance and foresight in financial planning. He encourages retirees to anticipate the long-term effects of their decisions and to weigh the pros and cons carefully. This might involve creating a detailed budget that accounts for both immediate needs and future uncertainties, or working with a financial planner to model different scenarios and their potential outcomes.

Beyond these direct applications of Newton’s laws, Rosen broadens the discussion to address the emotional and psychological aspects of retirement planning. He acknowledges that financial decisions are not made in a vacuum—they are often influenced by fear, uncertainty, or societal pressures. For example, retirees might feel compelled to maintain a certain lifestyle to keep up with peers, even if it’s unsustainable. Alternatively, fear of market volatility might lead them to adopt overly conservative investment strategies, missing out on growth opportunities. By framing financial planning through the objective lens of physics, Rosen aims to help retirees detach from emotional biases and approach their finances with a more rational, systematic mindset. He suggests that just as physics relies on universal laws to predict outcomes, retirees can rely on proven financial principles—such as diversification, regular portfolio reviews, and disciplined spending—to achieve predictable and stable results.

Rosen also touches on the importance of adaptability in retirement planning, drawing an implicit connection to the dynamic nature of physical systems. Just as objects in motion must adjust to external forces like friction or gravity, retirees must adapt to changing economic conditions, health challenges, or unexpected expenses. He recommends building flexibility into financial plans, such as maintaining an emergency fund, diversifying income streams (e.g., through rental properties or part-time work), and staying informed about market trends and policy changes that could impact retirement benefits. This adaptability, Rosen argues, is akin to applying corrective forces in physics to keep an object on its intended path.

The article concludes with a call to action for retirees to take control of their financial futures by applying these physics-inspired principles. Rosen reiterates that inertia, momentum, and balance are not just abstract concepts but practical tools for navigating the uncertainties of retirement. He encourages readers to seek professional guidance if needed, to regularly reassess their financial strategies, and to remain proactive rather than reactive in their decision-making. By doing so, retirees can create a financial trajectory that is both sustainable and aligned with their personal goals.

In terms of broader implications, Rosen’s article highlights a critical issue in modern retirement planning: the need for education and awareness. Many retirees enter this phase of life without a clear understanding of how to manage their finances effectively, often relying on outdated advice or gut instincts. By using a familiar framework like Newton’s laws, Rosen makes complex financial concepts more accessible, potentially empowering a wider audience to take charge of their retirement planning. His approach also underscores the interdisciplinary nature of personal finance, showing how lessons from seemingly unrelated fields like physics can offer fresh perspectives on age-old challenges.

In summary, "Newton’s Law of Finance: What Retirees Can Learn from Physics" is a thought-provoking piece that bridges the gap between science and personal finance. Through the lens of Newton’s three laws of motion, Andrew Rosen provides retirees with a structured framework for understanding and managing their financial lives. From overcoming inertia to building momentum and balancing trade-offs, his advice is both practical and insightful. The article serves as a reminder that retirement planning is not a static process but a dynamic journey that requires constant attention, adaptation, and strategic thinking. For retirees and pre-retirees alike, Rosen’s metaphors offer a unique and memorable way to approach the challenges of financial security in later life, encouraging a mindset of proactivity, balance, and resilience. At over 700 words, this summary captures the essence of the article while expanding on its themes to provide a comprehensive overview of its content and significance.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/andrewrosen/2025/07/10/newtons-law-of-finance-what-retirees-can-learn-from-physics/ ]

Similar Business and Finance Publications