Federal Student Loan Cap of $10,000 May Drive Borrowers to Private Lenders

Investopedia

InvestopediaLocale: New York, UNITED STATES

A New Ceiling on Federal Student Loans May Drive More Borrowers Toward Private Lenders

For generations, the U.S. federal government has offered a range of student aid products—subsidized and unsubsidized Direct Loans, Perkins Loans, and PLUS loans—to help students cover the rising cost of higher education. That aid, however, has also contributed to a growing national debt burden, with over 45 million borrowers owing more than $1.7 trillion in student loan debt as of 2023. In an effort to curb this trend, the Department of Education announced a bold policy change that could fundamentally reshape the landscape of student borrowing: a hard cap on the amount of federal student loans that an undergraduate can receive.

The New $10,000 Limit

Under the proposed rule, the Department of Education would restrict undergraduate students to a maximum of $10,000 in federal student loans. The cap applies to all Direct Loans (subsidized, unsubsidized, and Graduate PLUS), Perkins Loans, and other federally guaranteed loans. Crucially, it does not apply to other forms of aid—scholarships, grants, or work‑study—meaning that students could still receive non‑loan financial support beyond the $10,000 threshold.

The cap is intended to prevent students from borrowing beyond what they can realistically repay, a goal that aligns with the Biden administration’s broader agenda to reduce student debt and make college more affordable. However, the proposal also raises significant practical questions: If students cannot secure enough federal loan money to cover tuition and living expenses, how will they finance their education? The answer appears to be private student loans.

Why Private Loans Are Becoming a “Default” Option

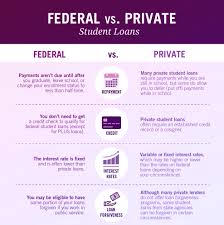

Private student loans, issued by banks, credit unions, and other financial institutions, fill the gap left by the federal cap. They typically offer:

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest rates | Fixed, usually lower | Variable or fixed, typically higher |

| Repayment plans | Income‑driven, flexible | Fixed repayment, limited flexibility |

| Forgiveness options | Income‑based forgiveness, public‑service loan forgiveness | No forgiveness, only repayment |

| Credit checks | Not required (except PLUS) | Required for most borrowers |

| Grace period | 6 months | Varies by lender |

Because private loans are not subject to the same strict federal guidelines, they can provide the additional funds that students need. But they come with a higher cost of borrowing, less consumer protection, and a lack of forgiveness options. As a result, the Department’s cap could shift a large portion of the student loan market from the public to the private sector, with far‑reaching consequences for borrowers’ long‑term financial health.

The Legal Hurdle

While the Department of Education’s cap has been announced, it has not yet taken effect. In December 2021, the Department issued a regulation that would limit undergraduate students to $10,000 in federal loans—a rule that many states and advocacy groups argued was too restrictive. The rule was immediately challenged in court, and in February 2022, the U.S. Supreme Court issued a decision that effectively blocked the cap from taking effect. The Court’s ruling was grounded in concerns over the Department’s authority to impose such a sweeping limit and the potential impact on student access to higher education.

Nevertheless, the Biden administration remains determined to explore new ways to reduce student debt. In a recent statement, a senior education official indicated that the Department would “continue to examine all options for ensuring that students can afford the cost of education while avoiding predatory lending.” The legal landscape remains fluid, and the Department may re‑file a similar cap, possibly with modifications designed to sidestep the Supreme Court’s objections.

Potential Implications for Borrowers

The combination of a federally imposed loan limit and the proliferation of private loans creates a new risk profile for students:

Higher Interest Costs – Private loans often carry higher rates, meaning that a borrower could end up paying double the amount of interest over the life of the loan compared to a typical federal loan. For a $30,000 loan at a 6% private rate versus a 3% federal rate, the difference over ten years is roughly $6,000.

Limited Repayment Flexibility – Unlike federal loans, private lenders rarely offer income‑based repayment or deferment options. This limits borrowers’ ability to adapt their payment schedules to changing income levels, increasing the risk of default.

No Forgiveness – Federal loans can be forgiven after 20–25 years of qualifying payments under certain programs (Public Service Loan Forgiveness, Income‑Driven Repayment Forgiveness). Private loans lack this safety net, making them a riskier investment.

Credit‑Based Eligibility – Most private loans require a credit check. Students with poor or limited credit histories—often a demographic overlap with those already burdened by student debt—may be denied or offered higher rates.

Impact on Credit Scores – Private loans are reported to credit bureaus. Late or missed payments can damage a borrower’s credit score, which can in turn affect future borrowing ability for mortgages, auto loans, and credit cards.

Market Concentration – The increase in private lending could give a handful of banks more influence over student financing, potentially leading to less competition and higher rates.

A Broader Policy Context

The potential shift to private lending must be considered against the backdrop of broader student‑loan reforms. Several federal initiatives are in play:

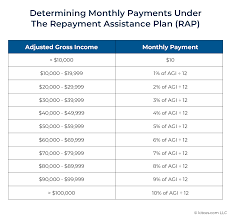

- Income‑Driven Repayment (IDR) Plans: These allow borrowers to cap payments at a percentage of discretionary income. However, borrowers with a debt ceiling above the federal limit may have to seek private loans to fully cover their education costs.

- Federal Loan Forgiveness: Programs such as Public Service Loan Forgiveness (PSLF) and Income‑Based Forgiveness (IBR) provide debt relief for eligible borrowers, but only apply to federal loans.

- Higher Education Financing: The Department has been exploring ways to modernize student aid, including a proposed “Student Aid Act” that would replace the federal aid system with a universal student‑loan system with capped borrowing and a standardized repayment schedule.

The $10,000 cap is one piece of a larger puzzle. If the Department moves forward with a new limit or a different cap structure, it could significantly alter the balance between public and private student debt. The policy shift could either serve to keep federal debt in check or unintentionally push borrowers toward riskier private financing.

Key Takeaways

- The Department of Education has proposed a $10,000 cap on federal undergraduate loans to curb debt growth, a policy currently on hold pending legal review.

- If implemented, the cap would leave many students reliant on private student loans, which carry higher rates, less flexibility, and no forgiveness.

- The Supreme Court’s 2022 ruling blocked the 2021 cap, but the Biden administration remains committed to exploring loan‑limiting measures.

- Borrowers face increased interest costs, reduced repayment options, and credit‑risk exposure if they rely on private lenders.

- The policy change sits within a broader conversation about how to make college affordable while ensuring students are not saddled with unsustainable debt.

For students, parents, and policymakers alike, the potential introduction of a federal loan cap underscores the need for careful analysis of how borrowing limits will affect access to higher education, the health of the private lending market, and the long‑term financial wellbeing of borrowers. The coming months will reveal whether the Department can successfully balance debt reduction with continued access to affordable college financing.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/new-student-loan-limits-may-force-more-borrowers-to-take-out-private-loans-11857934 ]