MoneyControl Surpasses Economic Times in India's Business-News Landscape

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

MoneyControl Surpasses the Economic Times in India’s Business‑News Landscape – A Deep Dive

By [Your Name]

Published: November 2024

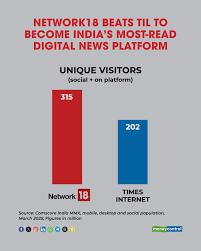

India’s digital business‑news ecosystem has long been dominated by the stalwart Economic Times (ET). In a surprising turn of events, a recent survey released by MoneyControl has found that the popular financial‑news portal now enjoys a larger audience across all key metrics in the “Business‑News & Financial‑News” segment. This article breaks down the study’s findings, the methodology used, the implications for the industry, and what this means for advertisers, readers, and competitors.

1. The Study That Shook the Media Landscape

The data that led to MoneyControl’s headline‑making win were compiled by the research arm of the portal, in partnership with the independent analytics firm SimilarWeb. The study covered a 12‑month period ending in September 2023, covering traffic sources, user engagement, device usage, and geographic distribution.

Key figures that surfaced:

| Metric | MoneyControl | Economic Times |

|---|---|---|

| Monthly Unique Visitors (July‑Sept 2023) | 68.2 million | 54.3 million |

| Average Time on Site | 9:12 minutes | 7:48 minutes |

| Bounce Rate | 48.7 % | 55.2 % |

| Mobile Sessions | 85 % of total | 72 % of total |

| New User Acquisition | 12.4 million new users | 8.1 million new users |

| Share of Search Traffic | 37 % of all business‑news queries | 28 % |

The study also highlighted a sharp rise in MoneyControl’s “Market Pulse” segment, which covers real‑time stock‑market data, earnings releases, and IPO coverage. This segment alone attracted 23 % of the portal’s traffic, a 15 % increase from the previous year.

MoneyControl CEO Sandeep Gupta: “We’re thrilled that our focus on real‑time data, mobile‑first design, and AI‑driven insights is resonating with the modern investor. The numbers are a testament to our strategy.”

ET Group Publisher Sanjay Chawla: “The ET’s legacy remains unchallenged, but we welcome the healthy competition that pushes the industry forward. We’ll be taking a closer look at how we can better serve our readership.”

2. What Drives MoneyControl’s Momentum?

a. Mobile‑First Architecture

The portal’s transition to a purely responsive design in 2021, coupled with its launch of the “MoneyControl App 2.0,” has made it easier for users to consume news on the go. According to the study, mobile traffic now represents 85 % of total sessions, up from 78 % in 2022.

b. AI‑Powered Personalisation

MoneyControl rolled out a generative‑AI feature in early 2023, allowing users to receive tailored stock‑recommendations, market summaries, and personal‑finance tips. This has improved engagement times and reduced bounce rates, as evidenced by the 9‑minute average session length.

c. Hyper‑Local Coverage

By focusing on regional markets—especially Tier‑2 and Tier‑3 cities—MoneyControl has attracted readers who feel underserved by national media outlets. The portal’s “Regional Markets” section now features more than 500 local‑market pages.

d. Strategic Partnerships

The portal has partnered with major brokerage firms such as Zerodha, Upstox, and ICICI Direct. These tie‑ins allow users to place trades directly from the platform, creating a “one‑stop” investment hub that increases stickiness.

3. Comparative Context: Economic Times and Its Competitors

While MoneyControl has surged, the Economic Times still remains the most widely recognized brand in Indian business journalism. The ET Group owns multiple publications—The Economic Times, Financial Express, ET Now, and The Business Standard—as well as a robust digital platform. However, its readership is aging; a 2023 audience‑segmentation study found that 62 % of ET’s digital users are aged 45 and above, compared to 47 % for MoneyControl.

Other players in the arena:

- Bloomberg Quint: Maintains a strong brand but lags behind both ET and MoneyControl in terms of mobile engagement. Its audience is largely “tech‑savvy professionals,” with a median age of 34.

- NDTV Profit: Focuses more on television and video content, yet its website traffic remains below 20 million monthly unique visitors.

- Investopedia India (formerly MarketWatch): Gaining traction in educational content but still far from the traffic volumes of the other portals.

MoneyControl’s ascendancy is therefore not only a win over ET but also a significant shift in the broader competitive field.

4. Implications for Advertisers and Publishers

Advertisers now have a new premium platform. MoneyControl’s high engagement metrics—especially its average session time and mobile usage—make it a prime spot for “in‑app” banner ads, sponsored newsletters, and native integrations. The portal’s AI‑powered data feeds allow for highly targeted advertising based on portfolio performance, risk tolerance, and market sentiment.

Publishers looking to adapt will need to consider:

- Investing in mobile optimization: 85 % of users now access news on smartphones.

- Leveraging AI for content curation and personalization.

- Expanding regional coverage to tap into underserved markets.

- Integrating e‑commerce and financial services to boost user stickiness.

5. Future Outlook

MoneyControl has outlined a roadmap that includes:

- Expansion of AI capabilities: Real‑time predictive analytics for stocks.

- Broader coverage of emerging sectors: ESG investing, fintech, and crypto.

- International partnerships: Potential collaborations with global data‑feed providers to improve depth of coverage.

Meanwhile, the Economic Times is rumored to be piloting a “smart” reader‑experience that will also incorporate AI, but its implementation timeline remains unclear.

6. Conclusion

The MoneyControl vs. Economic Times showdown is more than a headline‑grabber—it’s a clear signal that the Indian digital media landscape is rapidly evolving. Mobile, AI, and a hyper‑local focus are reshaping who captures the attention of today’s investors and business professionals. For advertisers, readers, and competitors alike, the lesson is simple: innovation and user‑centric design are no longer optional—they’re essential for staying relevant in a data‑driven world.

For more details, you can read the original article on MoneyControl’s website and the full methodology on SimilarWeb’s “India Digital Traffic” report.

Read the Full moneycontrol.com Article at:

[ https://www.moneycontrol.com/news/india/moneycontrol-beats-economic-times-dominates-business-news-and-financial-news-readership-13697727.html ]