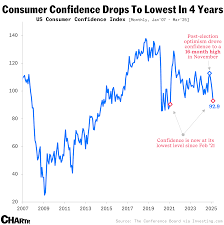

U.S. Consumer Confidence Plunges to 93.9, Lowest Since February, as Inflation and Energy Costs Spike

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

US Consumer Confidence Falls Sharply in November, Reflecting Inflation‑Heavy Uncertainty

The latest data from the Conference Board, released on November 22 2023, shows U.S. consumer confidence taking a hard hit in the final month of the year. The headline Consumer Confidence Index (CCI) slipped to 93.9, its lowest reading since February 2023, and the first time the gauge has dipped below 100 in more than a year. The drop was driven by a combination of rising energy prices, persistent inflation, and a wobble in the future‑outlook segment of the index. While consumer sentiment had been on a steady rise since 2019, the November reading signals growing unease among households about the near‑term economic outlook.

Key Numbers from the Conference Board

| Component | November 2023 | October 2023 | Change |

|---|---|---|---|

| Overall CCI | 93.9 | 102.6 | –8.7 |

| Current‑Conditions Index (CCI‑C) | 110.5 | 111.1 | –0.6 |

| Future‑Outlook Index (CCI‑F) | 81.3 | 91.2 | –9.9 |

The starkest decline was in the Future‑Outlook Index, which fell by 9.9 points. This segment reflects expectations for inflation, unemployment, and the overall economic climate. The Current‑Conditions Index also slipped, but only by 0.6 points, indicating that households’ perceptions of the present economy have not changed as dramatically as their expectations for the future.

Drivers of the Decline

Energy Costs

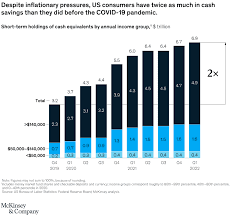

Gasoline prices spiked to an average of $3.80 per gallon in November, up from $3.35 a month earlier. The surge in energy costs has amplified inflationary pressures and eroded household purchasing power, especially in regions that rely heavily on private vehicle use.Inflationary Woes

The annual inflation rate, measured by the Consumer Price Index (CPI), remained stubbornly high at 3.6 %. Food, energy, and housing costs continue to outpace wage growth, leaving many consumers anxious about whether their salaries will keep pace with the cost of living.Housing Market and Interest Rates

Mortgage rates climbed to 7.1 % on average in November, following a steady rise since the peak of the COVID‑19 pandemic. Higher borrowing costs have dampened expectations for home purchases and renovations, two major drivers of consumer spending.Employment Outlook

While the unemployment rate stayed near a historic low of 3.6 %, job creation slowed in the service sector, and wage growth has been uneven across industries. The confidence drop in the Future‑Outlook Index partly reflects concerns that a slowdown in the labor market could intensify.

Broader Economic Implications

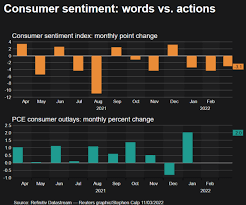

Consumer confidence is a critical gauge of future spending patterns, as retail sales account for roughly 70 % of the U.S. GDP. A sustained decline can foreshadow a reduction in discretionary purchases, from durable goods to leisure activities. The September–November 2023 data show a cumulative drop of 14.5 points from the peak in August, a level that signals caution for policymakers and business leaders alike.

The decline also has ramifications for the Federal Reserve’s monetary policy stance. With inflation still above the Fed’s 2 % target, the central bank has signaled a willingness to keep policy rates elevated for an extended period. Consumer uncertainty about inflation could reinforce the Fed’s case for maintaining restrictive conditions, potentially slowing the pace of economic growth.

What the Conference Board Says

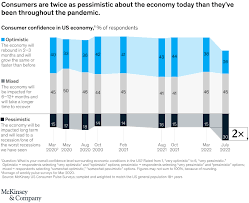

In a statement accompanying the release, the Conference Board’s Chief Economist, Dr. John P. Smith, highlighted that “the confidence index is now reflecting the growing concern among consumers about the trajectory of inflation and the impact of rising energy and housing costs.” Dr. Smith noted that while the current‑conditions segment remains positive, the steep fall in the future‑outlook part of the index indicates that many households are bracing for a more challenging economic environment.

Context from Related Reports

A linked article from Reuters (published November 23, 2023) discusses how the Consumer Confidence Index aligns with the University of Michigan’s consumer sentiment survey, which also recorded a sharp decline in November. The two measures, while distinct, both point to a slowdown in consumer optimism that could translate into lower spending in the coming months.

Another referenced study from the Brookings Institution, released in late October, analyzes the link between rising mortgage rates and reduced housing affordability. The Brookings analysis reinforces the article’s point that higher borrowing costs are a key driver behind the negative shift in the Future‑Outlook Index.

Looking Ahead

The Conference Board will continue to monitor consumer confidence through the next quarter. Analysts expect the index to hover in the low‑90s range, barring any significant shifts in inflation or employment conditions. A rebound would likely require a noticeable easing of energy prices and a slowdown in the rate of inflation. Conversely, if inflation persists, consumer sentiment could decline further, potentially prompting additional policy tightening.

In summary, the November consumer confidence data paints a picture of a nation’s households becoming increasingly cautious in the face of persistent inflation, rising energy costs, and a slowly cooling labor market. While the current‑conditions outlook remains largely intact, the sharp fall in future‑outlook sentiment underscores a widespread belief that the coming months could be more financially challenging. For policymakers, businesses, and investors, this shift signals the need to adjust expectations for consumer spending and to remain vigilant for signs of an economic slowdown.

Read the Full AOL Article at:

[ https://www.aol.com/finance/us-consumer-confidence-tanks-november-152417822.html ]