UK Caps Salary-Sacrifice Benefits at GBP2,000, Slashing Tax-Free Perks for Workers

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Workers and Businesses Set to Feel the Chill of a £2,000 Salary‑Sacrifice Cap

A sweeping change to the UK’s payroll rules will hit both employees and firms across the country this spring. The Treasury announced that the cap on salary‑sacrifice arrangements will be slashed to £2,000 a year – a move that critics say will erode tax‑efficient benefits and make recruitment harder for small and medium‑sized enterprises (SMEs). The decision is part of a broader review of tax law aimed at curbing loopholes and tightening the tax base.

What the New Cap Means

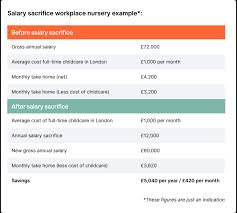

Under the current system, workers could exchange up to £10,000 of their pre‑tax wages for benefits such as pension contributions, childcare vouchers, or gym memberships. Those benefits were exempt from income tax and National Insurance, allowing both employers and employees to save money on tax and National Insurance contributions (NICs). The new £2,000 limit will apply to almost all non‑pension salary‑sacrifice schemes.

“The £2,000 cap is a straightforward way to reduce the use of salary‑sacrifice arrangements that currently allow large companies to shift taxable income to employees without paying the appropriate tax,” the Treasury said in a statement.

Because the cap applies to the total value of all non‑pension benefits, an employee taking a £2,000 child‑care voucher package would see the same tax savings that they currently enjoy, but any additional benefit beyond that threshold would be taxed normally. For a mid‑level salary of £30,000, a £2,000 sacrifice would reduce taxable income to £28,000, saving around £350 in tax and NICs for the employee.

Impact on Workers

Many employees rely on salary‑sacrifice schemes to make the most of their take‑home pay. The new limit means that those who previously took advantage of multiple small benefits will see their net savings drop sharply. A financial adviser on the article noted that for many families, the loss of a £1,500 child‑care voucher could mean the difference between making ends meet and slipping into debt.

“It’s a win‑for‑the‑state, but it’s a loss for workers who depend on these benefits to manage everyday costs,” the adviser said.

The article also highlighted that the cap will apply to the most popular non‑pension benefits – such as cycle‑to‑work schemes, free or subsidised lunch vouchers, and even company‑owned bicycles – leaving employees with fewer options to offset tax.

Repercussions for Small Businesses

Business groups, especially those representing SMEs, have slammed the move as a threat to their ability to attract and retain talent. The Federation of Small Businesses (FSB) released a statement calling the cap “a painful blow to small firms that rely on cost‑effective benefits to stay competitive.” The FSB estimates that the cap could add an additional £300 million to the payroll tax bill for small employers over the next five years.

A small‑business owner interviewed for the piece explained that the new cap would make it harder to offer “package deals” that include a mix of salary and benefits. “We’ve built our recruitment pitch around these perks,” she said. “Now, we have to either raise salaries or lose out on potential hires.”

The article links to a companion piece from the Irish News that discusses how the UK’s competitiveness could be impacted by a tighter labour‑cost environment, especially in sectors that rely heavily on skilled specialists.

Why the Government is Making the Change

The cap is part of the UK’s latest “Tax Law Review 2024,” which seeks to close loopholes that allow large employers to shift tax burdens onto employees. By limiting salary‑sacrifice arrangements, the Treasury argues it will raise an estimated £1.2 billion in additional tax revenue over five years.

“We’re tightening a loophole that’s been widely used to shift tax liabilities from the company to the employee,” the Treasury’s spokesperson said. “This will bring the system back into line with our broader policy of ensuring everyone pays their fair share.”

The government has also cited the need to make the payroll system simpler. By capping the total value of non‑pension benefits, employers can avoid complex calculations around individual benefit levels and reduce compliance costs.

Reactions Across the Spectrum

Political Opposition: Labour’s Shadow Chancellor called the cap “a cynical move that unfairly penalises workers for the benefit of the state.” He added that it would push many people toward “increasing debt” to cover childcare costs.

Pension Advocates: Some pension experts argue that the cap does not affect pension contributions, which are still exempt from tax and NICs. However, they warn that the overall tightening of the benefits regime could indirectly reduce the attractiveness of employer‑sponsored pension schemes.

Employer Associations: The Institute of Directors (IoD) said the cap would "complicate the employer’s cost‑benefit analysis" and urged the Treasury to consider a phased approach to implementation.

Workers’ Unions: Unite the Union welcomed the cap as a step toward fairness, but warned that the loss of tax‑efficient benefits could “exacerbate inequality” if not coupled with higher wages.

What Comes Next

The new rules will take effect on 1 April 2024, aligning with the start of the new fiscal year. Employers will need to adjust their payroll systems and communicate the change to staff. Employees should review their benefit packages to determine whether any adjustments are necessary.

The article concludes with a reminder that the cap is just one part of a broader overhaul of the UK tax system, which also includes changes to the National Insurance contribution thresholds and revisions to the payroll tax credit. Those interested in a deeper dive can read the Treasury’s full “Tax Law Review 2024” report, linked in the original article.

In Summary: The UK’s new £2,000 salary‑sacrifice cap will reduce the amount employees can exchange for tax‑free benefits, leading to a noticeable drop in net pay for many. While the move is framed as a measure to curb tax avoidance and raise revenue, small businesses warn of its potential to make recruitment more costly and the overall labour market less attractive. Whether the policy will achieve its intended fiscal tightening without unduly hurting workers remains to be seen.

Read the Full The Irish News Article at:

[ https://www.irishnews.com/news/uk/workers-and-businesses-will-feel-pain-from-2000-salary-sacrifice-cap-NG4PSPAVPRI37JAQ2JB4OWYHMY/ ]