MA vs Original Medicare: Baseline Differences in Coverage and Cost Structure

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Why Medicare Advantage Isn’t Always the Best Choice – A 500‑Word Summary of Investopedia’s “Don’t Choose a Medicare Advantage Plan Until You Read This: 5 Trade‑Offs Few Discuss”

Medicare Advantage (MA) plans, also called Medicare Part C, have become a popular alternative to Original Medicare because they promise lower monthly premiums and bundled services. However, Investopedia’s recent article cautions that this convenience can come at a cost, and that there are subtle, sometimes hidden, trade‑offs that most beneficiaries overlook. Below is a concise, reader‑friendly recap of the article’s key take‑aways, including the five major trade‑offs that can influence a beneficiary’s decision.

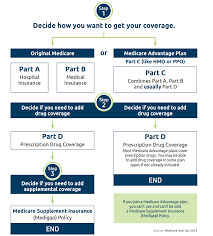

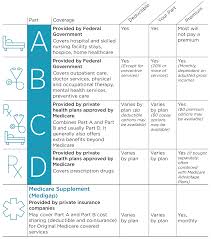

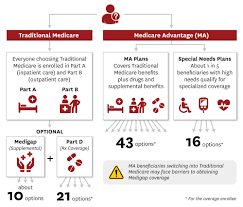

1. MA vs. Original Medicare: The Baseline Differences

Original Medicare (Part A for hospital insurance and Part B for medical services) is a fee‑for‑service system. Beneficiaries can visit any provider that accepts Medicare, pay a standard copay or coinsurance, and are covered for out‑of‑network care—although it usually requires higher out‑of‑pocket payments or additional coverage (e.g., Medigap).

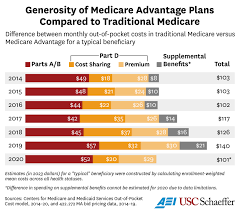

Medicare Advantage plans are offered by private insurers and often combine Part A, Part B, and sometimes Part D (prescription drug coverage). MA plans can provide additional benefits—like vision, dental, and fitness programs—that Original Medicare does not cover.

The article stresses that the convenience of “everything in one plan” is balanced by significant differences in cost structure, provider choice, and coverage limits.

2. The Five Trade‑Offs That Are Often Overlooked

Provider Network Restrictions

MA plans typically operate on a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) network. While many plans offer the same or lower monthly premiums, the downside is that you must use network doctors, hospitals, and specialists unless you qualify for an “out‑of‑network” exception (which often comes with higher costs).

Investopedia notes that the average beneficiary may have to pay significantly more when seeking care from a provider outside the network.Out‑of‑Network Costs and Coverage Gaps

Unlike Original Medicare, which generally covers out‑of‑network care (though at higher cost), MA plans may refuse to cover certain services performed by out‑of‑network providers, or require you to pay a large coinsurance.

The article underscores that a beneficiary’s “out‑of‑network” costs can outweigh the savings from a lower monthly premium.Prescription Drug Coverage Variability

While many MA plans include Part D drug coverage, the formulary (the list of covered drugs) can differ dramatically from the standard Medicare Part D plans. Some plans may exclude popular or high‑cost medications or impose stricter tiered copays.

Investopedia warns that a plan that looks cheap on paper may end up charging more for your everyday prescriptions.Limited Choice of Hospitals and Specialists

Because MA plans contract with a specific set of hospitals and specialists, you may lose access to certain facilities or experts. The article points out that this limitation can be particularly problematic for people with chronic conditions or those who need specialist care.

In some cases, beneficiaries discover they cannot use their preferred hospitals without incurring a penalty.Potential for Higher Cost‑Sharing and Benefit Caps

Many MA plans impose yearly maximums (cap on how much the plan will pay for out‑of‑network services). Once you hit that cap, you are responsible for all costs. Additionally, some plans shift a portion of the cost‑sharing back to the beneficiary (higher copays or coinsurance).

The article illustrates that for high‑cost illnesses, the annual maximum can be a real financial burden.

3. Why These Trade‑Offs Matter

Investopedia’s article explains that while a lower monthly premium may seem attractive, the total cost of care depends on:

- Actual utilization: If you frequently visit specialists or travel out of state for care, an MA plan’s network restrictions could push your costs up.

- Prescription needs: Certain drug plans may exclude your medication or impose higher copays.

- Risk tolerance: Some beneficiaries prefer predictable costs (original Medicare + Medigap) while others are comfortable with the risk‑reduction strategy offered by MA plans.

The article stresses that beneficiaries should perform a detailed cost‑benefit analysis, including reviewing the plan’s Summary of Benefits & Coverage (SBC), to see how the plan will cover the specific services you anticipate needing.

4. Practical Steps to Make an Informed Choice

Identify Your Health Care Needs

List the specialists, hospitals, and prescription medications you regularly use. Compare them against each MA plan’s network and formulary.Estimate Out‑of‑Pocket Costs

Use tools like the Medicare Plan Finder or consult the SBC to estimate potential costs for common procedures, specialist visits, and drug coverage.Consider a Medigap Policy

If you prefer Original Medicare’s flexibility, a Medigap policy can help cover deductibles, copays, and other out‑of‑network costs.Read the Fine Print

Pay close attention to annual out‑of‑network maximums, specialty care restrictions, and pharmacy benefit tiers.Seek Expert Advice

Speak with a licensed insurance agent or Medicare counselor who can help you compare plans side‑by‑side.

5. Bottom Line

The Investopedia article concludes that medicare advantage is not a one‑size‑fits‑all solution. For many, the trade‑offs—especially in network limitations and out‑of‑network cost behavior—can outweigh the benefits of lower premiums or extra services. The key takeaway: Never lock into an MA plan without first running a detailed cost comparison against your personal health profile.

Where to Learn More

- Medicare.gov offers a comprehensive Plan Finder and the official Summary of Benefits & Coverage for each MA plan.

- The article’s source references several additional Investopedia pieces on Medicare Part D formularies and Medigap policies, which provide deeper insight into prescription drug coverage and supplemental insurance options.

By taking the time to analyze these five critical trade‑offs, Medicare beneficiaries can avoid hidden costs and select a plan that truly aligns with their health care needs and financial goals.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/don-t-choose-a-medicare-advantage-plan-until-you-read-this-5-trade-offs-few-discuss-11856514 ]