Baby Boomers Pass $36 Trillion to Younger Generations - The Largest Wealth Transfer in History

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The Largest Wealth Transfer in History: What It Means for Your Finances and Savings

An In‑Depth Summary of Investopedia’s 2025 Analysis

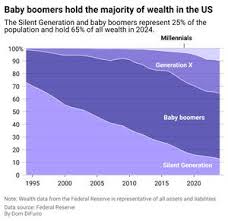

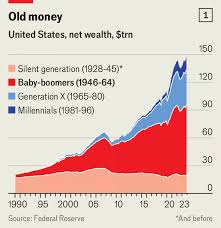

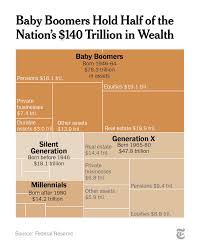

The Investopedia article titled “The Largest Wealth Transfer in History: What It Means for Your Finances and Savings” dives deep into the monumental shift of wealth from one generation to the next. As the baby‑boomer cohort—born 1946‑1964—reaches retirement age, their combined net worth is poised to pass to the younger generation, predominantly Millennials and Generation Z. With an estimated transfer of $36 trillion, this event is the single biggest generational wealth hand‑off ever recorded. Below is a comprehensive overview of the article’s main points, key implications for investors and savers, and the actionable strategies it recommends.

1. The Scale of the Transfer

The article begins by putting the $36 trillion figure into context:

- Historical Comparisons: The article contrasts the current hand‑off with previous large transfers, such as the 2001 “Great Recession” wealth shift, to underscore its unprecedented magnitude.

- Sources of Wealth: Baby boomers hold substantial equity in private business, real estate, pension funds, and investment portfolios. A significant portion of this wealth is also locked into tax‑advantaged accounts like 401(k)s and IRAs.

- Timing: The peak of the transfer is expected between 2026 and 2034, aligning with the retirement of the “Silent Generation” who will eventually be succeeded by Gen X retirees.

The article links to Investopedia’s “What Is the Generational Wealth Transfer?” guide for readers who want a broader historical perspective.

2. Why the Transfer Matters

The piece explains why this isn’t just a “fun fact” for analysts; it has concrete, far‑reaching effects on:

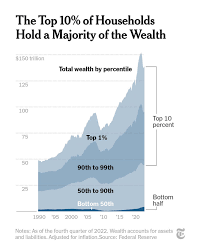

- Capital Markets: A large influx of capital into the stock market could drive up valuations. The article cites recent data from the S&P 500 and NASDAQ showing accelerated growth trends coincident with early retirements.

- Interest Rates & Inflation: The sudden availability of funds could pressure central banks to adjust monetary policy. The article references The Fed’s Balance‑Sheet Shrinking policy and notes that increased consumer spending could spur inflationary pressures.

- Real Estate: Housing demand is expected to rise, particularly in suburban and secondary‑city markets, potentially outpacing supply.

- Consumer Behavior: Millennials are known for prioritizing experiences over material goods, potentially shifting the distribution of wealth across sectors.

An embedded link to the “How the Wealth Transfer Will Affect the Stock Market” article expands on the market‑specific implications.

3. Investor Response: The “Wealth Transfer Investing” Strategy

The article identifies a new, formalized investment approach called “Wealth Transfer Investing.” Its core tenets include:

- Diversification Across Asset Classes: While equities are still a mainstay, investors are urged to overweight bonds—especially Inflation‑Protected Securities—and alternative assets like real estate and commodities.

- Focus on High‑Quality Corporate Bonds: The stability of these bonds is highlighted as a safe harbor against market volatility.

- Use of ETFs and Mutual Funds: The article recommends leveraging index ETFs (e.g., SPY, VTI) for broad market exposure, and fixed‑income ETFs (e.g., TLT, AGG) to balance risk.

- Sector Rotation: Given the boom in technology and renewable energy, the article suggests increased allocation to tech ETFs (e.g., QQQ) and green energy funds (e.g., ICLN).

The piece links to “What Is a Wealth Transfer Investment Strategy?” for a detailed breakdown of portfolio construction.

4. Personal Financial Planning

While the macro picture is compelling, the article zeroes in on the individual level:

4.1. Adjusting Savings Rates

- Higher Contributions: The article recommends increasing retirement contributions by up to 20% for those in their 30s and 40s to capture the surge in market liquidity.

- Emergency Funds: With higher market volatility, a robust emergency fund (6‑12 months of expenses) becomes even more critical.

4.2. Tax‑Efficient Strategies

- Roth Conversion: The article highlights the potential benefits of converting traditional IRA assets to Roth IRAs ahead of the tax code’s likely adjustments.

- Municipal Bonds: Tax‑exempt municipal bonds are presented as an attractive option for high‑income earners in high‑tax jurisdictions.

4.3. Real Estate Considerations

- Primary Residence: Homeowners are encouraged to evaluate the benefits of refinancing or using a HELOC to invest in other assets.

- Investment Property: The article encourages diversifying into rental properties or real‑estate crowdfunding platforms, especially in growth corridors.

An embedded link to “Real Estate Investing in the Age of Generational Wealth Transfer” offers deeper guidance.

5. Risks & Caveats

The article does not paint a rosy picture entirely. Key risks highlighted include:

- Overvaluation: There is a risk of a bubble forming in both equities and real estate.

- Policy Responses: Central banks might tighten monetary policy, leading to higher borrowing costs.

- Market Saturation: Too many investors following the same strategy can erode returns.

The article points readers to its “Risks of Wealth Transfer Investing” side bar for a granular risk assessment.

6. How to Stay Ahead

Investopedia concludes with practical steps to stay informed:

- Regular Portfolio Review: Quarterly checks to re‑balance based on market conditions.

- Education: Subscribing to reputable financial newsletters and webinars that cover generational dynamics.

- Professional Guidance: Working with a fiduciary financial planner who can incorporate the wealth transfer narrative into a personalized plan.

The article also recommends exploring the “Financial Planning for the Great Wealth Transfer” guide for a step‑by‑step plan.

Takeaway

The “Largest Wealth Transfer in History” article serves as both a macroeconomic primer and a practical playbook for individual investors. The $36 trillion hand‑off is reshaping markets, influencing policy, and redefining risk profiles across asset classes. Whether you’re a millennial, a Gen‑X saver, or a seasoned portfolio manager, understanding this shift—and how it can be leveraged—could make the difference between riding the wave and being swept away. Armed with the insights from Investopedia’s detailed analysis, you can position yourself to benefit from one of the most significant financial events of our time.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/the-largest-wealth-transfer-in-history-what-it-means-for-your-finances-and-savings-11770688 ]