Protecting Your Business from Fraud: Stay Vigilant, Stay Secure

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Protecting Your Business from Fraud: Stay Vigilant, Stay Secure

In an era where digital footprints are as valuable as cash registers, the risk of fraud looms over every business—no matter how small or large. The recent feature in the Berkshire Eagle titled “Protecting Your Business from Fraud: Stay Vigilant, Stay Secure” dives into the growing menace of corporate fraud, explains why businesses are prime targets, and offers a practical, multi‑layered approach to safeguarding assets, reputation, and the trust of clients.

Why Fraud Is a Top Threat for Modern Businesses

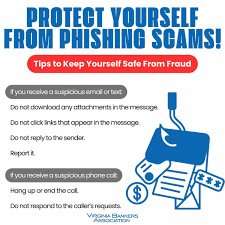

The article opens by highlighting a chilling trend: small‑to‑medium enterprises (SMEs) are experiencing a 25% increase in reported fraud incidents over the past year (source: Bureau of Justice Statistics, 2023). Fraudsters have adapted to new technologies, shifting from physical theft and embezzlement to sophisticated cyber‑based schemes such as phishing, account takeover, and synthetic identity theft.

Key takeaways:

| Threat Type | Typical Method | Impact |

|---|---|---|

| Phishing | Fake emails requesting credentials | Data breach, financial loss |

| Vendor Fraud | Fake invoices or altered payment details | Direct monetary theft |

| Employee Fraud | Unauthorized transactions or falsifying records | Loss of trust, legal repercussions |

| Cyber‑extortion | Ransomware or threat of data leaks | Operational downtime, ransom costs |

The Berkshire Eagle points out that the line between internal and external fraud has blurred: employees can collaborate with outside attackers to siphon funds through seemingly legitimate channels.

Recognizing the Red Flags

Before you can fight fraud, you must be able to see it. The article lists five warning signs that business owners should monitor:

- Unusual Bank Activity – Large transfers to unfamiliar vendors or sudden changes in payment instructions.

- Discrepancies in Invoices – Multiple invoices from the same vendor with slightly altered amounts or dates.

- Sudden “Hard” IT Changes – Unplanned software installations or unauthorized user access.

- Employee Requests for “Urgent” Payments – Pushes to expedite payments outside of the normal approval cycle.

- Frequent System Errors – Repeated login failures or system locks that point to credential compromise.

If you spot more than one red flag, it’s a sign that an investigation is warranted.

Building a Multi‑Layered Defense Strategy

The article breaks down a comprehensive defense into three pillars: People, Process, and Technology. Below is a summarized version of the recommended actions.

1. Strengthen People: Training & Awareness

- Regular Fraud Awareness Workshops – At least bi‑annual sessions for all staff, focusing on real‑world phishing examples and the consequences of data misuse.

- Zero‑Trust Culture – Encourage employees to verify any request for financial transaction, even if it comes from a senior officer.

- Anonymous Reporting Hotline – Provide a secure channel (e.g., a third‑party whistleblower platform) so employees can report suspicious activity without fear of retaliation.

2. Optimize Process: Controls & Policies

- Segregation of Duties (SoD) – Ensure that no single employee can approve, process, and reconcile payments. Use a “three‑person rule” for high‑value transactions.

- Vendor Verification Protocol – Before onboarding a new supplier, verify credentials via a third‑party database and request a signed letter of good standing.

- Periodic Audits – Internal or external audits should focus on financial workflows, especially for cash‑heavy or high‑risk departments.

- Incident Response Plan – Create a step‑by‑step playbook that outlines who to contact, how to isolate affected systems, and the documentation required for legal or insurance purposes.

3. Deploy Technology: Tools & Automation

- Multi‑Factor Authentication (MFA) – Enforce MFA for all access points, especially financial systems.

- Anti‑Phishing Email Gateways – Use tools that filter known malicious URLs and attachments.

- Automated Transaction Monitoring – Employ machine‑learning platforms that flag anomalous transaction patterns in real time.

- Secure Payment Platforms – Transition to digital payment solutions that require dual‑signature approvals for large transfers.

The Berkshire Eagle includes a helpful link to the U.S. Small Business Administration’s Fraud Prevention toolkit, which provides templates for SoD charts, vendor vetting checklists, and incident response checklists (https://www.sba.gov/fraud-prevention).

Case Study: A Mid‑Size Manufacturing Firm

The article uses a case study of a regional manufacturing company that fell victim to an internal fraud scheme. An employee colluded with a fake vendor to submit invoices for “equipment upgrades” that never materialized. By implementing the three‑pillar strategy outlined above, the company recovered $120,000 and avoided a major audit penalty.

Key lessons highlighted:

- Early Detection – The audit team noticed the unusual pattern of repeated invoices and flagged them before the funds were transferred.

- Strong SoD – Had the finance manager not also handled payments, the fraud would have been intercepted by the accounting clerk.

- Technology Leverage – The company’s automated monitoring flagged the duplicate vendor numbers, prompting an immediate investigation.

Resources and Further Reading

U.S. Department of Justice (DOJ) – Fraud Resources

https://www.justice.gov/fraud

(Provides guidance on reporting fraud and understanding federal statutes.)Federal Trade Commission (FTC) – Business Fraud

https://www.ftc.gov/industries/business

(Offers detailed information on common business fraud schemes and preventive measures.)National Association of Corporate Directors (NACD) – Fraud Prevention Playbook

https://www.nacd.com/fraud

(A curated set of best practices for corporate governance and fraud prevention.)FBI’s Internet Crime Complaint Center (IC3)

https://www.ic3.gov

(A platform to report cyber‑fraud incidents and obtain case updates.)

Bottom Line

Fraud is no longer an abstract threat; it is an active, evolving risk that can cripple businesses in seconds. The Berkshire Eagle article reminds us that the most effective defense begins with vigilance: staying aware of red flags, fostering a culture of accountability, and employing technology that turns suspicion into action. By adopting the three‑pillar framework—People, Process, and Technology—business owners can create a resilient shield that not only deters fraudsters but also protects the bottom line and the trust of customers and partners.

In an age where every transaction can be monitored by a bot, every email can be spoofed, and every employee’s access can be compromised, staying vigilant and staying secure is not optional—it is the cornerstone of sustainable business success.

Read the Full Berkshire Eagle Article at:

[ https://www.berkshireeagle.com/business/columnist/protecting-your-business-from-fraud-stay-vigilant-stay-secure/article_909784b5-5904-4f5b-b48d-b6462d076896.html ]