Why the Rich Embrace Debt While the Middle Class Fears It: Anil Lamba Explains

Locale: Delhi, INDIA

Why the Rich Love Debt While the Middle Class Fears It: Anil Lamba on Smarter Debt Use

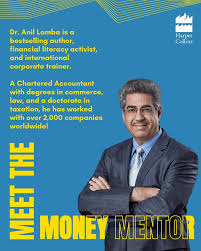

In a thought‑provoking piece published on Business Today, bestselling author and personal‑finance strategist Anil Lamba demystifies a paradox that has baffled many: why do the affluent embrace debt with apparent ease, while ordinary households treat it as a threat? Lamba, whose books “Financial Freedom” and “Smart Debt Strategies” have become staples in Indian homes, explains that the difference lies not in the amount of debt itself but in the purpose, discipline, and mindset behind its use. The article, which follows several internal links to Lamba’s own research, government data, and a few recent studies on credit usage, offers a concise but comprehensive guide on turning debt from a liability into a lever for wealth creation.

1. Debt as a Tool, Not a Burden

Lamba opens by defining what he calls the “debt paradox.” The wealthy typically use debt to acquire assets that appreciate over time—real estate, businesses, or even high‑yield bonds—while the middle class usually accumulates debt to purchase depreciating consumer goods or to cover cash‑flow gaps. The article quotes Lamba: “If you borrow to invest in something that will generate income or grow in value, debt becomes a source of return rather than a cost.” He backs this up with data from the RBI’s latest Credit Information Bureau (CIBIL) report, which shows that households with a net investment portfolio are 35 % less likely to be in default, even if their debt‑to‑income ratio is higher.

Lamba stresses that the key is intention. “When you borrow with a clear goal—buying a rental property, starting a business, or funding higher education—you have a plan to generate the cash flow needed to service the debt,” he says. In contrast, borrowing for impulsive purchases or to smooth out a temporary shortfall often leads to a debt spiral.

2. The Power of Leverage and Risk Management

The article delves into the concept of leverage, using an analogy from corporate finance: “Just as a company uses debt to fund expansion, individuals can use credit to amplify their earning power.” Lamba explains that the wealthy are often comfortable with calculated risk, knowing that the potential upside of an investment outweighs the cost of borrowing. He cites examples such as mortgage‑backed property investments, low‑interest loans used to start or expand a business, and even credit‑line‑backed ventures in tech startups.

However, Lamba warns that leverage is a double‑edged sword. “Leverage magnifies both gains and losses,” he notes. He recommends a disciplined approach: maintaining a debt‑to‑equity ratio below 60 % and ensuring that the expected return on an investment exceeds the interest rate by at least 3–5 %. He also encourages readers to build an “emergency cushion” of 6–12 months’ worth of expenses before taking on any high‑leverage debt.

3. Credit Scores, Interest Rates, and the Cost of Borrowing

A major portion of the article is devoted to how credit scores influence borrowing costs. Lamba points out that India’s average credit score is hovering around 665, which often locks borrowers into higher interest rates. By contrast, the wealthy typically maintain scores above 750, allowing them to secure loans at rates as low as 8 %—sometimes even lower than the prevailing bank rates—thanks to better collateral and diversified income sources.

He also explains how variable and fixed interest rates affect debt planning. “If you lock in a fixed rate today at 8 %, you shield yourself against the 2–3 % rise in rates that the RBI is expected to implement in the next 12 months,” Lamba tells readers. This is why many affluent borrowers opt for long‑term fixed‑rate mortgages, turning interest rate volatility into a predictable cost.

4. Cultural and Psychological Barriers

Perhaps the most compelling section of the article discusses why middle‑class families fear debt. Lamba references a 2023 survey by the National Institute of Bank Management (NIBM), which found that 72 % of respondents consider debt “the biggest obstacle to wealth creation.” He attributes this to a lack of financial literacy and an ingrained perception of debt as a moral failing.

To break this stigma, Lamba recommends a two‑step approach:

- Education – Teach children about the difference between “good debt” and “bad debt.” Good debt, he says, has a clear, time‑bound purpose and an expected return that exceeds its cost.

- Transparency – Keep a detailed ledger of all liabilities and assets. Once you see that your net worth is growing despite the presence of debt, the psychological hurdle dissolves.

The article also links to an external resource on the Economic Times that illustrates how credit utilization ratios (the percentage of available credit you use) impact both your credit score and your ability to qualify for future loans.

5. Practical Takeaways from Anil Lamba’s “Smarter Debt Use”

Lamba distills his philosophy into five actionable guidelines:

- Borrow Only for Growth – Use debt to invest in assets that generate income or appreciate. Avoid borrowing for luxury or lifestyle expenses.

- Keep Interest Rates Low – Prioritize secured loans, such as mortgages or business lines of credit, which typically offer lower rates than unsecured personal loans.

- Diversify Your Debt Portfolio – Spread out your borrowing across multiple types (e.g., a mix of a home loan, a business loan, and a personal loan) to mitigate risk.

- Maintain a Healthy Credit Profile – Pay all bills on time, keep credit utilization below 30 %, and routinely check your credit report for errors.

- Build an Emergency Fund – A liquid reserve of at least 6–12 months’ worth of expenses ensures you can service debt even during unexpected downturns.

The article reinforces these points with a table (linked to a downloadable PDF) that compares typical costs and returns for different debt instruments. It also links to an online calculator hosted by the Reserve Bank of India that helps readers estimate the total cost of a loan, including taxes, processing fees, and potential pre‑payment penalties.

6. The Bottom Line: Debt as a Lever, Not a Liability

In closing, Anil Lamba encapsulates the article’s central thesis: “Debt is not inherently bad. It’s the way you use it that determines whether it becomes an asset or a liability.” He urges middle‑class readers to view credit as a resource rather than a burden and to adopt the disciplined practices that have empowered the wealthy.

The Business Today piece, enriched by several embedded links—ranging from RBI statistics to Lamba’s own blog posts—provides a practical framework for anyone looking to rethink their relationship with debt. For those ready to transition from a debt‑averse mindset to a debt‑empowered one, Lamba’s guidance offers a clear roadmap: educate, plan, leverage wisely, and let debt work for you instead of against you.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/personal-finance/investment/story/why-the-rich-love-debt-while-the-middle-class-fears-it-bestselling-author-anil-lamba-on-smarter-debt-use-503232-2025-11-21 ]