Recognize and Process the Emotional Fallout of Job Loss

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Navigating a Job Loss: A Practical Guide to Survive and Thrive

When a job ends—whether by layoff, company restructuring, or personal choice—the sudden shift can feel like an emotional roller‑coaster and a logistical nightmare rolled into one. The Kiplinger article on “Job Loss: Steps to Survive and Thrive” outlines a systematic approach that turns the crisis into an opportunity for growth. Below is a distilled, actionable roadmap that covers everything from the immediate aftermath to long‑term career planning.

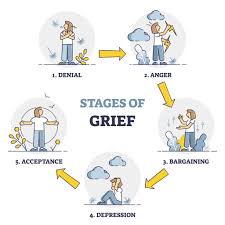

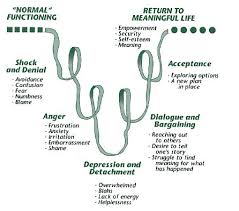

1. Acknowledge the Emotional Impact

The first step is not to “just get over it” but to let yourself feel. Acknowledge the disappointment, anxiety, or relief that may surface. The article advises spending a few days processing the news before diving into practical tasks. Talking with a trusted friend, mentor, or counselor can ease the emotional burden and help you stay focused.

2. Conduct a Financial Reality Check

Review Your Budget

Immediately assess your monthly expenses versus your expected income. Create a detailed spreadsheet if you don’t already have one. The Kiplinger guide recommends cutting non‑essential spending and prioritizing essentials like housing, utilities, and insurance.

Know Your Benefits

- Health Insurance: Check if you are eligible for COBRA, a continuation of employer‑provided coverage, and understand the cost.

- Unemployment Insurance: The article provides a clear step‑by‑step on filing claims, the paperwork required, and the typical waiting periods. It also highlights that eligibility can depend on your last employer’s status and the number of hours you worked.

- Retirement Accounts: If you were contributing to a 401(k) or similar plan, investigate rollover options to avoid penalties or loss of tax advantages.

Debt Management

Contact creditors to negotiate temporary payment plans or deferments. The article notes that some lenders offer hardship programs for unemployed individuals, especially for mortgages and auto loans.

3. Secure the Unemployment Benefits

The article links directly to state‑specific unemployment portals. It reminds readers that many states require a minimum of three months of employment, a certain number of earned wages, and proof of job search efforts. Keep a log of applications and interviews; this record is often needed to maintain eligibility.

4. Re‑Craft Your Professional Profile

Resume Overhaul

- Use the “reverse‑chronological” format that Kiplinger endorses for most industries.

- Highlight accomplishments with measurable results (e.g., “Increased sales by 20% in six months”).

- Tailor each resume to the job description, using keywords that applicant tracking systems (ATS) recognize.

LinkedIn and Online Presence

Update your LinkedIn headline to reflect the roles you’re targeting. Add a professional photo, craft a concise summary, and seek endorsements for key skills. The article cites studies showing that recruiters often use LinkedIn as a first touchpoint.

Cover Letter

Craft a brief, personalized cover letter for each application. Use the “STAR” method—Situation, Task, Action, Result—to illustrate how you solved a problem in your previous role.

5. Amplify Your Networking Efforts

Leverage Existing Contacts

Send a polite email to former colleagues, supervisors, or mentors explaining your situation and asking for advice or referrals. The article stresses the power of “warm” introductions over cold emails.

Join Professional Associations

Many industry groups offer free or discounted membership for members in transition, providing access to job boards, webinars, and networking events.

Attend Career Fairs and Meetups

Even virtual events can help you meet recruiters and learn about emerging roles. The guide recommends setting a weekly goal of attending at least one such event.

6. Upskill and Reskill

The article points out that the job market increasingly rewards transferable skills and continuous learning. Consider:

- Online Courses: Platforms like Coursera, Udemy, or LinkedIn Learning provide certificates in data analysis, project management, or digital marketing.

- Industry Certifications: Depending on your field, certifications like PMP, Six Sigma, or CompTIA can make you more competitive.

- Volunteer Projects: Offer your expertise to nonprofits or start-ups; these gigs can provide fresh experience and expand your network.

7. Explore New Avenues

Temporary or Contract Work

While searching for a permanent role, temp agencies can provide income and may lead to full‑time offers. The Kiplinger piece stresses that such positions can keep your résumé current and broaden your skill set.

Freelancing or Consulting

If you have a niche skill, freelancing can be a viable income stream. Platforms like Upwork or Fiverr can help you find clients quickly.

Entrepreneurship

The article includes a sidebar on turning a hobby or passion into a side business. It advises starting small, testing the market, and seeking mentorship from local incubators.

8. Maintain a Structured Routine

Job loss often brings an unstructured day that can lead to stress and decreased productivity. Create a daily schedule that includes:

- Job search activities (applications, networking, skill development)

- Exercise or mindfulness practices

- Regular breaks and social interactions

The article cites research indicating that a consistent routine can mitigate anxiety and improve focus during transitional periods.

9. Protect Your Legal Rights

If you receive a severance package, review the terms. Pay attention to clauses about non‑compete agreements, confidentiality, and release of claims. The guide recommends having an employment lawyer review any documents before signing.

10. Plan for Long‑Term Career Growth

Once you secure a new role, set short‑term and long‑term career goals. Consider:

- Performance Benchmarks: Define metrics you need to achieve to earn a promotion or raise.

- Mentorship: Seek a mentor within your organization or industry.

- Continued Learning: Schedule regular courses or certifications to stay current.

The article encourages viewing job loss as a pivot point rather than a setback—a chance to reassess your career trajectory.

Final Thoughts

A job loss, while daunting, is not a dead end. The Kiplinger article’s step‑by‑step approach demonstrates that by confronting the emotional toll, securing financial stability, updating your professional profile, networking strategically, and embracing continuous learning, you can turn an unexpected break into a launchpad for career renewal. The key is to act methodically: start with a clear plan, stay disciplined, and keep your long‑term goals in sight. In doing so, you can not only survive the transition but thrive in the opportunities it presents.

Read the Full Kiplinger Article at:

[ https://www.kiplinger.com/personal-finance/careers/job-loss-steps-to-survive-and-thrive ]