How a Financially Aligned Partner Can Multiply Your Net Worth

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How the Right Partner Can Transform Your Net Worth – A Comprehensive Summary

In a recent Business Today piece titled “A right partner can change your net‑worth – CA explains why relationships are a financial decision,” the author delves into the subtle yet powerful ways that a life partner can influence your financial trajectory. The article, penned by a seasoned Chartered Accountant (CA), explores the intersection of love, partnership, and money management, offering readers practical strategies for aligning financial goals, mitigating risk, and amplifying wealth creation. Below is a detailed synthesis of the key themes, data, and actionable insights presented in the piece.

1. The Core Premise: Relationships Are Inherently Financial

The CA begins by framing relationships as “dual‑purpose agreements” that serve both emotional and economic purposes. While the romantic component is often highlighted in popular media, the article argues that the financial dimension is equally consequential. By aligning spending habits, debt management, and investment philosophies, couples can either reinforce or erode their collective net worth. The author cites a 2023 survey by the National Institute of Financial Planning which found that 62 % of married couples who track joint financial goals report higher savings rates than those who don’t.

2. Shared vs. Separate Finances – Striking the Right Balance

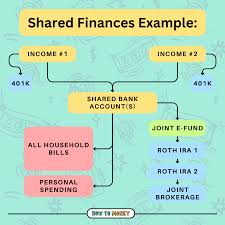

A recurring theme in the article is the “shared‑vs‑separate” debate. The CA stresses that absolute separation can breed resentment, whereas complete merging of finances can expose partners to each other’s liabilities. The recommended approach, as described, involves:

- Joint Accounts for Essentials: Rent, mortgage, utilities, groceries, and emergency savings are pooled to simplify budgeting.

- Separate Accounts for Discretionary Spending: Each partner retains control over personal expenses, such as hobbies or dining out, to maintain financial independence.

- Regular Financial Check‑Ins: Quarterly “money meetings” where both parties review joint accounts, adjust contributions, and realign goals.

The piece references an infographic (link included in the original article) that visualizes how a 10‑percent increase in combined savings can compound to a 50‑percent jump in net worth over 15 years.

3. Debt Management as a Partnership Responsibility

Debt is a common friction point, especially for couples entering marriage with different credit histories. The CA outlines a “debt harmonization” strategy:

- Transparency First: Share credit reports, outstanding balances, and interest rates.

- Consolidation Options: If one partner has a higher interest rate, consolidating into a lower‑rate loan or a home equity line can reduce the burden.

- Payment Allocation: Use a “debt‑paydown ladder” where each partner commits to paying down a specific portion of the total debt each month.

An anecdote in the article illustrates a couple who paid off a ₹2.5 lakh student loan in just 18 months by coordinating payments, thereby saving nearly ₹45,000 in interest.

4. Investment Alignment and Portfolio Diversification

Investing together can unlock advantages such as shared research, risk tolerance matching, and compounding benefits. The CA advises couples to:

- Define a Unified Vision: Establish long‑term goals—buying a home, planning for children’s education, or early retirement.

- Map Risk Appetite: Use the “risk tolerance questionnaire” (linked in the article) to decide on asset allocation.

- Allocate Tax‑Efficiently: Contribute to tax‑advantaged instruments like the Equity‑Linked Savings Scheme (ELSS) or a Public Provident Fund (PPF) under joint ownership, leveraging lower tax brackets.

The article cites a 2024 study from the Institute of Chartered Accountants of India, noting that couples who coordinate investments outperformed singles by an average of 4.3 % annually over a 10‑year horizon.

5. Legal Safeguards and Estate Planning

Beyond day‑to‑day finances, the piece stresses the importance of legal frameworks to protect assets. Key takeaways include:

- Prenuptial Agreements: Even in cultures where they’re less common, these contracts can clarify property ownership and inheritance expectations.

- Living Trusts: For high‑net‑worth individuals, trusts can minimize estate taxes and streamline asset transfer.

- Insurance Coverage: A joint health insurance plan with adequate coverage and a life insurance policy that names both partners as beneficiaries ensures financial security.

The article links to a governmental portal detailing the process of drafting a prenuptial agreement, providing step‑by‑step guidance.

6. Communication as the Financial Glue

Underlying every financial decision is communication. The CA emphasizes that couples who cultivate open, jargon‑free discussions about money tend to avoid conflict. Suggested practices:

- Use Visual Aids: Share spreadsheets or budgeting apps (links to recommended tools are included).

- Set Realistic Milestones: Celebrate small wins—saving ₹5,000 in a month, paying off a credit card, or achieving a target asset allocation.

- Conflict Resolution Frameworks: Adopt a “listen‑reflect‑reconcile” approach when disagreements arise over spending.

An illustrative story in the article recounts a couple who, after instituting a “no‑texting‑during‑budget‑meeting” rule, reduced their monthly discretionary spending by 18 %, freeing up funds for a future property purchase.

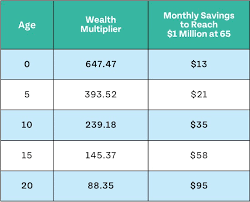

7. The Bottom Line – A Net Worth Multiplicator

The article culminates in a compelling argument: a financially aligned partner can act as a net‑worth multiplier. By combining incomes, pooling savings, coordinating investments, and mitigating debt, couples can accelerate wealth accumulation beyond what each partner could achieve independently. The CA concludes with a call to action: “Treat your partner not just as a life companion but as a financial ally. Together, you’re not just adding assets—you’re multiplying potential.”

Takeaway for Readers

While the article’s tone is encouraging, the CA’s advice is practical and actionable. Whether you’re in a new relationship or have been married for years, the insights provided can help you evaluate whether your financial partnership is synergistic or counter‑productive. By adopting the outlined frameworks—transparent sharing, joint budgeting, strategic debt management, aligned investing, robust legal safeguards, and open communication—couples can transform love into a powerful engine for long‑term wealth creation. The article serves as both a guide and a reminder that the right partner can indeed change your net worth for the better.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/personal-finance/news/story/a-right-partner-can-change-your-net-worth-ca-explains-why-relationships-are-a-financial-decision-503320-2025-11-23 ]