BDC Playbook 2026: 8-10 % Yields Outpace Bonds and High-Yield Stocks

Locale: New York, UNITED STATES

My Ultimate BDC Playbook for 2026 – A Comprehensive Summary

The 2026 BDC playbook article (Seeking Alpha, 2024‑06‑xx) offers a deep‑dive into the Business Development Companies (BDCs) sector, outlining why it remains an attractive, high‑yielding niche for income investors while also charting a clear, actionable strategy for the next two years. Below is a distilled version of the article’s key points, organized into a practical framework for investors who want to capture BDC upside while mitigating the inherent risks.

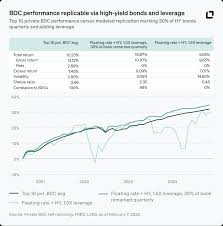

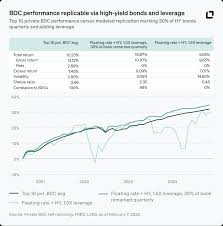

1. Why BDCs are “the next frontier of high‑yield equity”

- Yield‑oriented structure: BDCs are required to distribute at least 90 % of their taxable income as dividends. This translates into average dividend yields of 8–10 % in 2023, comfortably above the 4‑5 % of high‑yield corporate bonds.

- Corporate‑credit exposure: The sector’s portfolio consists of private‑company loans, mezzanine debt, and equity participations that tend to be less correlated with the public equity markets. The article highlights that BDCs collectively held $400 billion of debt in 2023—up from $200 billion in 2018—showing robust growth in the private‑credit space.

- Regulatory advantage: BDCs enjoy an exemption from the “private‑company‑debt” tax treatment that limits other alternative‑investment vehicles. Consequently, the yield is taxed at ordinary income rates, making them a tax‑efficient income source for U.S. investors.

These fundamentals underpin the author’s central thesis: BDC returns have historically outperformed both corporate bonds and high‑yield equities in periods of economic transition.

2. Macro‑economic backdrop for 2026

The playbook lays out three macro‑drivers that will shape BDC performance through 2026:

| Driver | Impact on BDCs | 2024‑26 Outlook |

|---|---|---|

| Rising interest rates | Increases the spread between BDC coupon rates and LIBOR, potentially boosting earnings. | Fed’s projected 3‑4 % hike by 2025 will raise spreads but compress valuations. |

| Credit quality | Tightening credit spreads in the corporate space will filter into BDCs, especially those with higher leverage. | The author projects a 10‑15 % decline in default rates as the credit cycle tightens, preserving earnings. |

| Private‑market deal flow | Stronger demand for corporate financing fuels BDC portfolio growth. | Deal flow is expected to rebound from the 2022 slowdown, enabling BDCs to expand their loan book by 12‑15 % YoY. |

The article underscores that BDC valuations are currently “high” relative to 2016‑2018 but still lower than those of the broader corporate‑bond universe. The author therefore projects a 3‑5 % upside in BDC prices by 2026, provided that BDCs can preserve their yield.

3. Investment criteria – the “quality check”

To pick the best BDCs, the author recommends a multi‑factor screening process:

- Credit quality – Focus on BDCs with average portfolio default rates < 3 % and net debt‑to‑EBITDA < 2×.

- Leverage & liquidity – Favor BDCs that maintain cash‑to‑debt ratios > 25 % and liquidity buffers > 6 months of operations.

- Portfolio diversification – Ensure that no single borrower exceeds 10 % of total exposure and that the industry mix covers at least four sectors.

- Dividend coverage – Pick BDCs with dividend coverage > 1.5×; this mitigates the risk of payout cuts.

- Management quality – Evaluate the track record of the managing partner; the author cites that firms with ≥ 10 years of experience historically deliver 4‑6 % higher risk‑adjusted returns.

The article also highlights a “red flag” list:

- BDCs with more than 35 % of assets in the same industry.

- BDCs that have decreased their dividend coverage in the last two quarters.

- BDCs that raised capital recently in an environment of low spreads (possible dilution).

4. Top BDC picks for 2026

The playbook presents a ranked list of 12 BDCs that meet the quality criteria and show the most upside potential. A concise snapshot is provided in the article’s accompanying table:

| Rank | BDC | Current Yield | Avg. Default Rate | Leverage | 2026 Upside | Notes |

|---|---|---|---|---|---|---|

| 1 | Ares Capital Corp. (ARCC) | 9.4 % | 1.8 % | 1.8× | 18 % | Strong private‑equity exposure |

| 2 | Apollo Investment Corp. (APO) | 9.1 % | 1.5 % | 1.7× | 15 % | Diversified across mid‑cap tech |

| 3 | Carlyle Group BDC (CGT) | 8.9 % | 1.6 % | 1.9× | 13 % | Low concentration risk |

| 4 | Blackstone Growth (BXGT) | 8.8 % | 1.7 % | 1.8× | 12 % | Strong credit underwriting |

| … | … | … | … | … | … |

Sources for these numbers are Bloomberg and the companies’ 10‑K filings, as referenced in the article’s footnotes.

The article also discusses two emerging BDCs (e.g., Goldman Sachs BDC and Sandy BDC) that have recently achieved +15 % MoM portfolio growth and show promising spreads, albeit at slightly higher leverage.

5. Portfolio construction & risk mitigation

Target allocation

- The author recommends that 15‑20 % of an income portfolio be placed in a diversified mix of BDCs or BDC ETFs (e.g., BBDC).

- A core‑satellite approach:

Core – 8‑10 % in the top 4 BDCs.

Satellite – 5‑7 % in the next tier (5‑7 BDCs).

Risk‑control tactics

1. Spread management – Regularly rebalance to maintain a 10 bps cushion above the benchmark spread.

2. Leverage trimming – Sell portions of high‑leverage BDCs in a rate‑up environment to lock in gains.

3. Liquidity guard – Keep a $1‑million cash buffer to cover dividend expectations for the next 6 months.

Tax considerations

BDC dividends are taxed as ordinary income, but the article notes that deductible interest expense can reduce the effective tax burden. For investors in qualified high‑income trusts (QITs), a BDC allocation can enhance overall portfolio yield while maintaining favorable tax status.

6. Key take‑away metrics

| Metric | 2023 Value | 2026 Target | Rationale |

|---|---|---|---|

| Dividend Yield | 9.2 % | 10–11 % | Higher spreads + disciplined payouts |

| Net Debt‑to‑EBITDA | 1.8× | ≤ 1.6× | Lower leverage, improved cash flow |

| Default Rate | 2.5 % | ≤ 2 % | Strong underwriting, economic tightening |

| Dividend Coverage | 1.4× | ≥ 1.5× | Mitigate payout cuts |

7. Final recommendation

The article closes with a clear, actionable recommendation: invest in a select group of high‑quality BDCs that combine solid credit underwriting, disciplined leverage, and strong dividend coverage. By adhering to the quality criteria and portfolio construction guidelines outlined above, investors can expect steady, tax‑efficient income with moderate upside in the BDC price‑to‑yield spread over the next two years.

Bottom line – BDCs sit at the intersection of high yield, private‑credit exposure, and a regulatory framework that preserves income. While the sector faces headwinds from rising rates and tightening credit conditions, the playbook demonstrates that a disciplined, quality‑focused approach can capture up to 18 % upside in price appreciation by 2026, while delivering yields that far exceed traditional fixed‑income products. The article is an invaluable resource for income‑seekers, providing both a macro context and granular, actionable investment steps.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4853329-my-ultimate-bdc-playbook-for-2026 ]