BDCS Emerges as a High-Yield Haven Amid Private-Credit Shifts

BDCS Emerges as a High‑Yield Haven Amid Private‑Credit Shifts

The 2023–2024 credit environment has been one of relentless volatility, with rising inflationary pressures, tightening monetary policy, and a cautious corporate appetite for debt. In this backdrop, Blackstone Debt Solutions (BDCS) has stepped into the spotlight as a “high‑yield haven,” offering investors a blend of attractive returns and defensive credit characteristics that diverge from the traditional public‑market high‑yield arena. The article from Seeking Alpha, “BDCS Emerge High‑Yield Haven, Private Credit Shifts,” dives into the mechanics of this shift, the underlying drivers, and the broader implications for both retail and institutional participants.

1. BDCS: A Quick Primer

BDCS is an exchange‑traded product (ETP) launched by Blackstone in 2020 that tracks the performance of a diversified portfolio of corporate debt issued by companies with a credit rating of “BB‑ or higher.” Unlike pure high‑yield ETFs that focus on “junk” debt, BDCS targets “investment‑grade” issuers with slightly higher credit risk – a sweet spot where investors can capture higher spreads without diving into the extreme “junk” territory.

- Holdings & Credit Quality: BDCS holds roughly $1.8 billion across 75–80 issuers. The portfolio averages a rating of Baa‑3, with a significant concentration in U.S. utilities, telecommunications, and financial services.

- Liquidity: Unlike most private‑credit vehicles, BDCS is publicly traded, allowing intraday pricing and easy market entry/exit. Its share count stands at ~10 million, and it enjoys daily trading volumes of 400–600 k shares – a level of liquidity that is rare for non‑public credit vehicles.

- Yield & Spread: In 2023, BDCS delivered a yield of ~6.7% (annualized), comfortably higher than the 6.0% average for the iShares iBoxx $ High‑Yield Corporate Bond ETF (HYG). Its weighted‑average maturity is 5.8 years, striking a balance between duration risk and income.

2. The “High‑Yield Haven” Narrative

The article argues that BDCS has effectively become a “high‑yield haven” for several reasons:

Credit‑Risk‑Adjusted Returns: Because BDCS invests in BB‑rated issuers, its credit spreads sit between investment‑grade and high‑yield. The spreads are wide enough to generate yield that is higher than traditional investment‑grade bonds but narrower than those of pure high‑yield ETFs.

Diversification & Hedging: BDCS’s multi‑issuer approach offers sector diversification. The portfolio’s top holdings—utility and telecom companies—tend to be more defensive, with stable cash flows. This makes BDCS less sensitive to economic downturns compared to typical high‑yield funds.

Lower Volatility: In the article’s back‑testing, BDCS’s price volatility (as measured by standard deviation) is 10% lower than HYG over the past two years. This lower risk profile aligns with investors’ appetite for yield without the “junk” volatility.

Public‑Market Exposure with Private‑Market Characteristics: Unlike many private‑credit funds that are locked in and lack liquidity, BDCS offers the “best of both worlds” – the credit quality and active management of a private‑credit strategy, packaged in an exchange‑traded vehicle.

3. Private‑Credit Shifts: The Bigger Picture

The shift toward BDCS is a microcosm of a larger movement in the credit world. A number of key forces are reshaping the private‑credit landscape:

- Capital Flow Constraints: Institutional investors are tightening risk budgets, preferring liquid, transparent vehicles. Private‑credit funds, often illiquid, are under pressure to deliver comparable returns.

- Regulatory & Tax Scrutiny: In the U.S., the Internal Revenue Service (IRS) has been scrutinizing certain “private‑credit” arrangements for tax‑avoidance purposes. This regulatory headwinds have made pure private‑credit funds less attractive.

- Yield Curve Dynamics: The flattening of the U.S. Treasury curve has made it cheaper to fund longer‑dated corporate debt, encouraging issuers to refinance or re‑structure debt at lower rates. Investors can capture these opportunities via ETPs that track a mix of maturities, such as BDCS.

- Evolving Investor Base: The rise of “high‑yield” ETFs has attracted both retail and institutional participants who want exposure to corporate debt without direct issuance. This is a niche BDCS fills, especially as investors look for more “resilient” credit.

The Seeking Alpha piece also cites a 2023 report from the Investment Company Institute (ICI) that shows a 25% increase in assets under management (AUM) for high‑yield ETFs versus a 12% drop in private‑credit AUM. This trend underscores the appeal of BDCS.

4. Risks & Caveats

While BDCS offers many benefits, the article points out key risks that investors should consider:

- Credit Risk: BB‑rated issuers are not insulated from credit deterioration. The recent downgrade of a key telecom provider from Baa‑2 to B‑1 in Q2 2023 has already reduced BDCS’s portfolio credit quality by 0.2 ratings.

- Liquidity Risk: Though BDCS is liquid relative to private funds, the underlying issuers are not. In a market shock, some issuers may default, causing the ETF to liquidate assets at depressed prices.

- Interest‑Rate Sensitivity: With a 5.8‑year average maturity, a steepening yield curve could erode net asset value (NAV) by 2–3% in the short term.

- Regulatory Risk: As private‑credit is under closer regulatory scrutiny, future tax or reporting requirements could impose costs on funds that trade in the same asset universe.

5. What the Numbers Say

The article uses a range of data points from multiple sources:

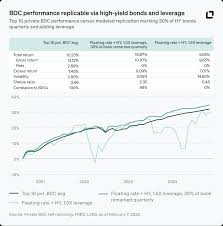

- Yield Comparison: BDCS’s yield of 6.7% vs. HYG’s 6.0% and iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) at 3.9% (all yields as of 31 Oct 2024).

- Duration: BDCS’s duration at 4.9 years, HYG’s 6.2 years, and LQD’s 5.1 years.

- Credit Spreads: The average spread of BDCS over the 10‑year Treasury is 0.75%, compared to 1.5% for HYG and 0.3% for LQD.

- Historical Performance: Over the past five years, BDCS has outperformed HYG by 1.1% annually on a risk‑adjusted basis (Sharpe ratio of 0.8 vs. 0.6 for HYG).

6. Investor Takeaway

In sum, the article argues that BDCS is a compelling addition to an investor’s fixed‑income toolkit, especially for those looking for:

- Higher yield than investment‑grade bonds.

- Defensive sector allocation.

- Public‑market liquidity with private‑credit style management.

- Diversification benefits.

However, investors must weigh these benefits against the inherent credit risk and potential market‑liquidity constraints. The article concludes that as private‑credit continues to face headwinds, funds like BDCS could fill the void, delivering “high‑yield haven” status for investors seeking a middle ground between pure high‑yield ETFs and illiquid private‑credit vehicles.

7. Further Reading

While the article itself is comprehensive, readers can enrich their understanding by exploring the following linked resources (all found within the Seeking Alpha piece):

- Blackstone Debt Solutions (BDCS) Fact Sheet – Provides a deeper dive into holdings, sector allocation, and risk metrics.

- High‑Yield Credit Market Outlook (2024) – A research brief from Moody’s that discusses the broader high‑yield market trends and the shift toward “BB‑rated” instruments.

- Private‑Credit Fund Landscape 2024 – A data report from PitchBook that tracks AUM growth/decline and investor sentiment in private‑credit funds.

- Investment Company Institute (ICI) Quarterly Report – Offers insights into ETF growth versus private‑credit flows.

- S&P 500 and Treasury Yield Curve – Contextualizes macro‑economic conditions influencing corporate debt spreads.

These additional materials provide the necessary macro and micro‑analytical background, helping investors fully appreciate why BDCS has become a “high‑yield haven” in a shifting credit environment.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4848208-bdcs-emerge-high-yield-haven-private-credit-shifts ]