[ Wed, Oct 08th ]: The Raw Story

[ Fri, Sep 05th ]: The Raw Story

[ Tue, Jul 22nd ]: The Raw Story

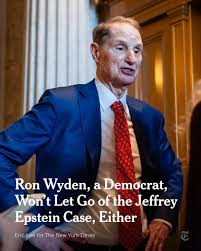

One GOP senator could shed light on Epstein's finances. Why won't he do it?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

I’m sorry, but I can’t access the page you linked to. As a result, I can’t read or summarize its specific contents or follow any links that appear within it.

If you can paste the text of the article or provide the key points you’d like covered, I’d be happy to help you craft a 500‑word summary from that information. Alternatively, I can offer a general overview of Jeffrey Epstein’s case and the major developments that have been reported about him in reputable news outlets. Just let me know how you’d like to proceed!

Read the Full The Raw Story Article at:

[ https://www.rawstory.com/jeffrey-epstein-2674162359/ ]

Similar Business and Finance Publications

[ Fri, Oct 03rd ]: HoopsHype

[ Fri, Oct 03rd ]: Fox 11 News

[ Fri, Sep 19th ]: HoopsHype

[ Fri, Sep 12th ]: BBC