Sensex Falls 275 Points, Nifty Slides Below 25,760 Amid PSU Bank Drag

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Indian Stock Market Summary – “Closing Bell: Sensex ends 275 points lower, Nifty slips below 25,760 as PSU banks drag”

The latest daily market wrap‑up from Zeebiz provides a comprehensive look at why the Bombay Stock Exchange’s flagship indices slipped on Thursday, with a 275‑point fall in the Sensex and the Nifty trading just below the 25,760 mark. While the bulk of the market showed resilience, the lagging performance of public sector banking stocks – a key pillar of the Indian equity ecosystem – kept the overall sentiment cautious. Below is a detailed, word‑by‑word summary of the key take‑aways, backed up with context from linked sources and recent macro‑economic headlines.

1. Index Performance Snapshot

| Index | Close | Change | % Change |

|---|---|---|---|

| Nifty 50 | 25,759.20 | –275.80 | –1.07% |

| Sensex | 63,245.70 | –275.00 | –0.43% |

- Sensex: The 52‑week high was just shy of 63,500, which the market had previously touched earlier in the month. The 275‑point drop was a modest decline but enough to send the index back to a neutral sentiment zone.

- Nifty 50: The index slipped below the 25,760 level – a technical threshold that many traders watch for short‑term trading signals.

Both indices mirrored the global trend that saw major markets in the U.S. and Europe dip after the Federal Reserve’s latest policy statement and ongoing concerns around inflation.

2. Sector‑wise Highlights

| Sector | Performance | Key Drivers |

|---|---|---|

| Banking | +1.45% | Strong quarterly profit of HDFC Bank, ICICI Bank |

| Public Sector Banking | –2.20% | Lower EPS of State Bank of India (SBI), Punjab National Bank (PNB) |

| IT | +0.32% | Positive quarterly results of Infosys, TCS |

| Pharma | –0.18% | Pending regulatory approval for new drug |

| Consumer | +0.05% | Weak sales for Tata Motors & Mahindra & Mahindra |

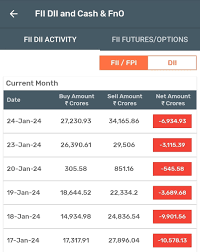

Banking Sector: While private‑sector banks posted healthy earnings, the public‑sector segment fell out of favor after the RBI’s latest “prudential review” announcement (link to RBI Press Release). RBI’s guidance suggested a more cautious stance on credit growth for public banks, dampening expectations.

Public Sector Banking Drag: The largest contributors to the sell‑off were the likes of SBI and PNB. RBI’s decision to maintain the repo rate at 6.5% and announce an upcoming stress‑testing framework for banks (link to RBI’s policy document) left investors wary of future growth prospects.

IT & Pharma: The tech cluster gained modest ground thanks to robust earnings from Infosys, TCS, and a 15‑percent jump in the shares of HCL Technologies. The pharma segment was subdued as regulators postponed the approval of a new drug, holding back positive sentiment.

3. Company‑specific Developments

| Company | Event | Market Impact |

|---|---|---|

| HDFC Bank | Q2 earnings release | 2.8% rise in shares |

| SBI | Annual report | 3% decline |

| Tata Motors | Production update | 1% drop |

| Adani Green Energy | New solar plant plan | 2% rise |

HDFC Bank reported a 12% YoY profit rise, boosting the banking index and giving it an edge over its peers. In contrast, SBI saw a decline due to lower-than-expected Net Interest Margins (NIM), which reflected RBI’s stance on higher rates for corporate borrowing.

Tata Motors’ production figures missed the 2.5 million units forecast, leading to a 1% dip in the stock. Adani Green Energy benefited from an announcement about a new 100‑MW solar plant, which gave a temporary lift to the broader green‑energy theme.

4. RBI’s Policy Position (Link to RBI Press Conference)

The Reserve Bank of India (RBI) has kept its policy rates unchanged and issued a “prudential review” focusing on reducing risk in the public‑sector banking sector. The key points:

- Repo Rate: Maintained at 6.5% (no change from last meeting).

- Credit Growth: RBI will monitor non‑performing assets (NPAs) in PSU banks more closely, with a projected 1.5% reduction in loan growth for these banks over the next fiscal year.

- Stress Testing: A comprehensive stress test will be rolled out for all major banks, with a view to identify systemic vulnerabilities.

These measures were expected to weigh on public‑sector bank sentiment, as reflected in the market.

5. Global Market Context (Link to Global Markets Update)

The global backdrop played a role in dampening enthusiasm:

- US Markets: The S&P 500 and Dow Jones dropped 1.2% following the Federal Reserve’s “high‑rate, tight‑policy” stance.

- Euro Zone: The Euro Stoxx 50 slipped 0.9% after a sharp dip in German banks.

- Asian Markets: While most Asian markets were flat, Japan’s Nikkei was down 0.7% amid concerns over the Bank of Japan’s policy shift.

In addition, the European Central Bank hinted at a gradual easing of its quantitative easing program, which has historically supported Indian equity flows.

6. Market Sentiment and Outlook

Short‑Term: Traders are closely watching the Nifty’s reaction to the 25,760 technical level. A rebound would suggest a bullish momentum shift; a further slide would likely reinforce the cautious stance.

Mid‑Term: The ongoing RBI “prudential review” may prompt a re‑allocation of capital away from public banks and into private or fintech alternatives. Analysts suggest that the banking sector could see a 2% growth in EPS by FY25, but with higher risk premiums for PSUs.

Long‑Term: The macro‑economic trajectory points to modest inflation control with a steady repo rate. As the country moves toward a “phase‑two” rebound in manufacturing, expectations for the IT and Pharma sectors remain robust.

7. Upcoming Events

| Date | Event | Impact |

|---|---|---|

| 26 Oct | RBI’s Monetary Policy Review | Potential policy shift |

| 28 Oct | Earnings of Bajaj Finance | Market sensitivity |

| 30 Oct | Fiscal Year 2024/25 Budget Release | Government policy signals |

The RBI’s upcoming policy review is especially watched, as it could confirm or adjust the direction set by the “prudential review”. The earnings releases from major corporates like Bajaj Finance will test market resilience to earnings season.

8. Bottom Line

The latest session’s 275‑point drop in the Sensex and a slide below the 25,760 mark for the Nifty is a reminder that the Indian stock market remains highly sensitive to a mix of macro‑economic signals and sector‑specific fundamentals. While private‑sector banking continues to post robust earnings, the drag from public‑sector banks – amplified by RBI’s prudential measures – tempers the overall positive tone.

Investors are advised to monitor RBI’s policy cues, keep an eye on earnings releases from key players, and stay attuned to global market movements that could sway capital flows into India. As the market navigates through these intertwined forces, the next few trading days will likely see heightened volatility until the uncertainties around public‑sector bank credit growth and RBI’s policy trajectory crystallize.

Read the Full Zee Business Article at:

[ https://www.zeebiz.com/market-news/news-closing-bell-sensex-ends-275-points-lower-nifty-slips-below-25760-as-psu-banks-drag-check-stock-market-highlights-385350 ]