Save Repayment Plan: What Every Borrower Needs to Know

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The “Save” Repayment Plan: What Every Borrower Needs to Know

An in‑depth summary of Investopedia’s feature on the new federal student‑loan repayment option

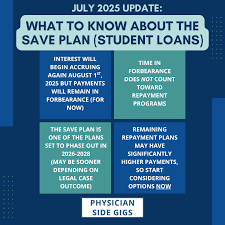

1. The Big Picture

Investopedia’s article, “Save Repayment Plan: What Borrowers Should Know,” dives into a recently launched federal student‑loan repayment option that aims to make repayment more flexible and “savvy” for borrowers who want to keep their debt manageable while still working toward eventual payoff. The plan, often shortened to the “Save Plan,” is part of a suite of reforms announced by the U.S. Department of Education that also includes updates to Income‑Driven Repayment (IDR) plans and loan‑forgiveness thresholds.

According to the article (and the linked Department of Education FAQ), the Save Plan:

- Extends the repayment period to a maximum of 30 years, allowing borrowers to lower their monthly payment.

- Calculates payments based on a borrower’s discretionary income, similar to other IDR plans.

- Includes a “savings” feature that lets borrowers set aside extra funds when they have surplus income, which the plan automatically applies to principal.

- Requires annual recertification of income and family size, ensuring payments stay in line with a borrower’s financial reality.

The plan is aimed at borrowers who have Direct Loans and are comfortable with a longer amortization horizon in exchange for lower month‑to‑month commitments.

2. Who Qualifies?

The Investopedia piece clarifies that the Save Plan is available only to borrowers with federal Direct Loans (including subsidized, unsubsidized, Perkins, and FFEL loans that were converted to Direct Loans). A few key eligibility points highlighted in the article and its reference to the Federal Student Aid portal are:

| Requirement | Description |

|---|---|

| Direct Loan status | Must hold at least one Direct Loan; no non‑Direct loans allowed. |

| Current standing | No delinquent loans and no prior default. |

| Enrollment window | New borrowers automatically offered the plan at loan origination; existing borrowers must request the plan through their servicer and are eligible for retroactive enrollment if they meet criteria. |

| Income recertification | Must file the annual FAFSA or the “Income-Driven Repayment” form to confirm income and family size. |

Borrowers who already enrolled in REPAYE, PAYE, or IBR before the Save Plan was launched can often switch to it, but may need to work with their servicer to confirm eligibility.

3. How the Payment Calculation Works

At its core, the Save Plan mirrors the mechanics of standard IDR plans: a borrower’s monthly payment equals a fixed percentage of discretionary income. However, the plan introduces a distinct “savings” component that makes it feel more like a personal budgeting tool:

Discretionary Income Formula

[ \text{Discretionary Income} = \text{Gross Income} - 150\% \times \text{Filing Status Poverty Threshold} ] The plan typically uses 10 % of discretionary income as the base payment (the exact percentage can vary by borrower profile, as indicated in the article).Payment Cap

The monthly payment is capped at the amount a borrower would pay under a 10‑year Standard Plan, ensuring no one is overburdened relative to a conventional repayment schedule.Saves & Pays Feature

Borrowers can earmark a portion of their income to a “Savings” account within the plan’s portal. Each month, the plan automatically uses the savings balance to offset principal, essentially providing a “pre‑payment” that reduces accrued interest over time.Interest Accrual

Interest continues to accrue at the current rate on each loan balance. If the borrower doesn’t use the savings feature, the monthly payment only covers a small portion of the accrued interest, extending the payoff window.Annual Recertification

Every year, borrowers file the standard FAFSA or a specific IDR recertification form. If income increases, the plan recalculates the payment automatically, and if the borrower’s discretionary income dips, the payment drops accordingly.

4. Pros & Cons: Is the Save Plan Right for You?

Pros

- Lower Monthly Burden: Payments can be significantly lower than the 10‑year Standard Plan, reducing the risk of missed payments or default.

- Built‑In Savings Mechanism: The “Saves & Pays” feature encourages proactive repayment and can help borrowers pay off debt faster than a typical IDR plan.

- Transparency: The plan’s portal provides real‑time updates on how much of each payment goes toward interest versus principal.

- Flexibility: Borrowers can always opt to pay more than the scheduled amount, either through the savings feature or by making a lump‑sum payment.

Cons

- Higher Total Interest: Extending the repayment period to 30 years can result in paying 2–3 times as much in interest compared to the Standard Plan.

- Complexity: Managing a separate savings account and ensuring consistent recertification can be burdensome for some borrowers.

- Limited to Direct Loans: Borrowers with a mix of Direct and non‑Direct loans may find the plan inapplicable or may need to consolidate first.

- Potential Eligibility Issues for Forgiveness: While the plan may still qualify for Public Service Loan Forgiveness (PSLF), it may not count toward some forgiveness thresholds in other IDR plans if borrowers do not use the savings feature.

The article’s side‑by‑side comparison table (drawn from the linked Department of Education FAQ) highlights that the Save Plan sits roughly between the standard IDR plans and the 10‑year Standard Plan in terms of monthly cost, but can be advantageous if the borrower actively uses the savings component.

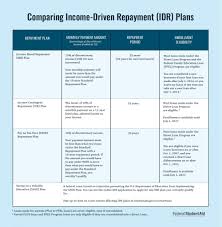

5. Comparison to Other IDR Plans

| Plan | Typical Payment | Maximum Term | Key Feature |

|---|---|---|---|

| Standard | 10‑year amortization | 10 years | Fixed payment |

| Pay As You Earn (PAYE) | 10 % of discretionary income | 20 years | Income‑based |

| Revised Pay As You Earn (REPAYE) | 10 % of discretionary income | 20–25 years | Income‑based, no recertification required |

| Income‑Based Repayment (IBR) | 10 % of discretionary income (unless high‑income) | 20–25 years | Income‑based, recertification |

| Save Plan | 10 % of discretionary income (capped) | 30 years | Income‑based + savings feature |

The Save Plan’s primary differentiator is the optional savings component, which can dramatically change the long‑term cost of the loan if used consistently.

6. How to Enroll

The article walks borrowers through a three‑step enrollment process:

Log In to Federal Student Aid

Visit studentaid.gov, sign in, and navigate to the “Repayment Options” section.Select the Save Plan

Click “Enroll in a Repayment Plan” and choose “Save Plan” from the dropdown. The portal will calculate your estimated monthly payment.Submit Recertification Form

Complete the online Income‑Based Repayment recertification (Form 4506‑O, 4506‑T, or the new IDR recertification form). Once approved, the plan activates.

The article stresses that borrowers should also review their servicer’s instructions, as some servicers may handle the enrollment process slightly differently.

7. Impact on Loan Forgiveness

If a borrower chooses the Save Plan and then later seeks forgiveness under PSLF or other forgiveness programs, the article clarifies:

- PSLF Eligibility: The plan’s payments are counted toward the 120 qualifying payments required for PSLF, as long as the borrower is making payments under a bona fide IDR plan.

- Other Forgiveness Programs: The plan’s longer term may reduce the chance of qualifying for other forgiveness thresholds that depend on the number of payments (e.g., IBR 20‑year forgiveness). However, if the borrower activates the savings feature and pays more than the required amount, the forgiveness calculations can still apply.

Borrowers who plan to pursue forgiveness should evaluate whether the Save Plan’s extended term may delay forgiveness, and whether using the savings feature could accelerate payoff before that point.

8. Quick‑Reference Checklist

| Item | Take Action |

|---|---|

| Verify Loan Type | Ensure you hold only Direct Loans. |

| Check Eligibility | No delinquency; meet income criteria. |

| Enroll Early | Register via studentaid.gov before the next recertification cycle. |

| Set Up Savings | Open the “Saves & Pays” account in the portal. |

| Recertify Annually | File the FAFSA or IDR form by the deadline each year. |

| Monitor Balances | Track how much of each payment goes to principal vs. interest. |

| Plan for Forgiveness | If you’re in public service, confirm your payment counts toward PSLF. |

9. Bottom Line

The Save Repayment Plan offers a compelling option for borrowers who are looking for a lower monthly payment but are also willing to take a longer path to debt repayment. Its unique savings feature gives borrowers a structured way to accelerate payoff if they have the means, but without the plan, borrowers will likely shoulder more interest over the course of a 30‑year term. As the article points out, the decision hinges on your financial goals, your willingness to engage with a savings account, and how much total cost you’re comfortable paying.

Investopedia’s piece serves as a solid primer for anyone considering the Save Plan—especially because it pulls together direct links to the Department of Education’s own FAQ pages and the official repayment calculator. For the most accurate, up‑to‑date information, be sure to consult the official federal student‑aid portal or your loan servicer’s website before making a final decision.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/save-repayment-plan-what-borrowers-should-know-11865023 ]