BLS Employment Report Delays: Uncertainty Fuels Market Volatility

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

When the Treasury and the Labor Department Fall Silent: A 500‑Word Guide to the Post‑Shutdown Economic Calendar

The 2018‑2019 U.S. federal government shutdown sent ripples through every corner of the American economy, but its most tangible impact has been on the cadence of official data releases. For investors, economists, and anyone who relies on the Bureau of Labor Statistics (BLS), the Federal Reserve, the Treasury Department, and other agencies to gauge the health of the economy, a pause in the “heartbeat” of macro data can feel like a collective gasp. This article distills the key government reports that have been delayed or reshaped because of the shutdown, why those delays matter, and what investors can do to stay on track.

1. The BLS Employment Situation – A Core Indicator

What’s on the line?

The monthly Employment Situation Report (often called the “jobs report”) is the cornerstone of U.S. labor market analysis. It delivers headline figures such as unemployment rate, jobless claims, average hourly earnings, and detailed industry breakdowns. Market participants read the data like a weather forecast: a stronger jobs report can lift equity markets, whereas a weak report can tighten risk sentiment.

How the shutdown hit it:

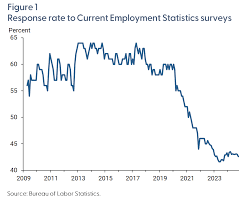

During the shutdown, BLS workers responsible for compiling and verifying the data were furloughed. The result was a staggered release schedule: while some core metrics were still published on time, the seasonally adjusted figures and supplementary tables were delayed by a week or more. This meant that traders could no longer rely on the full context of the jobs story—especially the “first‑quarter” revision that is often the most market‑moving.

Implications for investors:

- Volatility spikes: In the days following the job data, markets tended to widen bid‑ask spreads as participants grappled with incomplete information.

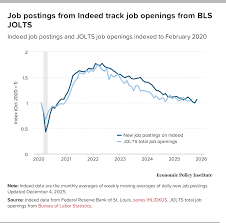

- Revised expectations: Analysts had to incorporate a higher level of uncertainty into their models, often leaning on alternative data sources like payroll data from private employers or real‑time online job postings.

2. The Consumer Price Index (CPI) – Inflation’s Pulse

Why it matters:

The CPI tracks the price changes of a basket of goods and services that consumers purchase. It is the primary gauge of inflation that informs the Federal Reserve’s monetary policy decisions. A CPI figure that outpaces expectations can prompt rate hikes, while a softer reading may keep policy dovish.

Shutdown fallout:

BLS’s ability to collect and process the retail and producer price data was hampered, causing a shift in the release calendar. The core CPI (which excludes volatile food and energy prices) was delayed by one week, while the headline CPI experienced a shorter but still noticeable lag. The timing of the CPI release is critical because it often sits on the “cusp” of Fed announcements, and any misalignment can distort market expectations.

Market response:

- Yield curve adjustments: U.S. Treasury yields often moved in anticipation of the CPI release, as traders priced in the probability of a Fed rate decision.

- Options pricing: Derivatives on Treasury bonds had to adjust implied volatilities to reflect the new timing of CPI data.

3. Treasury Auctions – The Debt Market’s Backbone

What’s at stake?

The U.S. Treasury issues bonds and notes to finance government spending. Each auction’s success determines the cost of borrowing for the federal government and sets a benchmark for other fixed‑income securities.

How the shutdown interfered:

Treasury staff shortages caused minor delays in auction schedules, particularly for medium‑term securities. Additionally, the Treasury’s daily “Treasury Yield Curve” report, which aggregates auction results and market activity, experienced a lag that disrupted analysts’ ability to track real‑time interest‑rate sentiment.

Consequences for fixed income markets:

- Bid‑ask tightening: The market saw wider spreads as traders compensated for the uncertainty in the supply of new debt.

- Yield adjustments: In the absence of fresh auction data, yields on existing Treasury securities drifted in response to speculative flows.

4. The Fed’s Economic Projections – The “Dot Plot” on Hold

Why it’s critical:

The Federal Open Market Committee (FOMC) releases a “dot plot” each meeting, reflecting the Committee’s consensus view of where interest rates should be heading. Market participants use this information to price in the path of monetary policy.

Shutdown effect:

While the Fed’s meeting schedule itself remained intact, the release of the policy statement and the accompanying fiscal projections were delayed by 24‑48 hours. The Fed’s internal data feeds, many of which rely on the same government statistics that were delayed, also experienced a lag. This meant that the full context of the Fed’s policy stance—particularly the underlying inflation and employment outlook—was not available until later in the day.

Investor adjustments:

- Rebalancing: Portfolio managers had to shift their positions based on incomplete data, often using models that incorporated alternative inflation gauges (e.g., the Personal Consumption Expenditures price index).

- Communication: Asset‑pricing analysts increased transparency about the uncertainties, flagging the potential for a “catch‑up” effect later in the trading day.

5. The U.S. Census Bureau – Demographic Data on Standby

Key releases:

The Census Bureau’s population estimates, migration statistics, and housing data underpin many long‑term economic forecasts. They also feed into mortgage market analyses and consumer spending models.

Shutdown ramifications:

Due to staff furloughs, the Census Bureau postponed the release of its Population and Housing Unit Counts by several weeks. Moreover, the American Community Survey (ACS) data, which provides high‑frequency socioeconomic insights, experienced a significant delay.

Strategic response:

- Alternative data usage: Investors leaned on big‑data analytics from private sources (e.g., credit‑card transaction flows, satellite imagery of building permits) to fill the gap.

- Forecast adjustments: Economists revised their growth projections to account for the lagged demographic input, adding a margin of error for variables heavily dependent on Census data.

6. Other Affected Agencies

- Department of Commerce: The Gross Domestic Product (GDP) estimate for the fourth quarter was revised, but the release of the advance estimate was delayed.

- Department of Agriculture: Agricultural commodity reports (e.g., corn and soybean inventories) saw a one‑week lag, affecting commodity futures.

- U.S. Department of Labor: Unemployment claims (both initial and continuing) were posted with a delayed schedule, which increased uncertainty around the health of the labor market.

What Investors Can Do in a Data‑Sparse Environment

Prioritize Alternative Data

With official statistics delayed, the market increasingly turns to alternative data streams—such as satellite imagery, credit‑card transaction data, and sentiment analytics—to gauge economic activity in real time.Adjust Volatility Models

Incorporate higher implied volatilities for equities and fixed income in your risk‑management models. The uncertainty introduced by delayed data often translates into steeper option premiums and wider bid‑ask spreads.Keep a Flexible Positioning Strategy

Instead of rigidly buying or selling based on a single data point, consider using a range of scenarios—best case, base case, worst case—to ensure that your portfolio remains robust to unexpected revisions.Stay Informed About the Calendar

Maintain an up‑to‑date economic calendar that flags not only the release dates but also any anticipated delays. Many financial news platforms now provide real‑time alerts when a report is rescheduled.Leverage Central Bank Commentary

Even when official data are delayed, central banks often provide forward guidance and qualitative commentary. This can serve as a stop‑gap to understand policy direction.

Bottom Line

The 2018‑2019 U.S. government shutdown demonstrated that macro data releases are more than mere numbers—they are the nervous system of modern financial markets. When the BLS, the Treasury, the Census Bureau, and other agencies pause, markets react with heightened volatility, spreads widen, and risk premia shift. Investors who understand which reports are affected, why they matter, and how to adapt to missing information can navigate the turbulence with greater confidence. The shutdown’s legacy is not just the immediate market disruption, but also the accelerated adoption of alternative data sources and more resilient risk‑management practices—an evolution that will shape the economic landscape for years to come.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/economic-calendar-these-are-the-government-reports-we-re-still-waiting-on-after-the-shutdown-11864954 ]