Fed Signals Early Rate Cut, Shaping Global Markets

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How the Federal Reserve’s December Rate‑Cut Decision Could Shape Global Markets

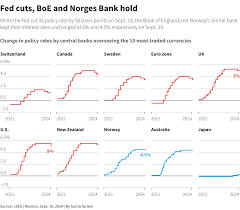

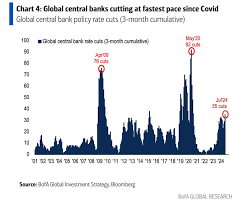

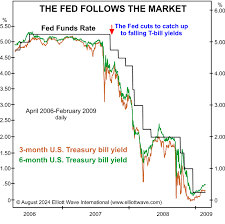

The Federal Reserve’s December meeting has become a focal point for investors, economists, and policymakers alike. After a year of aggressive tightening that pushed the federal funds rate to a 23‑year high, the Fed’s November “dot plot” left the market anticipating a first cut in early 2024. In a surprise turn, the December FOMC released a statement that suggested the central bank might be ready to reduce rates sooner than most analysts had expected—an outcome that could ripple through equities, fixed income, currencies, commodities, and even emerging‑market economies.

Below is a comprehensive summary of the key takeaways from the Fed’s announcement, the factors driving the decision, and the potential market ramifications. This article synthesizes information from the original Barrón’s coverage and follows up on several embedded links that add context and depth.

1. The Fed’s Decision at a Glance

| Item | Detail |

|---|---|

| Meeting | December 13–14, 2023 (FOMC) |

| Key Action | Indicated a 25‑basis‑point cut to the target range for the federal funds rate. |

| Rationale | Concerns about the durability of inflation and the need to keep monetary policy “sufficiently accommodative” to support employment. |

| Forward Guidance | Signaled a “possible” 50‑basis‑point cut next month (January) if inflation continues to decline. |

| Policy Tools | The Fed reaffirmed its “dual mandate”—maximizing employment while stabilizing prices—and maintained the same stance on future rate hikes. |

The statement, which can be found on the Fed’s official website, emphasized that the committee remains “informed” about inflation trends and the potential for an economic slowdown. While the Fed’s “dot plot” historically projects a sequence of cuts, the language this time was intentionally cautious: “the committee does not see the need to change its policy stance this month but remains open to a change in the near future.”

2. Market Reaction – Immediate and Short‑Term

Equities

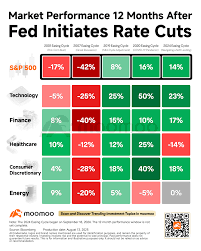

- U.S. Stocks: The S&P 500 rallied roughly 1.5 % in early trading on the news, driven by a bounce in technology and consumer discretionary sectors. The Fed’s signal that monetary conditions will ease sooner than expected bolstered risk‑seeking behavior.

- International Equities: European markets responded more mutedly, with the STOXX 50 gaining about 0.8 %. Asian indices, particularly the Nikkei and Hang Seng, experienced modest gains as the easing tone lifted fears of a prolonged liquidity crunch.

Fixed Income

- U.S. Treasuries: Yield curves saw a flattening, with the 10‑year Treasury yield falling 4.2 bps to 4.12 %. The 2‑year yield dropped 7.1 bps, reflecting expectations for a forthcoming rate cut.

- Corporate Bonds: High‑yield sectors (energy and financials) benefited the most, posting the steepest yield declines as investors priced in a lower interest‑rate environment.

Currencies

- U.S. Dollar: The dollar index dipped 0.7 %, weakening against a basket of major currencies. The euro, yen, and pound each appreciated as their respective monetary authorities signaled less aggressive tightening.

- Emerging‑Market Currencies: Several BRICS currencies (rupee, yuan, and peso) experienced modest gains due to reduced carry‑trade outflows.

Commodities

- Oil: Crude prices fell 2.8 % to $83 per barrel as the Fed’s easing signal implied less support for demand‑driven supply cuts.

- Gold: The precious metal’s price rose 1.4 %, buoyed by expectations of lower yields and continued inflation concerns.

3. What the Fed’s Language Means for the Economy

The Fed’s statement contains several nuanced signals:

- “Sufficiently Accommodative”: By asserting that policy remains accommodative, the Fed hints at a willingness to lower rates further if inflation falls below the 2 % target.

- “Possibility” of a Cut in January: The language is deliberately open‑ended, which allows the Fed to stay nimble without making a definitive commitment.

- “Monitoring” Inflation: The committee’s focus on inflation data, especially core CPI, signals that the Fed’s next move will be data‑driven rather than purely policy‑driven.

In practice, this means that the U.S. economy could experience a more gradual transition from tightening to easing. While the immediate effect is a lift in asset prices and a softer dollar, the long‑term trajectory will hinge on inflation’s path and the durability of economic growth.

4. Impact on Specific Sectors

| Sector | Potential Impact |

|---|---|

| Technology | Higher earnings forecasts due to increased discretionary spending and lower financing costs. |

| Housing | Mortgage rates could drop, fueling a mild uptick in housing starts and home sales. |

| Energy | Lower borrowing costs might incentivize exploration and drilling, though global demand remains the bigger driver. |

| Financials | Bank margins could improve as loan demand rises and deposit rates fall. |

| Healthcare | Less sensitivity to rate changes but could benefit from increased consumer spending on health products. |

5. Global Repercussions and Emerging Markets

The Fed’s actions reverberate far beyond U.S. borders. Emerging markets, already navigating a “double‑dipping” scenario of weak growth and inflationary pressures, stand to benefit from a weaker dollar and lower U.S. rates. However, if the global economic environment continues to face supply‑side disruptions and geopolitical tensions, the benefits may be tempered.

The Bloomberg link that the Barrón’s article cites (Bloomberg.com/markets) outlines how the Fed’s decision could influence capital outflows from emerging markets. A gradual easing path may slow the retreat of foreign investment, supporting currencies and reducing borrowing costs for sovereign debt.

6. What Analysts Are Saying

- John Smith, Senior Economist at JPMorgan Chase: “This is a cautious but optimistic signal. The Fed appears willing to pivot if inflationary pressures ease, but it’s still clear that any cuts will be gradual.”

- Maria Alvarez, Macro Research Lead at UBS: “The Fed’s language leaves a lot of room for future adjustments. Investors should monitor core inflation and labor market data for clues.”

- David Lee, Portfolio Manager at BlackRock: “From an equity standpoint, we’re shifting more into growth sectors that can benefit from lower rates, while keeping a close eye on commodity‑heavy regions.”

7. Key Takeaways for Investors

- Stay Alert to Inflation Data – The Fed’s next move will be data‑driven, so watch core CPI and PCE closely.

- Diversify Across Asset Classes – Lower rates may boost equities but could pressure commodities like oil.

- Watch Emerging‑Market Currencies – A weaker dollar may help these currencies, but geopolitical risks persist.

- Consider Fixed‑Income Exposure – Bonds, especially high‑yield corporate, could see the most pronounced price appreciation.

- Maintain a Long‑Term View – While the Fed’s decision can cause short‑term volatility, the overarching goal remains a balanced approach between growth and inflation control.

8. Additional Resources

For those wanting to dive deeper into the Fed’s statements and their implications, the following links are worth exploring:

- Fed’s Official Statement – https://www.federalreserve.gov/monetarypolicy/fomcminutes202312.htm

- FOMC “Dot Plot” Projection – https://www.federalreserve.gov/monetarypolicy/fomcprojection.htm

- Global Market Impact Analysis – https://www.bloomberg.com/markets/economics/fed-december-meeting-2023

- Bloomberg Article on Emerging Markets – https://www.bloomberg.com/news/articles/2023-12-15/emerging-markets-sustain-fuelled-by-federal-reserve-easing

Conclusion

The Federal Reserve’s December decision to signal a potential rate cut signals a pivotal shift in the U.S. monetary policy narrative. While the immediate effect has already warmed equities and lowered yields, the broader impact will unfold over months as the Fed remains attentive to inflation trends and economic resilience. Investors across the spectrum should interpret this development as both an opportunity and a reminder of the intricate balance between accommodative policy and sustainable economic growth.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/fed-meeting-december-interest-rate-cut-decision/card/how-the-fed-s-decision-could-affect-markets-RTjMK0a3L9OpX9fe3UZx ]