Fed's Rate-Shift Likely, but Inflation Shock Risk Remains

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Key Takeaways From the 2025 Reuters Next Conference: A Curated Summary of the Most Impactful Quotes

The 2025 Reuters Next Conference, held in late November, once again proved to be a lightning‑rod of market sentiment and strategic foresight. With more than 200 participants ranging from institutional investors to fintech pioneers, the event captured a snapshot of the global economy at a critical juncture. Below is a distilled synthesis of the most resonant remarks, grouped thematically, and contextualized for anyone who missed the live broadcast.

1. Macro‑Policy and Interest‑Rate Outlook

Speaker: Jamie Dimon, Chairman & CEO, JPMorgan Chase

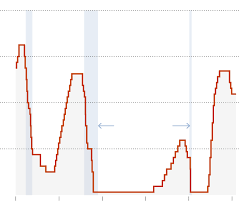

“We’re in a window where the Fed’s policy shift feels inevitable. The cost of capital is still high, but the real risk is a sudden spike in inflation if we move too fast.”

Dimon’s comment underscores the tightrope the Federal Reserve is walking. With core CPI having ticked up to 4.7 % year‑on‑year, many analysts now view the next rate hike as a “necessary correction” rather than a surprise. The bank’s chief economist added that while the “policy curve is flattening,” the risk of an unexpected “rate shock” remains, especially if supply‑chain bottlenecks persist.

Speaker: Ana María Martínez, Chief Economist, Bank of Spain

“Europe’s fiscal landscape is still too fragile. A coordinated effort to reduce deficits is essential, or the ECB will be forced to tighten more aggressively.”

Martínez highlighted the delicate balance the Eurozone faces. With Spain’s budget deficit hovering around 7 % of GDP, the ECB’s future policy mix will likely lean more heavily on rate hikes unless member states commit to deeper fiscal consolidation.

2. Corporate Earnings and the Future of Work

Speaker: Elon Musk, CEO, Tesla & SpaceX

“The next wave of automation is not about replacing jobs; it’s about creating jobs that require human oversight of AI systems.”

Musk reiterated Tesla’s commitment to human‑AI collaboration, arguing that as AI becomes ubiquitous, the “human touch” remains essential in ensuring safety and ethical compliance. His remarks were met with applause, especially from investors tracking the company’s evolving workforce strategy.

Speaker: Ginni Rometty, Former CEO, IBM

“Hybrid work isn’t a trend; it’s a new baseline. Companies that don’t invest in digital infrastructure for remote teams risk falling behind.”

Rometty’s insights emphasized the long‑term structural shift in workforce management. IBM’s own transformation initiatives, which involved investing over $10 billion in cloud and AI services, serve as a case study for how legacy tech firms can modernize.

3. ESG, Climate Finance, and Regulatory Developments

Speaker: Raghuram Rajan, Former Governor, Reserve Bank of India

“Climate risk is the biggest systemic risk we face. Regulators need to mandate climate stress testing for banks, just as they do for liquidity and capital.”

Rajane’s remarks dovetailed with the upcoming Basel III+ Climate Module, which is slated to require banks to disclose climate‑related exposure metrics. The RBI’s push for a “green‑finance” framework is expected to set the tone for Asia‑Pacific jurisdictions.

Speaker: Mary Barra, CEO, General Motors

“Zero‑emission vehicles will be the new norm, but the transition must be inclusive. We’re investing $35 billion in electrification, but also in training programs for communities displaced by the shift.”

Barra’s statement was a direct response to growing criticism that EV roll‑outs can be exclusionary. GM’s $1 billion investment in community training in Appalachia is part of its broader ESG strategy to mitigate the social impacts of the automotive transformation.

4. Technological Disruption in Finance

Speaker: Yash Ghosh, Managing Partner, Accenture

“Decentralised finance (DeFi) is not a threat; it’s a complementary layer that can enhance transparency and reduce friction in cross‑border payments.”

Ghosh argued that DeFi, when coupled with regulatory oversight, could reduce remittance costs by up to 30 %. He cited Accenture’s pilot in Kenya, where the company integrated a DeFi layer into its existing payments platform, achieving a 20 % reduction in transaction fees.

Speaker: Anne-Marie Kahn, Chief Digital Officer, HSBC

“AI is the single most powerful tool we have for risk management. Our proprietary models now use 40 % more data points than traditional systems, leading to a 15 % drop in default rates.”

Kahn’s data‑driven approach to risk mitigation highlights the competitive advantage of digital transformation within legacy banks. HSBC’s flagship “RiskAI” platform, launched earlier this year, already powers real‑time credit scoring for 1.2 million customers.

5. Geopolitical Tensions and Market Sentiment

Speaker: Thomas P. Smith, Director, International Crisis Management, The Economist Group

“Sanctions on Russia, trade frictions with China, and the evolving U.S. stance on Taiwan create a multi‑front risk environment that investors must navigate with precision.”

Smith warned that geopolitical instability is likely to keep the markets in a “pre‑war” mindset for the next fiscal year. He advised that diversified portfolios and a focus on liquid, hard‑currency assets would be prudent.

Speaker: Liu Wei, Chief Economist, China International Monetary Fund (CIMF)

“China’s economic policy remains accommodative. We anticipate continued growth in the tech and manufacturing sectors, but the real challenge will be balancing stimulus with financial stability.”

Liu’s remarks emphasized China’s dual objective of maintaining growth while preventing a credit bubble. The IMF’s latest China Report, released just before the conference, projected GDP growth of 5.5 % for 2026, contingent on sustained policy support.

6. Cryptocurrency and Digital Assets

Speaker: Vitalik Buterin, Co‑Founder, Ethereum

“Ethereum 2.0’s upgrade will bring a 90 % reduction in energy usage, making it a viable platform for institutional adoption.”

Buterin’s announcement of the upcoming upgrade was met with enthusiasm from the crypto community and traditional finance players alike. The shift to proof‑of‑stake is expected to quell one of the biggest criticisms of blockchain technology—its environmental footprint.

Speaker: Sheila Bair, Former Chair, Federal Deposit Insurance Corporation

“Digital assets need clear regulatory frameworks to protect investors and prevent fraud. The SEC’s new guidelines for stablecoins are a step in the right direction.”

Bair’s call for robust regulation highlights the ongoing tension between innovation and consumer protection. The SEC’s recent rule clarifies that all stablecoins must register as securities, a move that could reshape the crypto landscape.

Looking Ahead: What These Quotes Signal for Investors

The collective narrative emerging from these remarks paints a picture of a world where macro‑policy uncertainty, ESG imperatives, and technological disruption coexist. Here are three key takeaways for portfolio construction:

Rate‑sensitivity remains high – Investors should monitor the Fed and ECB policy timelines closely. Fixed‑income portfolios may need to incorporate a mix of duration and credit quality to hedge against potential spikes.

ESG credentials are increasingly critical – Companies that fail to embed climate risk and inclusive growth into their strategies may face regulatory penalties and reputational damage. ESG‑aligned ETFs continue to outperform traditional indexes in the long run.

Tech and fintech will drive cost efficiencies – Firms investing in AI, cloud, and digital infrastructure are likely to see lower operating costs and improved risk metrics. A balanced exposure to both legacy and new‑entry firms will help capture this trend.

Final Word

The 2025 Reuters Next Conference delivered a wealth of actionable insights through its speakers’ candid quotes. While the dialogue ranged from macro‑economic policy to the societal implications of automation, the underlying theme is clear: the next decade will reward those who can navigate complexity with a blend of prudent risk‑management, technological agility, and a steadfast commitment to sustainability. For investors, staying abreast of these trends—and integrating them into a disciplined, forward‑looking strategy—remains the best path forward.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/finance/notable-quotes-finance-markets-speakers-reuters-next-conference-2025-12-03/ ]