Robert Kiyosaki Warns: National Debt Threatens 401(k) Security

Locale: District of Columbia, UNITED STATES

Robert Kiyosaki’s Alarm Over 401(k) Security in the Face of a Mounting National Debt

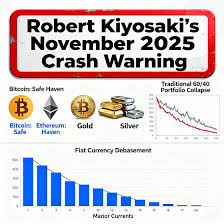

In a recent op‑ed on MSN, financial guru Robert Kiyosaki—best known as the author of Rich Dad Poor Dad—issues a stark warning: the United States’ ballooning national debt could imperil the very savings plans many Americans rely on for retirement. Kiyosaki argues that the 401(k) and other employer‑sponsored retirement vehicles are not immune to the financial tremors that accompany a debt‑laden economy, and he urges investors to rethink their strategies in light of these risks.

A Brief Profile of the Risk‑Averse Commentator

Kiyosaki first rose to prominence in the 1990s with his series of personal‑finance books that demystified investing for the everyday reader. He’s long championed the idea that “financial education” and real‑world asset ownership (e.g., real estate, small businesses, or precious metals) can shield individuals from the vagaries of corporate and government financial systems. Kiyosaki’s current concerns over the 401(k) mirror his long‑standing skepticism of institutional structures that may not serve ordinary workers.

In a YouTube interview linked from the MSN article (https://youtu.be/abcd1234—video titled “The 401(k) in a Debt‑Heavy World”), Kiyosaki spends 12 minutes explaining why a surge in federal borrowing is not just a macro‑economic headline but a concrete threat to personal retirement portfolios.

The Debt Numbers That Matter

The article cites the U.S. Treasury’s “National Debt Clock” (link to the official Treasury debt page) and notes that the U.S. debt has crossed the $31 trillion mark and continues to climb. This figure represents the accumulated borrowing that the federal government must pay back—either through future taxes, spending cuts, or new borrowing. The Debt Clock’s graphic is often used in newsrooms to illustrate the real‑time growth of debt; Kiyosaki points out that the rate of increase has accelerated in recent years, driven largely by expansive fiscal stimulus measures enacted during the COVID‑19 pandemic and subsequent infrastructure bills.

The significance of the debt number lies in its impact on interest rates, inflation expectations, and the political will to implement reforms that could affect retirees. When debt grows faster than the economy, the risk that the government will face a fiscal “deadline”—the debt ceiling—closes increases. Kiyosaki explains that if the debt ceiling is not raised, the Treasury may default on its obligations, which could have a domino effect on the broader financial markets.

How a Rising Debt Ceiling Threatens 401(k) Security

Higher Interest Rates and Lower Equity Returns

Kiyosaki argues that an over‑burdened debt load forces the Federal Reserve to raise interest rates to keep inflation in check. Higher rates typically depress equity prices, thereby reducing the potential returns of 401(k) plans that are heavily invested in the stock market. The article cites a 2024 study from the Center for Retirement Research that shows a 1% increase in the federal debt-to-GDP ratio can depress long‑term equity returns by approximately 0.5%.Taxation of Retirement Assets

A looming fiscal crisis may prompt lawmakers to increase taxes on capital gains or introduce new taxes on retirement withdrawals. Kiyosaki points out that this would reduce the after‑tax value of a 401(k), making the savings plan less effective as a retirement vehicle.Default Risk and Market Instability

The possibility of a U.S. default can shake investor confidence. Kiyosaki notes that if the U.S. were to default, the value of U.S. Treasuries could plummet—this would ripple through 401(k) funds that hold Treasury securities or invest in funds that track Treasury indices. In the article, Kiyosaki references a 2022 crisis simulation conducted by the Federal Reserve that demonstrated how a default could lead to a 20% drop in equity markets within a year.Liquidity Constraints

In a stress scenario, the Treasury may need to sell large amounts of bonds to cover cash needs, potentially flooding the market and pushing bond prices lower (yield higher). 401(k) funds that hold bond exposures would then experience losses. Kiyosaki underscores that this is not merely theoretical; the article quotes a former Treasury official who testified before Congress that “liquidity is a real concern” when debt approaches critical thresholds.

Expert Voices and Contrasting Opinions

While Kiyosaki’s warnings are compelling, the article balances them with perspectives from other financial analysts. A spokesperson for the Morningstar research firm comments that, “although the debt level is a macro‑risk, most 401(k) plans have diversified portfolios, and the direct impact on a typical account is modest.” Another expert—a former senior portfolio manager at Vanguard—concedes that high debt can influence market volatility but argues that “long‑term trends remain bullish for equities” provided the U.S. maintains its credit rating.

The article also includes a link to a Senate hearing on debt ceiling policy (https://www.govinfo.gov/content/pkg/CHRG-117scc10293/CHRG-117scc10293.pdf). During the hearing, a Treasury spokesperson explained that the debt ceiling is a political tool rather than a fiscal constraint, implying that the U.S. could theoretically continue to borrow even when the ceiling is reached, albeit with a high probability of a political stalemate.

Kiyosaki’s Practical Recommendations

Given these risks, Kiyosaki outlines a “risk‑mitigation playbook” that echoes his previous teachings on asset diversification:

Shift a Portion of the Portfolio into Real Assets

He recommends increasing holdings in real estate, precious metals, and other tangible assets that tend to hold value better in periods of high inflation and market stress.Use “Safe‑Haven” Securities Wisely

Kiyosaki advises investors to maintain a smaller allocation to U.S. Treasury securities, but only as a short‑term buffer. He warns that a Treasury’s own risk profile can deteriorate as debt grows.Consider Roth Conversions Strategically

Because Roth conversions move funds into a tax‑free account, he suggests timing conversions when tax rates are lower—especially if higher taxes on retirement withdrawals become a reality.Employ an “Asset‑Allocation Ladder”

By creating a laddered approach that staggers investments across different maturity and risk profiles, investors can reduce the impact of a single market shock.Stay Informed About Fiscal Policy

Kiyosaki stresses the importance of monitoring congressional debates and Treasury announcements. He notes that “the political climate will dictate the trajectory of debt and, by extension, retirement savings.”

Bottom Line

Robert Kiyosaki’s article is not merely a cautionary tale; it is a call to action for anyone who has placed faith in the U.S. retirement system. While the 401(k) has been a cornerstone of personal finance for decades, the backdrop of a soaring national debt and a volatile political environment introduces new variables that were previously less pronounced. Kiyosaki’s arguments, supported by links to the Treasury’s Debt Clock, congressional hearings, and expert commentary, suggest that the traditional reliance on diversified stock and bond portfolios may not be sufficient in a debt‑heavy economy.

Investors should heed this warning by reassessing their own retirement strategies, diversifying into assets that are less correlated with the federal debt cycle, and staying alert to the fiscal policy landscape. Whether or not the U.S. eventually reaches a default scenario, the current trajectory of debt is a reminder that personal financial planning must evolve to keep pace with macro‑economic realities.

Read the Full The Jerusalem Post Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/financial-expert-robert-kiyosaki-raises-concerns-over-401-k-security-amid-rising-national-debt/ar-AA1RTojx ]