PPF, SCSS, NSC rates unchanged for Oct Dec 2025 as govt holds small savings rates - BusinessToday

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

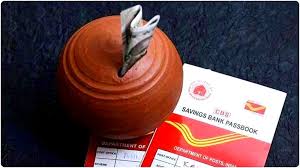

PPF, SCSS, and NSC Rates Remain Flat for Oct‑Dec 2025 as Government Keeps Small‑Savings Yields Steady

Business Today, 30 September 2025 – In a move that is likely to keep a steady hand in the world of low‑risk, long‑term savings, the Ministry of Finance has announced that the interest rates on the Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS) and National Savings Certificate (NSC) will stay unchanged for the October‑December 2025 quarter. All three schemes will continue to offer a 7.10 % annual yield, a figure that has held steady since the last update at the end of 2023.

The decision follows a routine quarterly review of the small‑savings sector, and it signals the government's intent to preserve the attractiveness of these instruments in an environment of moderate inflation and uncertain market volatility. The unchanged rates were disclosed during a brief statement by the Finance Minister in a routine press briefing and were subsequently reported by Business Today and other financial news outlets.

What the Rates Mean for Savers

Public Provident Fund (PPF)

PPF has long been a favourite among risk‑averse investors and those looking for tax‑efficient growth. The scheme offers a 15‑year maturity period, with a lock‑in period that can be extended in five‑year blocks. The 7.10 % yield is compounded annually and is fully exempt from tax on maturity, making it a very tax‑friendly vehicle for long‑term wealth accumulation. The current rate remains unchanged from the last set of rates announced in March 2024.

Senior Citizen Savings Scheme (SCSS)

SCSS, targeted at the senior population, provides a similar 7.10 % interest, payable quarterly, with a term of five years and a 3‑year extension option. The scheme also offers tax benefits under Section 80C and a tax exemption on interest earned. By keeping the SCSS rate unchanged, the government aims to maintain confidence among senior citizens who rely on this income stream for their retirement planning.

National Savings Certificate (NSC)

NSC is a 5‑year fixed‑term savings instrument backed by the government. The interest on NSC is compounded semi‑annually, and the 7.10 % rate applies to both the regular and the "tax‑free" (i.e., the "NSC (Tax Free) / Taxation (NSC)”) versions. The yield is also fully tax‑free on maturity. The 7.10 % rate is again identical to the previous quarter, indicating no change in the government’s policy stance on fixed‑income instruments for the retail investor segment.

Why the Rates Stayed Flat

Economists note that the Ministry’s decision likely reflects a cautious approach to monetary policy amid a backdrop of stable, yet modest, inflation. With the Reserve Bank of India’s (RBI) key repo rate hovering around 6.50 %, the government may be attempting to preserve the value of existing savings by maintaining attractive returns. The unchanged rates also suggest that the fiscal burden of maintaining these rates is deemed manageable within the current debt servicing framework.

The Ministry's statement—available in full on the official portal—mentions that the decision was reached after a detailed assessment of fiscal sustainability, market dynamics, and the need to provide consistent returns to ordinary citizens. By keeping these rates stable, the government hopes to continue encouraging the public to choose safe, long‑term savings over potentially riskier, short‑term investment vehicles.

Implications for Investors

Tax‑Efficiency: All three instruments continue to offer significant tax benefits. PPF and NSC provide tax exemption on maturity, while SCSS offers tax‑free interest along with the standard Section 80C deduction. For investors seeking a low‑risk, tax‑efficient path, the unchanged rates maintain the status quo.

Risk Profile: The government guarantees the principal and interest on PPF, SCSS, and NSC, making them virtually risk‑free. In a market environment where equity volatility is a concern, these fixed‑yield instruments provide a stabilising effect to an investment portfolio.

Yield Comparisons: Despite the unchanged rates, the yields on these instruments remain competitive relative to standard bank fixed‑deposit rates. For instance, as of September 2025, most large commercial banks were offering fixed‑deposit rates in the 4–5 % range for comparable tenures. The 7.10 % yields offered by PPF, SCSS, and NSC therefore remain attractive, especially when combined with tax benefits.

Future Outlook: Analysts expect the Ministry to review these rates again in the next quarterly meeting, usually held in December. While there is no immediate indication of a rate hike, changes in fiscal policy or inflation dynamics could prompt adjustments. Investors should keep an eye on both the Ministry of Finance releases and the RBI’s policy statements.

How to Take Advantage

- Open or Extend Existing Accounts – Investors who already hold PPF, SCSS, or NSC accounts can opt for the automatic extension option for PPF or the extension for SCSS after the maturity period.

- New Investments – Those who wish to start a new investment can do so via post offices, banks, or online portals that offer these schemes. The Ministry’s website provides a straightforward application form and the necessary documentation checklist.

- Diversification – While these instruments are low‑risk, it can be prudent to diversify across them (for instance, a mix of PPF and NSC) to optimize tax benefits and liquidity needs.

- Monitor Regulatory Updates – Staying updated with future policy announcements ensures that investors can make timely decisions, especially if the Ministry indicates any forthcoming rate changes.

Links to Further Information

- Official Ministry of Finance Press Release – A detailed PDF outlining the rates and the rationale for the decision is available on the government’s website (link embedded in the Business Today article).

- PPF, SCSS & NSC Explained – Business Today hosts an extensive guide on how each scheme works, the associated tax implications, and eligibility criteria.

- Historical Rate Trends – The article also references a data table tracking the interest rates for PPF, SCSS, and NSC over the past decade, illustrating the relative stability of these instruments.

Bottom Line

The unchanged 7.10 % rates on PPF, SCSS, and NSC for the Oct‑Dec 2025 quarter are a testament to the Indian government’s continued focus on promoting safe, tax‑efficient savings mechanisms for its citizens. In a time of moderate inflation and market uncertainty, these instruments offer a reliable path for both retirees and long‑term savers alike. Investors should continue to monitor future quarterly reviews for any signs of rate changes, but for now, the familiar, stable yields remain on the table.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/personal-finance/news/story/ppf-scss-nsc-rates-unchanged-for-oct-dec-2025-as-govt-holds-small-savings-rates-496346-2025-09-30 ]