Invoice Financing: A Modern Cash-Flow Lifeline for Small Businesses

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Invoice Financing: A Modern Cash‑Flow Lifeline for Small Businesses

(Summary of the Wall Street Journal article “Invoice Financing” – https://www.wsj.com/buyside/personal-finance/business-loans/invoice-financing)

1. The Core Concept

Invoice financing is a flexible, short‑term funding tool that lets businesses accelerate cash flow by borrowing against unpaid customer invoices. Instead of waiting 30, 60, or even 90 days for payment, a company can receive a large portion of the invoice value—typically 70–90%—immediately from a lender. The remaining balance (minus a fee) is paid once the customer settles the invoice.

The WSJ article lays out the mechanics in plain language, illustrating how the arrangement functions as a form of “invoice discounting” or “factoring” and why it has become a go‑to solution for many SMEs, especially those in manufacturing, distribution, and services where long payment cycles are the norm.

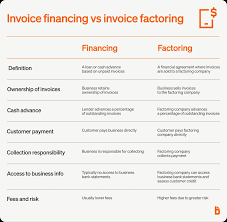

2. Two Main Variants: Factoring vs. Invoice Discounting

| Feature | Factoring | Invoice Discounting |

|---|---|---|

| Ownership | The factor buys the invoice outright. | The borrower retains ownership and control. |

| Credit risk | The factor often assumes the default risk. | The borrower is responsible for default. |

| Disclosure | Third‑party involvement is visible to customers. | The borrower can keep the arrangement confidential. |

| Fees | Typically higher; includes due‑diligence and credit assessment. | Lower fees; mainly a discount rate on the advance. |

The article emphasizes that the choice hinges on the borrower’s relationship with clients and appetite for sharing credit risk. Factoring is preferable for firms that need a full off‑balance‑sheet solution and are comfortable with a third party stepping into the invoicing relationship. Invoice discounting suits companies that prefer to keep the invoice chain private while still getting immediate working capital.

3. How It Works – Step by Step

- Submit Invoices – The business uploads or sends copies of outstanding invoices to the lender.

- Verification – The lender verifies the legitimacy of the invoice and the creditworthiness of the customer.

- Advance – Once approved, the lender disburses an upfront amount (typically 80% of the invoice value).

- Collection – The customer pays the invoice directly to the lender or to the business if the arrangement is “in‑kind.”

- Settlement – The lender deducts its fee (often expressed as a percentage or an annualized rate) and releases the remaining balance to the business.

- Follow‑up – In the case of factoring, the lender may also handle collections; for discounting, the borrower continues to manage payments.

The article stresses that the process is usually faster than a traditional bank loan—often taking just a few days from application to funds—but the quality of the invoice portfolio is crucial. Poor‑quality invoices (e.g., unpaid or disputed) can delay or deny financing.

4. Eligibility and Underlying Requirements

Unlike bank lines of credit, invoice financing largely depends on the underlying invoices rather than the borrower's credit score. Key criteria include:

- Invoice Age: Most lenders prefer invoices that are 30–45 days old.

- Invoice Amount: Minimum thresholds vary, but typically $5,000–$10,000.

- Customer Creditworthiness: Lenders evaluate the debtor’s payment history; they may require a minimum credit score or a known customer base.

- Business Stability: A consistent revenue stream and a clean balance sheet improve approval odds.

- Compliance: Companies must adhere to any regulatory or industry‑specific requirements that could affect invoice validity.

The WSJ article underscores that these factors can differ significantly among lenders, so it is advisable for businesses to shop around or seek a broker that specializes in invoice financing.

5. Costs – Fees, Interest, and Hidden Charges

Invoice financing is not free. The WSJ article breaks down typical cost components:

- Discount Rate: A percentage of the invoice value, usually expressed on an annualized basis. For example, a 2% monthly discount rate equates to roughly 24% APR.

- Processing Fees: One‑time fees covering verification and credit checks.

- Termination Fees: Charged if the borrower wants to end the arrangement prematurely.

- Re‑investment Fees: Some lenders charge a small fee if the borrower re‑uses the same invoice in a new financing cycle.

It’s worth noting that while the upfront cost can seem high, many small businesses find invoice financing more affordable than unsecured loans or credit card debt, especially when cash flow constraints make other options unviable.

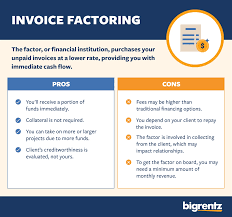

6. Pros and Cons – Why Small Businesses Turn to Invoice Financing

Advantages

- Rapid Capital Injection – Funds are often available within 24–48 hours.

- No Collateral Needed – Financing is secured by the invoices themselves.

- Improved Cash Flow – Enables purchase of inventory, pays payroll, or invests in growth while waiting for customers.

- Scalable – The arrangement can grow with the business; the volume of invoices is the limiting factor.

Disadvantages

- Higher Costs – Effective interest rates can be steep.

- Customer Disclosure (Factoring) – In factoring, the customer knows that a third party is handling payments, which can strain relationships.

- Quality Dependence – Invoices with disputes or poor credit risk reduce the amount of advance or cause denial.

- Limited Use – The facility only covers the invoiced amount; it doesn’t replace a general working‑capital line.

The article offers anecdotal examples of companies that successfully leveraged invoice financing to bridge seasonal cycles but also warns against overreliance, which can create a “cash‑flow trap” if the underlying sales volume dwindles.

7. The Current Landscape – Market Dynamics and Trends

According to the WSJ piece, the invoice‑financing market has seen significant growth in the past decade, driven by:

- Technological Innovation – Digital platforms that automate verification, payment collection, and real‑time analytics.

- E‑commerce Boom – Online marketplaces generate large volumes of invoices, creating new financing avenues.

- Pandemic‑Induced Liquidity Needs – The COVID‑19 crisis forced many small firms to seek alternative funding, accelerating adoption.

- Competitive Offerings – Fintech lenders have lowered fees and expanded eligibility, intensifying competition with traditional banks.

The article also highlights regulatory developments, noting that while invoice financing remains largely unregulated, some jurisdictions are tightening oversight on “invoice‑based lending” to protect both borrowers and debtors from predatory practices.

8. Practical Tips for Businesses Considering Invoice Financing

- Assess Your Invoice Portfolio – Make sure your invoices are clean, dated, and customer credit scores are favorable.

- Compare Multiple Lenders – Look beyond the advertised discount rate; consider total cost of capital, processing speed, and customer service.

- Understand Your Needs – Decide whether you want a third‑party to handle collections (factoring) or want to retain control (discounting).

- Read the Fine Print – Pay attention to termination clauses and the impact on your customer relationships.

- Plan for Repayment – Align the financing period with your cash‑flow cycle so that you can comfortably cover fees when invoices are paid.

The WSJ article recommends consulting with a financial advisor or an invoice‑financing broker who can navigate the plethora of options and tailor a solution that matches your specific cash‑flow profile.

9. Conclusion – A Tool Worth Considering, but Not a Panacea

Invoice financing can be a powerful ally for small and medium‑sized enterprises (SMEs) struggling with slow receivables and limited access to traditional credit. The Wall Street Journal article paints a balanced picture: when executed wisely, it offers speed, flexibility, and an immediate boost to working capital. Yet, the costs can be steep, and the solution is only as good as the quality of the underlying invoices.

In an increasingly digital and cash‑flow‑centric economy, invoice financing is poised to remain a staple of the SME funding toolkit. As the market matures, we can expect further refinement of fee structures, greater integration with accounting software, and perhaps more robust regulatory frameworks to safeguard all parties involved. For now, the key takeaway for business owners is simple: if you have a solid invoice base and urgent cash needs, invoice financing is worth a deeper look.

Read the Full Wall Street Journal Article at:

[ https://www.wsj.com/buyside/personal-finance/business-loans/invoice-financing ]