[ Tue, Jan 28th 2025 ]: rnz

[ Tue, Jan 28th 2025 ]: Kiplinger

[ Tue, Jan 28th 2025 ]: Reuters

[ Tue, Jan 28th 2025 ]: cnbctv18

[ Tue, Jan 28th 2025 ]: Reuters

[ Tue, Jan 28th 2025 ]: cnbctv18

[ Tue, Jan 28th 2025 ]: MSN

[ Tue, Jan 28th 2025 ]: Firstpost

[ Tue, Jan 28th 2025 ]: Reuters

[ Tue, Jan 28th 2025 ]: MSN

[ Tue, Jan 28th 2025 ]: MSN

[ Mon, Jan 27th 2025 ]: Forbes

[ Mon, Jan 27th 2025 ]: legit

[ Mon, Jan 27th 2025 ]: Investopedia

[ Mon, Jan 27th 2025 ]: AOL

[ Mon, Jan 27th 2025 ]: Investopedia

[ Mon, Jan 27th 2025 ]: AOL

[ Mon, Jan 27th 2025 ]: bnnbloomberg

[ Mon, Jan 27th 2025 ]: Tuko

[ Mon, Jan 27th 2025 ]: Oneindia

[ Mon, Jan 27th 2025 ]: cnbctv18

[ Mon, Jan 27th 2025 ]: Forbes

[ Mon, Jan 27th 2025 ]: Businessworld

[ Mon, Jan 27th 2025 ]: AgWeb

[ Mon, Jan 27th 2025 ]: Couriermail

[ Mon, Jan 27th 2025 ]: Newsweek

[ Mon, Jan 27th 2025 ]: Tuko

[ Mon, Jan 27th 2025 ]: Kiplinger

[ Mon, Jan 27th 2025 ]: AOL

[ Mon, Jan 27th 2025 ]: inc42

[ Mon, Jan 27th 2025 ]: Mint

[ Mon, Jan 27th 2025 ]: cnbctv18

[ Mon, Jan 27th 2025 ]: Reuters

[ Mon, Jan 27th 2025 ]: MSN

[ Mon, Jan 27th 2025 ]: Reuters

[ Mon, Jan 27th 2025 ]: coloradopolitics

[ Mon, Jan 27th 2025 ]: MSN

[ Mon, Jan 27th 2025 ]: Indiatimes

[ Mon, Jan 27th 2025 ]: Couriermail

[ Mon, Jan 27th 2025 ]: MSN

[ Sun, Jan 26th 2025 ]: Mint

[ Sun, Jan 26th 2025 ]: Reuters

[ Sun, Jan 26th 2025 ]: Investopedia

[ Sun, Jan 26th 2025 ]: Mint

[ Sun, Jan 26th 2025 ]: bdnews24

[ Sun, Jan 26th 2025 ]: Oregonian

[ Sun, Jan 26th 2025 ]: MSN

[ Sun, Jan 26th 2025 ]: MSN

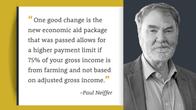

It's Tax Time: Your Guide To Calculate Farm Income This Year

AgWeb

AgWebGross income is an average of 2020 to 2022 items on your income tax return. However, we must wait on USDA for regulations to determine what they consider to be farm income. Either way, gross revenue is much easier for the farmer to be a "farmer" than AGI.

Read the Full AgWeb Article at:

[ https://www.agweb.com/news/business/taxes-and-finance/its-tax-time-your-guide-calculate-farm-income-year ]

Similar Business and Finance Publications

[ Sun, Jan 26th 2025 ]: MSN

[ Sat, Jan 25th 2025 ]: Forbes

[ Tue, Jan 07th 2025 ]: AgWeb

[ Sat, Dec 28th 2024 ]: Forbes

[ Thu, Dec 12th 2024 ]: Kiplinger

[ Wed, Dec 11th 2024 ]: The Victoria Advocate

[ Sat, Dec 07th 2024 ]: Forbes

[ Mon, Dec 02nd 2024 ]: Bill Williamson

[ Sat, Nov 30th 2024 ]: Bill Williamson