50/30/20 Budgeting: A Simple Guide for 2026

Locales: Scotland, UNITED KINGDOM

Sunday, February 15th, 2026 - In an increasingly complex financial landscape, many individuals are seeking simple, effective strategies to manage their money and reduce financial stress. A budgeting method gaining significant traction, and repeatedly advocated by financial experts, is the 50/30/20 rule. This straightforward framework offers a practical approach to allocating income, allowing individuals to prioritize needs, enjoy wants, and consistently build towards financial security. This article will delve deeper into the rule's components, its adaptability, benefits, and how it stacks up against other budgeting techniques, providing a comprehensive guide for those looking to take control of their finances in 2026.

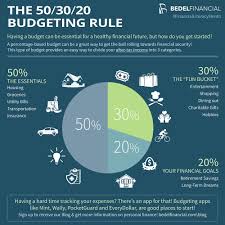

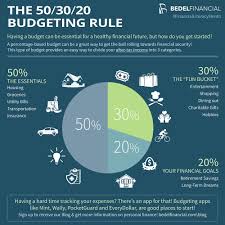

The core principle behind the 50/30/20 rule is remarkably simple: divide your after-tax income into three distinct categories. This isn't about restrictive deprivation, but rather a conscious allocation of resources.

Understanding the Pillars: 50% Needs, 30% Wants, 20% Savings & Debt

Needs (50%): This category encompasses essential expenses crucial for maintaining a basic standard of living. These are the non-negotiable costs that would significantly impact your life if unpaid. Examples include housing (rent or mortgage payments), utilities (electricity, water, gas, internet - increasingly viewed as a necessity in 2026), groceries, transportation (car payments, public transit), healthcare costs (insurance premiums, co-pays, prescriptions), and essential childcare. It's important to distinguish between 'needs' and 'wants' within this category. While a reliable car might be a 'need' for commuting to work, a luxury vehicle would fall into the 'wants' category.

Wants (30%): This portion of your income is dedicated to discretionary spending - things that enhance your lifestyle but aren't essential for survival. This includes dining out, entertainment (concerts, movies, streaming services), hobbies, travel, subscriptions (gym memberships, magazines, streaming platforms), and non-essential clothing purchases. The 'wants' category is where individuals have the most flexibility to adjust spending based on their priorities and financial goals. In 2026, with the proliferation of subscription services, careful monitoring of these costs is particularly important.

Savings & Debt Repayment (20%): This is arguably the most critical category for long-term financial health. It's allocated to building an emergency fund (aim for 3-6 months of living expenses), saving for future goals (down payment on a house, education, retirement), and aggressively paying down debt. This includes credit card debt, student loans, car loans, and any other outstanding liabilities. Prioritizing high-interest debt repayment can save you significant money in the long run. Contributing to retirement accounts, even small amounts, benefits from the power of compounding over time.

Adapting the Rule to Your Unique Circumstances

The 50/30/20 rule isn't a rigid formula. It's a guideline that should be tailored to your individual financial situation. For example, someone living in a high-cost-of-living area might need to allocate more than 50% of their income to 'needs,' requiring adjustments to the 'wants' or 'savings' categories. Similarly, individuals with significant debt burdens might choose to dedicate more than 20% to debt repayment, temporarily reducing savings contributions. The key is to be honest with yourself about your spending habits and adjust the percentages accordingly.

How Does it Compare to Other Budgeting Methods?

While other budgeting methods like zero-based budgeting (where every dollar is assigned a purpose) and envelope budgeting (using cash for specific categories) can be effective, the 50/30/20 rule offers a simpler, more flexible approach. Zero-based budgeting requires more meticulous tracking, while envelope budgeting can be cumbersome in a digital age. The 50/30/20 rule provides a broad framework without demanding excessive detail, making it easier to adhere to long-term.

Benefits of Implementing the 50/30/20 Rule

- Reduced Financial Stress: Knowing where your money is going can alleviate anxiety about finances.

- Increased Savings: A dedicated savings allocation ensures consistent progress towards financial goals.

- Debt Reduction: Prioritizing debt repayment helps you break free from the burden of liabilities.

- Greater Financial Awareness: The rule encourages mindful spending and helps you identify areas where you can cut back.

- Flexibility: The adaptable nature of the rule allows you to tailor it to your specific needs and circumstances.

In conclusion, the 50/30/20 rule provides a practical and accessible framework for managing your finances and achieving financial wellbeing. In 2026, where economic uncertainty remains a constant, a simple, effective budgeting method like this is more valuable than ever.

Read the Full Daily Record Article at:

[ https://www.dailyrecord.co.uk/lifestyle/money/follow-simple-spending-saving-rule-36385831 ]