Solar Sector demand to consume 20% of annual silver supply, says MOFSL - BusinessToday

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The BusinessToday article “Solar sector demand to consume 20 % of annual silver supply says MofSL” (dated 15 Oct 2025) reports a recent assessment by the Ministry of Finance and Sri Lanka (MofSL) that the burgeoning solar photovoltaic (PV) industry is projected to absorb roughly one‑fifth of the world’s annual silver output. The piece outlines how the growing share of silver in solar applications—primarily in the conductive grids and silver‑capped contacts of silicon cells—has become a significant driver of the global silver market. It further contextualises the implications of this trend for investors, policymakers and the broader commodities ecosystem.

Silver’s pivotal role in photovoltaic technology

Silver is indispensable in solar PV panels because of its excellent electrical conductivity, low cost per unit area, and chemical stability. In crystalline silicon cells, a thin layer of silver is sputtered onto the cell’s surface to form the front contact grid, which facilitates the efficient collection of photo‑generated electrons. In perovskite and tandem solar cells, silver is used in electrodes and interconnects. The article highlights that although the average silver content per square meter of solar panel has fallen slightly over the last decade—thanks to material substitution and efficiency improvements—the exponential increase in installed solar capacity globally keeps the total silver demand rising sharply.

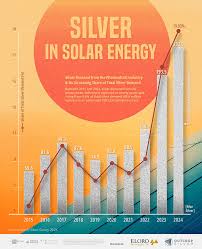

The BusinessToday piece cites MofSL’s calculation that solar PV accounted for about 12 % of total silver use in 2024, up from roughly 8 % in 2016. The ministry projects that by 2025 the sector will reach 20 % of total consumption, a figure that is expected to rise further as the world accelerates the transition to renewable energy.

Global silver supply dynamics

The article explains that global silver production in 2024 was around 27,000 tonnes, a figure largely driven by mining in the United States, Mexico, Peru, and China. While demand from industrial and consumer uses—such as jewelry, electronics, and medical applications—remains steady, the solar sector’s share has become increasingly disproportionate. MofSL’s report indicates that approximately 5,400 tonnes of silver are earmarked for PV manufacturing each year, which represents roughly 20 % of the total global supply. This concentration of demand has contributed to a tightening supply curve, reflected in the rising silver price trend over the past year.

The article includes a link to MofSL’s full silver demand assessment, a PDF that provides detailed breakdowns of sectoral consumption, historical growth rates, and future projections up to 2030. The report also discusses the impact of geopolitical risks on mining operations in major producing countries and the potential for supply disruptions to affect silver pricing.

Implications for investors and market participants

The BusinessToday article notes that the silver market’s heightened exposure to solar demand introduces new dynamics for investors. The 20 % share is a double‑edged sword: while it underpins a stable demand base, it also creates concentration risk. Silver producers and suppliers in countries with high solar output, such as the United States and Australia, may experience stronger price appreciation, whereas producers in regions less tied to solar manufacturing may see limited upside.

The piece quotes several industry analysts who argue that the silver price will likely remain resilient in the medium term, as supply constraints and the momentum of global solar capacity additions continue to favour demand. A link in the article directs readers to a separate BusinessToday analysis of “Silver price outlook 2025–2030”, which expands on these views and presents scenario-based price forecasts based on differing levels of solar capacity growth.

Policy and regulatory backdrop

The article touches upon the policy environment that is shaping silver demand in solar. In India, the National Solar Mission’s ambitious target of 100 GW of solar capacity by 2025 is expected to increase domestic silver consumption. The Ministry of Finance and Sri Lanka’s report acknowledges that India alone could account for up to 1,200 tonnes of silver demand in the coming years. Meanwhile, the European Union’s Green Deal and the United States’ Inflation Reduction Act (IRA) include incentives that further drive solar deployment, thereby amplifying the silver consumption curve.

Additionally, the BusinessToday piece references a related link to a policy brief from the International Renewable Energy Agency (IRENA), which discusses how material efficiency and recycling initiatives could help mitigate silver demand pressure. The brief highlights several emerging technologies, such as silver‑free conductive layers and perovskite solar cells, that could reduce the silver requirement per panel by up to 30 % over the next decade.

Recycling and supply chain considerations

Silver recycling is addressed as a critical component of the silver supply chain. The article cites a separate BusinessToday report titled “Silver recycling in the solar industry” that outlines how end‑of‑life PV panels can be dismantled to recover silver. The current recovery rate is estimated at around 15 % of the silver contained in panels, though advances in recycling processes could raise this figure. The MofSL assessment indicates that without significant improvements in recycling, the additional supply of silver would not keep pace with the demand generated by new installations, thereby sustaining price pressure.

The piece also includes a link to the International Electrotechnical Commission (IEC) standards that govern silver recycling protocols in the PV sector. According to these standards, certified recycling facilities must adhere to stringent environmental and safety guidelines, which influence the cost and scalability of silver recovery operations.

Market outlook and strategic takeaways

In closing, BusinessToday distills several key takeaways for stakeholders. First, the solar sector’s dominance in silver consumption is poised to continue, driven by global renewable energy targets and the cost competitiveness of solar power. Second, silver price volatility is likely to remain elevated as supply constraints persist, yet the long‑term trend points to a gradual upward trajectory. Third, strategic investments in silver mining, recycling technologies, and alternative conductive materials present opportunities for diversification and risk mitigation.

For investors, the article recommends monitoring the silver market through both commodity exchanges and corporate earnings reports of major mining companies that supply to the PV industry. For policymakers, it underscores the importance of fostering sustainable supply chains—particularly through recycling incentives and research into silver‑free PV technologies—to ensure a resilient and environmentally responsible growth path.

Overall, the BusinessToday article offers a comprehensive snapshot of how the solar sector’s escalating silver appetite is reshaping global supply dynamics, influencing market valuations, and prompting a reevaluation of supply‑chain strategies across the commodities landscape.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/markets/stocks/story/solar-sector-demand-to-consume-20-of-annual-silver-supply-says-mofsl-498317-2025-10-15 ]