Re-Making The Banking System

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Attempting to retrieve the article content.Re‑Making the Banking System: A Blueprint for Stability and Innovation

The United States banking system, long hailed as the bedrock of global finance, is facing a seismic shift. In the article “Re‑Making the Banking System,” published on Seeking Alpha, the author dissects the structural weaknesses that have become apparent in the wake of the 2008 crisis and the COVID‑19 pandemic, while outlining a comprehensive reform agenda aimed at restoring public confidence and fostering sustainable growth. Drawing on a mix of historical hindsight, contemporary regulatory debates, and emerging fintech trends, the piece argues that the old model—centered on a handful of megabanks, legacy IT infrastructure, and a patchwork of oversight—is no longer fit for the 21st‑century economy.

1. The Problem Landscape

1.1 Concentration and Systemic Risk

The article begins by highlighting the outsized influence of the top ten U.S. banks, which now control a staggering 40 % of the total banking system assets. This concentration amplifies systemic risk: a failure of a single institution can ripple through credit markets, liquidity channels, and even sovereign debt. The author cites the 2008 collapse of Lehman Brothers and the 2023 Bank of America‑related “short‑term crisis” as evidence of the vulnerability inherent in a top‑heavy system.

1.2 Outdated Infrastructure

Legacy core banking platforms, many of which were built in the 1970s, are inflexible, costly to maintain, and ill‑suited for rapid product innovation. The piece notes that over 70 % of U.S. banks still run on “on‑premises” hardware, leaving them exposed to cyber‑threats and limiting their ability to integrate with modern payment networks like the Real‑Time Payments (RTP) system.

1.3 Fragmented Oversight

The regulatory architecture—comprising the FDIC, Federal Reserve, OCC, and state regulators—has grown increasingly convoluted. The article emphasizes that the “dual‑role” oversight (supervision vs. resolution) creates gaps that can be exploited during financial distress. It points to recent criticisms of the FDIC’s resolution planning processes and the Federal Reserve’s reliance on “too‑big‑to‑fail” metrics that may not capture hidden risks.

1.4 Inequitable Access and the Digital Divide

While fintech has lowered entry barriers for consumers, the author argues that the benefits are unevenly distributed. Rural and low‑income communities still rely on a dearth of physical banking infrastructure, and the article underscores the need to align digital innovation with equitable access goals.

2. Reform Proposals

2.1 A “Community‑Bank‑First” Model

The centerpiece of the reform agenda is the “Community‑Bank‑First” model, which proposes a tiered regulatory framework. Smaller community banks would be granted “preferential status,” receiving lower capital and liquidity requirements based on their size and local impact. In return, they would be required to meet stricter customer‑service metrics and maintain a higher ratio of community‑focused lending. This approach seeks to restore the local‑bank model that historically spurred neighborhood development.

2.2 Central Bank Digital Currency (CBDC) Integration

The author calls for a phased rollout of a U.S. CBDC that would coexist with existing fiat currencies. By embedding the CBDC within the banking system’s settlement layer, the Fed could improve payment velocity, reduce inter‑bank settlement risk, and gain granular data on financial flows—data that could be used to detect emerging systemic threats. The article outlines a partnership model where community banks act as “digital‑cash agents,” providing end‑users with instant, low‑cost transfers.

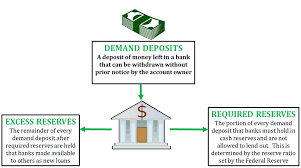

2.3 Reinforced Deposit‑Insurance Architecture

A major critique of the FDIC’s current deposit‑insurance cap—currently set at $250,000—lies in its inability to deter “risk‑taking” behavior. The reform proposal suggests a risk‑adjusted insurance premium model: banks that maintain higher capital ratios and robust stress‑testing would pay lower premiums, incentivizing prudent risk management. Additionally, the article advocates for a “dynamic‑cap” system where insured limits adjust based on macro‑economic indicators, thus discouraging large, concentrated deposits that could fuel a run.

2.4 “Digital Resilience” Standards

To combat cyber‑risk, the author proposes mandatory digital resilience standards for all banks. These would include mandatory penetration testing, real‑time threat intelligence sharing across the banking ecosystem, and the adoption of zero‑trust architecture in core systems. The article cites a 2024 report from the National Institute of Standards and Technology (NIST) that demonstrates the cost‑effectiveness of these measures in preventing high‑impact breaches.

2.5 Unified Oversight “One‑Stop” Agency

The reform agenda also recommends consolidating the FDIC, OCC, and Federal Reserve’s supervisory functions into a “One‑Stop” banking oversight agency. By streamlining reporting and risk assessment, this unified body could avoid regulatory arbitrage and provide a single point of accountability. The article references a 2023 think‑tank paper by the Brookings Institution that argues for such consolidation to reduce “regulatory overlap” costs.

3. Implementation Roadmap

3.1 Short‑Term (1–2 Years)

- Pilot Digital‑Cash Agent Program: Select 200 community banks nationwide to test CBDC integration.

- Risk‑Adjusted Premium Pilot: Roll out the new deposit‑insurance premium model in a 50‑bank cohort.

- Digital Resilience Standards: Issue regulatory guidance mandating zero‑trust architecture.

3.2 Medium‑Term (3–5 Years)

- Expand Digital‑Cash Program: Integrate CBDC across all community banks and major retail banks.

- Re‑engineer Core Banking Platforms: Provide federal grants for banks to modernize core systems.

- One‑Stop Oversight Agency: Legislate the consolidation of supervisory agencies.

3.3 Long‑Term (5+ Years)

- Full Community‑Bank‑First Framework: Adopt tiered regulatory regime nationwide.

- Dynamic Deposit Cap: Implement macro‑linked deposit‑insurance limits.

- Real‑Time Payment Ecosystem: Achieve 99.9% uptime across all banking networks.

4. Anticipated Benefits and Risks

4.1 Benefits

- Enhanced Stability: Reduced concentration risk and stronger capital buffers.

- Greater Access: Community banks can offer tailored financial services to underserved regions.

- Innovation Acceleration: CBDC and digital resilience standards pave the way for fintech breakthroughs.

- Lower Systemic Risk: Unified oversight and risk‑adjusted insurance create a more self‑correcting system.

4.2 Risks

- Implementation Cost: Upgrading legacy systems and integrating CBDC could strain bank budgets.

- Regulatory Complexity: Transitioning to a unified oversight agency may face political resistance.

- Cyber‑Attack Vector: Introducing new digital payment layers increases exposure if not properly secured.

5. Conclusion

The article closes by framing the proposed reforms not as a radical overhaul but as a natural evolution of the banking sector. Drawing parallels to the post‑2008 reforms—such as Dodd‑Frank and Basel III—it argues that the time is ripe for a “second wave” of regulatory innovation. By re‑balancing the relationship between banks, regulators, and consumers, the author envisions a more resilient, inclusive, and technologically forward banking system that can weather future shocks while delivering sustained economic growth.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4829864-re-making-the-banking-system ]