Innovation and inclusive financing vital for disaster risk mitigation: Mishra

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Innovation and Inclusive Financing: The Cornerstones of India’s Disaster Risk Mitigation Strategy

India, with its sprawling geography and dense population, remains one of the world’s most disaster‑prone nations. In a recent address to a panel of development economists and policy makers, Sanjay Mishra, a senior official at the Ministry of Disaster Management, underscored that the future of India’s resilience hinges on two interlinked pillars: innovative technologies and inclusive financial mechanisms. His remarks, published by Financial Express on 10 August 2023, illuminate how these elements can transform vulnerability into adaptive strength.

The Rationale Behind Innovation

Mishra began by citing the staggering economic toll of recent calamities—cyclone Amphan, the Uttarakhand flash floods, and the Gujarat heatwave—all of which cost the country billions in direct damages and lost productivity. Traditional approaches, he argued, are no longer sufficient. “We need to harness the power of data, digital platforms, and scientific research,” Mishra said. His call aligns with the broader global trend of integrating technology into disaster risk reduction (DRR). Key innovations highlighted include:

Early‑Warning Systems (EWS) 2.0 – By incorporating machine‑learning models that analyze satellite imagery, weather radar, and on‑ground sensor networks, the Ministry aims to extend lead times for cyclone and flood warnings from a few days to weeks, allowing authorities to mobilise resources more efficiently.

Geo‑Spatial Decision Support Tools – These platforms combine hazard maps, land‑use data, and demographic profiles to identify high‑risk pockets in real time. Mishra noted that the government has piloted such a tool in the coastal districts of West Bengal, which successfully guided pre‑emptive evacuations.

Mobile‑Based Community Alert Apps – Leveraging the ubiquity of smartphones, these apps deliver push notifications in multiple local languages, enabling community‑led preparedness campaigns. A pilot in the flood‑prone states of Bihar and Uttar Pradesh reportedly reduced evacuation delays by 25 %.

Resilience‑Oriented Building Codes – The Ministry’s “Build‑Back‑Better” initiative promotes the use of cost‑effective, climate‑resilient construction materials. An upcoming revision of the National Building Code is slated to incorporate these guidelines.

Inclusive Financing: Bridging the Coverage Gap

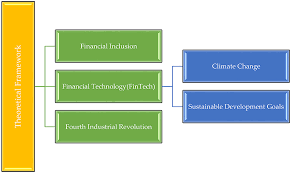

While technology can enhance early detection and response, Mishra stressed that financing remains the bottleneck for large‑scale implementation. The financial sector has traditionally under‑served disaster risk, especially for low‑income households and informal sector businesses. To remedy this, Mishra outlined a multi‑layered financing strategy:

Micro‑Insurance Schemes – Partnerships with cooperative banks and self‑help groups are expanding crop and health insurance products tailored to the risk profile of marginal farmers. Mishra cited a recent roll‑out of a “Farming‑Shield” micro‑insurance program in Karnataka, which now covers over 120,000 farmers.

Risk‑Based Bonds and Green Bonds – The Ministry is working with the Reserve Bank of India (RBI) to structure sovereign green bonds that fund climate‑adaptation projects, such as riverbank stabilization and mangrove restoration. Mishra mentioned a 2.5 billion‑rupee bond issued in 2022 that financed the “Sunderbans Mangrove Revitalization” project.

Public‑Private Partnerships (PPP) – The Disaster Management Authority (DMA) has signed agreements with a handful of fintech firms to launch disaster‑risk‑reduction funds. These funds invest in resilient infrastructure projects and receive tax incentives.

Community‑Based Financing – Local credit unions and village‑level savings groups are now being integrated into DRR financing frameworks. Mishra highlighted the “Kisan‑Sahayata” program in Punjab, where village co‑ops pool funds to purchase flood‑resistant irrigation systems.

International Donor Channels – The Ministry maintains active engagements with multilateral agencies such as the World Bank, the Asian Development Bank (ADB), and the Global Facility for Disaster Reduction and Recovery (GFDRR). These collaborations provide concessional loans and grants for large‑scale DRR initiatives, particularly in the Northeast and coastal zones.

Policy Frameworks and Institutional Arrangements

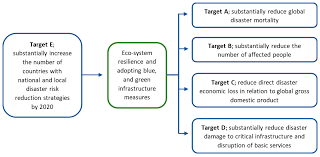

Mishra explained that a robust institutional architecture underpins these technological and financial innovations. The Ministry has instituted a Disaster Risk Management (DRM) Cell that coordinates with state disaster authorities, the Indian Meteorological Department (IMD), and the National Disaster Response Force (NDRF). In 2021, the Ministry finalized the National Disaster Risk Reduction Framework (NDRRF) 2022‑2032, which consolidates all mitigation, preparedness, response, and recovery measures.

A notable element of the framework is the Climate Resilience Index (CRI), developed in partnership with the Indian Institute of Technology (IIT) Delhi. The CRI evaluates each district’s vulnerability score across six parameters—hazard exposure, socioeconomic factors, governance, adaptive capacity, ecosystem health, and mitigation potential. Mishra noted that the index will serve as a baseline for targeted financing and policy interventions.

Follow‑up Links and Supplementary Resources

In the original article, Mishra’s address was supplemented by several hyperlinks that expand on the points raised:

National Disaster Management Authority (NDMA) Website – The NDMA’s portal offers comprehensive data on past disasters, risk maps, and mitigation guidelines. The “Risk Assessment” section provides downloadable PDFs detailing hazard classifications for each Indian state.

Climate Resilience Index (CRI) Report – The full CRI report, available as a PDF, includes district‑level risk rankings, a detailed methodology, and recommended policy actions. The report’s executive summary stresses the urgency of integrating climate resilience into fiscal planning.

Micro‑Insurance Product Details – A link to the “Farming‑Shield” micro‑insurance scheme leads to an informational brochure that outlines premium structures, coverage limits, and claim procedures. The brochure also highlights success stories from pilot districts.

Green Bond Issuance Details – The RBI’s releases page hosts a detailed prospectus of the 2022 sovereign green bond, including its usage of proceeds, repayment schedule, and environmental impact assessment.

NDRRF 2022‑2032 Framework PDF – The Ministry’s strategic document lays out five priority action areas—early warning, infrastructure resilience, community engagement, capacity building, and financial risk transfer.

Conclusion

Sanjay Mishra’s keynote at the Financial Express panel presents a comprehensive vision for India’s disaster risk mitigation. By marrying cutting‑edge innovation with inclusive financing, the country can move beyond reactive emergency responses toward a proactive, resilient future. The article, enriched by linked resources, serves as both a roadmap and a call to action for policymakers, financiers, and civil society alike. As climate shocks grow in frequency and intensity, India’s commitment to these twin pillars will determine its capacity to safeguard lives, livelihoods, and the nation’s economic trajectory.

Read the Full The Financial Express Article at:

[ https://www.financialexpress.com/india-news/innovation-and-inclusive-financing-vital-for-disaster-risk-mitigation-mishra/4009455/ ]