India's Growth Remains Stable Despite Intensified Global Headwinds

Locale: UNITED STATES, CHINA, EUROPEAN UNION, UNITED KINGDOM, INDIA

New Delhi, January 22nd, 2026 - Two years on from the Reserve Bank of India's (RBI) initial assessment in early 2024, India's position as the world's fastest-growing major economy remains remarkably stable, though the global headwinds that were flagged back then have intensified and morphed into new challenges. While the initial report in 2024 emphasized optimism tempered with caution, the current economic landscape demands a more nuanced perspective.

The RBI's 2024 "State of the Economy" report, forecasting India's continued dominance in growth, highlighted concerns around geopolitical instability, tightening financial conditions, and persistently high commodity prices. These concerns haven't simply vanished; they've compounded. The ongoing conflicts in Eastern Europe, initially a major focus, are now intertwined with escalating tensions in the South China Sea and growing economic anxieties related to trade protectionism across several major economies. The initial predictions of subdued exports have largely materialized, with global trade volumes significantly lower than projected in 2024.

However, India has demonstrated a surprising level of resilience. The robust domestic demand and investment that the RBI initially identified as key drivers of growth have proven to be even more vital than anticipated. While global markets stutter, India's burgeoning middle class continues to fuel demand for consumer goods, housing, and infrastructure projects. Government initiatives, particularly those focused on rural development and infrastructure upgrades, are contributing substantially to this internal momentum.

Navigating the New Global Landscape

The slowdown in global exports, initially expected to be moderate, has been more significant. The rise of protectionist measures, initially discussed in early 2024, has escalated into more formalized trade barriers, hindering India's export potential. Supply chain disruptions, a lingering consequence of the geopolitical instability, continue to plague various sectors, impacting manufacturing and logistical efficiency. The initial concerns about rising interest rates have also come to fruition, though the RBI has actively managed monetary policy to mitigate the most severe impacts on domestic investment. Recent data indicates a slight cooling of the real estate market, a potential indicator of broader economic sensitivity.

Supply-Side Reforms: A Continued Imperative

The RBI's early emphasis on supply-side reforms remains critically important. While the Indian economy has proven surprisingly resilient, sustained growth and long-term stability require addressing structural weaknesses. The agricultural sector, crucial for both food security and rural income, continues to face challenges related to climate change and outdated infrastructure. Progress on labour market reforms has been slower than initially hoped, hindering productivity gains in certain industries. Furthermore, the expansion of digital infrastructure, initially viewed as a key enabler of growth, is encountering challenges related to digital literacy and equitable access in rural areas.

Looking Ahead: The Next Five Years

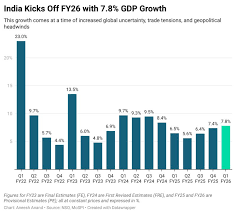

Experts now believe that India's growth rate, while still outpacing most major economies, will likely moderate slightly compared to the initial projections. The sustained pace of growth, currently estimated at around 6.5% for FY26, is largely dependent on the government's ability to effectively manage inflationary pressures, further stimulate domestic demand, and push forward with critical supply-side reforms. The success of the 'Make in India' initiative, intended to boost domestic manufacturing and reduce reliance on imports, will be crucial in navigating the increasingly volatile global trade environment.

Despite the evolving challenges, the long-term outlook for the Indian economy remains positive. The nation's demographic dividend - a young and increasingly skilled workforce - provides a significant advantage. However, harnessing this potential requires continued investment in education, healthcare, and infrastructure, alongside a commitment to fostering a business-friendly environment. The RBI will continue to monitor global developments closely and adapt its policies to support sustainable and inclusive growth. The resilience demonstrated in recent years suggests that India is well-positioned to navigate the complexities of the global economy, though vigilance and proactive policy measures remain paramount.

Read the Full Zee Business Article at:

[ https://www.zeebiz.com/economy-infra/news-rbi-flags-global-risks-but-sees-india-staying-fastest-growing-major-economy-388401 ]