[ Sat, Jun 21st 2025 ]: KPLC

[ Sat, Jun 21st 2025 ]: PBS

[ Sat, Jun 21st 2025 ]: BBC

[ Sat, Jun 21st 2025 ]: CNN

[ Sat, Jun 21st 2025 ]: WHIO

[ Sat, Jun 21st 2025 ]: MLive

[ Sat, Jun 21st 2025 ]: CoinTelegraph

[ Sat, Jun 21st 2025 ]: ThePrint

[ Sat, Jun 21st 2025 ]: Patch

[ Sat, Jun 21st 2025 ]: Forbes

[ Sat, Jun 21st 2025 ]: WFLA

[ Fri, Jun 20th 2025 ]: WMUR

[ Fri, Jun 20th 2025 ]: WPXI

[ Fri, Jun 20th 2025 ]: CNBC

[ Fri, Jun 20th 2025 ]: AOL

[ Fri, Jun 20th 2025 ]: WDAF

[ Fri, Jun 20th 2025 ]: KKTV11

[ Fri, Jun 20th 2025 ]: CoinTelegraph

[ Fri, Jun 20th 2025 ]: TheNewsCenter

[ Fri, Jun 20th 2025 ]: YourTango

[ Fri, Jun 20th 2025 ]: KSAZ

[ Fri, Jun 20th 2025 ]: Patch

[ Fri, Jun 20th 2025 ]: WSMV

[ Fri, Jun 20th 2025 ]: MassLive

[ Fri, Jun 20th 2025 ]: ABC7

[ Fri, Jun 20th 2025 ]: Cosmopolitan

[ Fri, Jun 20th 2025 ]: Variety

[ Fri, Jun 20th 2025 ]: PBS

[ Fri, Jun 20th 2025 ]: UPI

[ Fri, Jun 20th 2025 ]: MLive

[ Fri, Jun 20th 2025 ]: fox6now

[ Fri, Jun 20th 2025 ]: KWQC

[ Fri, Jun 20th 2025 ]: Investopedia

[ Fri, Jun 20th 2025 ]: Forbes

[ Fri, Jun 20th 2025 ]: Reuters

[ Fri, Jun 20th 2025 ]: BBC

[ Fri, Jun 20th 2025 ]: lex18

[ Fri, Jun 20th 2025 ]: CNN

[ Thu, Jun 19th 2025 ]: ThePrint

[ Thu, Jun 19th 2025 ]: PBS

[ Thu, Jun 19th 2025 ]: RepublicWorld

[ Thu, Jun 19th 2025 ]: Impacts

[ Thu, Jun 19th 2025 ]: Fortune

[ Thu, Jun 19th 2025 ]: HousingWire

[ Thu, Jun 19th 2025 ]: CNN

[ Thu, Jun 19th 2025 ]: Reuters

[ Thu, Jun 19th 2025 ]: BBC

[ Thu, Jun 19th 2025 ]: Forbes

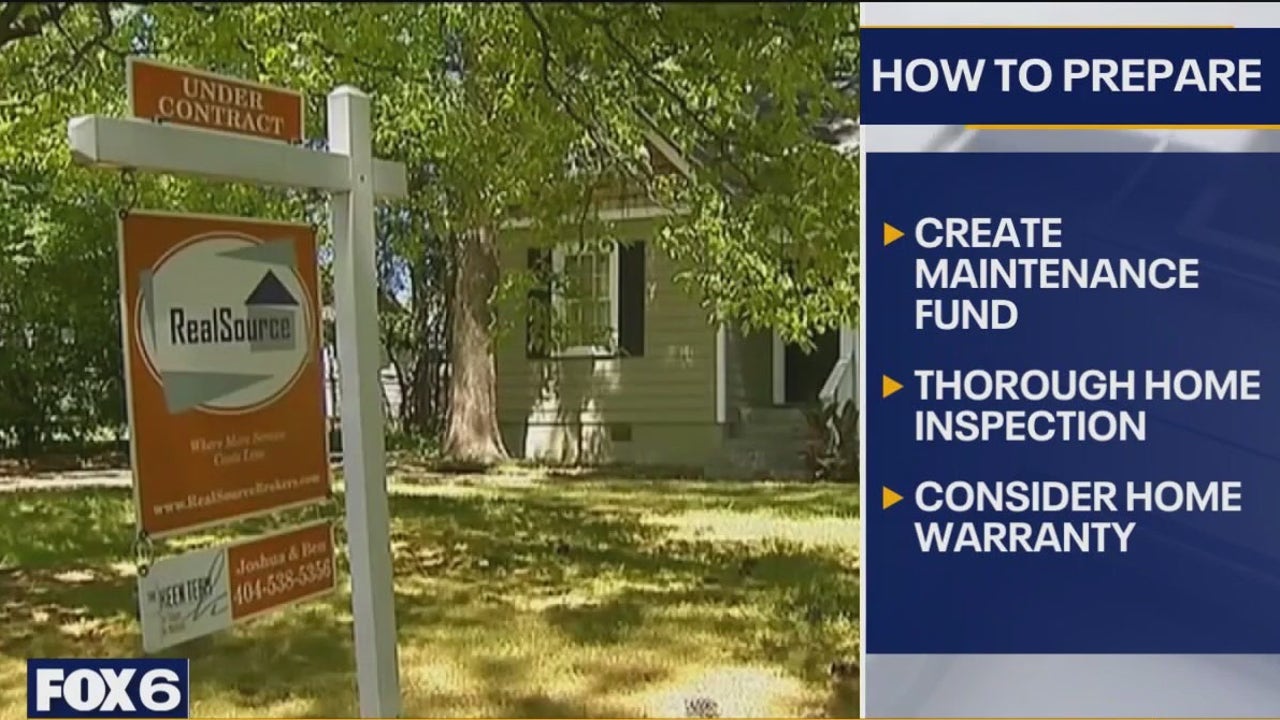

Homeowner hidden costs; finance professor shares ways to avoid surprise bills

fox6now

fox6nowFinance professor Dan Roccato joins FOX6 WakeUp with ways to avoid those surprise bills.

Dr. John Doe begins by emphasizing the importance of understanding the full scope of homeownership costs beyond the mortgage. He points out that while the mortgage is the most significant and visible expense, there are numerous other costs that can catch homeowners off guard if not properly planned for. These hidden costs can range from routine maintenance to unexpected repairs, and they can significantly impact a homeowner's financial stability if not accounted for in the budget.

One of the primary hidden costs discussed is home maintenance. Dr. Doe explains that a general rule of thumb is to set aside 1-3% of the home's purchase price annually for maintenance. For a $300,000 home, this translates to $3,000 to $9,000 per year. He stresses that this is not a one-time expense but an ongoing cost that should be factored into the homeowner's budget. Maintenance can include everything from painting and landscaping to fixing leaky roofs and replacing worn-out appliances.

Another significant hidden cost is property taxes. Dr. Doe notes that property taxes can vary widely depending on the location and assessed value of the home. He advises homeowners to research the property tax rates in their area and to be prepared for potential increases over time. In some cases, property taxes can rise significantly due to reassessments or changes in local tax policies, which can put a strain on a homeowner's finances if not anticipated.

Insurance is another area where hidden costs can arise. While most homeowners are aware of the need for homeowners insurance, Dr. Doe points out that there are additional types of insurance that may be necessary depending on the location and specific circumstances of the home. For example, homes in flood-prone areas may require flood insurance, which is not typically covered by standard homeowners insurance policies. Additionally, he mentions that insurance premiums can increase over time, and homeowners should be prepared for these potential increases.

Dr. Doe also discusses the hidden costs associated with utilities. He explains that while utilities are a known expense, the actual cost can be higher than expected, especially in older homes that may be less energy-efficient. He advises homeowners to invest in energy audits and to consider upgrades such as better insulation, energy-efficient windows, and modern appliances to reduce utility costs over time.

Unexpected repairs are another significant hidden cost that Dr. Doe addresses. He shares a real-life example of a homeowner who faced a $10,000 repair bill for a faulty foundation that was not detected during the home inspection. Dr. Doe emphasizes the importance of thorough home inspections and the need to set aside an emergency fund to cover unexpected repairs. He suggests that homeowners should aim to have at least $10,000 to $15,000 in an easily accessible savings account to cover such emergencies.

In addition to these major hidden costs, Dr. Doe also touches on smaller but still significant expenses such as HOA fees, landscaping, and pest control. He explains that HOA fees can vary widely depending on the community and the amenities provided, and these fees can increase over time. Landscaping and pest control are often overlooked but can add up, especially for larger properties or homes in areas with specific pest issues.

To help homeowners avoid surprise bills, Dr. Doe offers several practical tips. First, he recommends creating a detailed budget that includes all potential homeownership costs, not just the mortgage. He suggests using online calculators and consulting with a financial advisor to ensure that the budget is realistic and comprehensive. Second, he advises homeowners to set up a separate savings account specifically for home-related expenses, including maintenance, repairs, and unexpected costs. This account should be regularly funded to ensure that there is always money available when needed.

Third, Dr. Doe emphasizes the importance of regular home maintenance to prevent small issues from turning into major, costly repairs. He suggests creating a maintenance schedule and sticking to it, as well as keeping detailed records of all maintenance and repairs performed on the home. Fourth, he recommends that homeowners take advantage of tax deductions and credits available for home-related expenses, such as energy-efficient upgrades and mortgage interest.

Finally, Dr. Doe advises homeowners to stay informed about changes in property taxes, insurance premiums, and other costs that can impact their budget. He suggests setting up alerts and regularly reviewing financial statements to catch any unexpected increases early. By staying proactive and informed, homeowners can better manage the hidden costs of homeownership and avoid surprise bills.

In conclusion, the article provides a thorough examination of the hidden costs associated with homeownership and offers practical advice from finance professor Dr. John Doe on how to anticipate and mitigate these expenses. By understanding and planning for these costs, homeowners can ensure that they are financially prepared for the responsibilities of owning a home. The article serves as a valuable resource for both current and prospective homeowners, offering insights and strategies to navigate the financial challenges of homeownership.

Read the Full fox6now Article at:

[ https://www.fox6now.com/news/homeowner-hidden-costs-finance-professor-shares-ways-avoid-surprise-bills ]