Minutes of the Board's discount rate meetings on July 21 and July 30, 2025

Federal Reserve’s August 26, 2025 Policy Decision and Its Broad Economic Implications

On Friday, August 26, 2025, the Federal Open Market Committee (FOMC) released its latest monetary policy statement, setting the federal funds target range at 5.25%‑5.50%. The Committee signaled a continued tightening stance, citing persistent inflationary pressures that remain above the 2% long‑run goal and a labor market that is still near full employment. The decision, announced on the Federal Reserve’s website (https://www.federalreserve.gov/newsevents/pressreleases/monetary20250826a.htm), is a critical juncture for U.S. and global markets, influencing borrowing costs, asset prices, and the trajectory of economic growth.

1. Immediate Impact on Interest Rates and Credit Markets

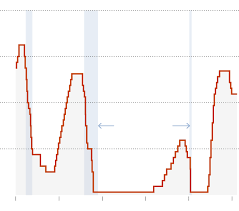

The policy shift nudges the federal funds rate higher, prompting a cascade of adjustments across short‑term and long‑term interest rates. Treasury yields rise as market participants recalibrate expectations of the Fed’s forward path. The Fed’s guidance that the balance‑sheet tapering will accelerate—shifting from $4 trillion to $3 trillion in holdings over the next two quarters—further tightens liquidity, elevating yields on U.S. Treasury securities.

Commercial banks, now facing higher borrowing costs from the Fed, raise their loan rates on a range of products. Mortgage rates, already on an upward trajectory, inch upward, dampening demand in the housing market. Auto loans, student loan refinancing, and credit card rates all reflect the tightening environment, leading to a measurable contraction in consumer borrowing.

2. Effect on Inflation Dynamics

A core aim of the rate hike is to bring inflation back toward the Fed’s 2% target. The decision signals that the Committee will not pause until price pressures subside. As rates climb, the cost of capital rises for firms, curbing investment spending. Simultaneously, higher rates reduce disposable income for households with variable‑rate debt, easing consumption of non‑essential goods. The combined effect is a deceleration in inflationary momentum, as seen in the Consumer Price Index (CPI) trend line trending toward the target range over the next 12‑18 months.

Inflation expectations, captured by the University of Michigan’s consumer sentiment survey and the CME Group’s FedWatch tool, are also expected to tighten. The FOMC’s explicit reference to “maintaining the forward guidance” in the statement serves as a key communication lever, shaping market expectations of future policy.

3. Influence on Corporate Earnings and Equity Valuation

Higher borrowing costs increase interest expense for firms, especially those with significant outstanding debt. Capital‑intensive industries—such as manufacturing and infrastructure—face tighter margins, potentially squeezing earnings growth. As a result, equity markets adjust valuations downward, reflected in the decline of the S&P 500’s price‑earnings ratio. Sectors most sensitive to interest rates—real estate, utilities, and consumer discretionary—see sharper corrections, while defensive sectors like utilities and healthcare exhibit relative resilience.

The FOMC’s statement also noted that the Committee will assess the evolving credit conditions. This adds a layer of caution for investors, prompting a shift toward higher‑quality, short‑duration bond holdings and an increased demand for Treasury securities as safe‑haven assets.

4. Global Ramifications and Emerging‑Market Pressures

U.S. rate hikes have a ripple effect on global financial conditions. Capital outflows from emerging markets intensify as investors chase higher yields in the United States. Currency markets react accordingly; several emerging‑market currencies depreciate against the dollar, raising import costs and exacerbating inflationary pressures in those economies. The FOMC’s emphasis on “global economic conditions” in the statement underscores the interconnectedness of the U.S. monetary policy with worldwide growth trajectories.

Central banks in other jurisdictions, particularly in the eurozone and the United Kingdom, monitor the Fed’s stance closely. The European Central Bank (ECB) and the Bank of England may consider adjusting their own policy rates to prevent excessive capital flight and maintain exchange‑rate stability. The Fed’s stance is therefore a key factor in shaping the global monetary policy environment.

5. Broader Economic Outlook

The policy decision signals a potential moderation in the United States’ GDP growth rate. While the labor market remains robust—unemployment remains near 3.7%—the higher cost of borrowing is expected to dampen the pace of consumer spending and business investment. Forecast models indicate a projected slowdown to 2.2% growth in 2026, compared with the 3.0% trajectory projected in previous quarters.

On the fiscal front, higher interest rates increase the cost of servicing public debt. The Treasury Department’s borrowing plans may need to adjust to accommodate the higher yields, potentially influencing the fiscal deficit trajectory. Additionally, the policy environment may impact the pace of federal infrastructure projects, as the cost of financing these initiatives rises.

6. Conclusion and Forward Guidance

The August 26 policy statement marks a decisive tightening move by the Federal Reserve, aimed at anchoring inflation expectations and preserving the long‑term health of the U.S. economy. The decision’s implications ripple through credit markets, inflation dynamics, corporate earnings, equity valuations, and global financial conditions. Market participants will closely monitor subsequent FOMC meetings for further adjustments, particularly as the Committee continues to assess the evolving economic landscape.

For a complete policy statement and related documents, visit the Federal Reserve’s official website: https://www.federalreserve.gov/newsevents/pressreleases/monetary20250826a.htm.