LA Voters Weigh Transformative Tax Plan

Locales: California, UNITED STATES

LA's Tax Gamble: Balancing Revenue Needs with Economic Realities

Los Angeles, CA - February 11, 2026 - Los Angeles voters are on the cusp of a potentially transformative decision that could reshape the city's financial landscape and impact two key industries: tourism and cannabis. The proposed tax increases, targeting hotels and unlicensed cannabis businesses, are fueling a heated debate as the election draws near. The core question isn't simply about raising revenue, but about how Los Angeles chooses to do so, and whether the proposed measures will achieve their stated goals without unintended consequences.

The city's argument for the new taxes is straightforward: Los Angeles faces significant budgetary pressures, compounded by escalating challenges like homelessness, aging infrastructure, and demands for improved public safety and park maintenance. City Councilmember Maria Rodriguez frames the proposal as a necessary step to address these issues, emphasizing the dedicated allocation of funds. "We are facing unprecedented demands on city resources," she explained in a recent press conference. "These taxes aren't about increasing government overreach; they are about responsibly funding the services our residents deserve." The projected revenue figures, exceeding $250 million annually according to city estimates, paint a compelling picture of potential financial relief.

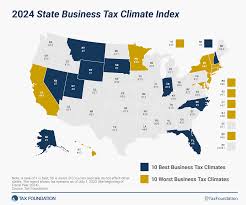

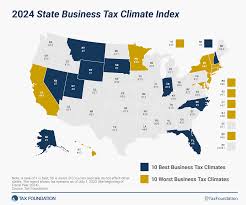

However, the devil, as always, is in the details. The proposed hotel tax, an increase of 3% on top of existing levies, is drawing fire from the tourism industry. Critics argue that Los Angeles is already a relatively expensive destination compared to other major US cities. Adding further costs, they claim, will drive away convention business, leisure travelers, and ultimately, jobs. David Chen, spokesperson for the Los Angeles Hospitality Alliance, warns of a potential "tipping point" where the cost of visiting Los Angeles outweighs the appeal. "We're already seeing competition from cities like Miami and Austin," Chen states. "Increasing hotel taxes will only exacerbate this trend, leading to decreased occupancy rates and reduced economic activity." The alliance is actively circulating data suggesting a potential 5-10% drop in hotel revenue if the tax is implemented.

The tax on unlicensed cannabis businesses presents a different, yet equally complex, set of challenges. While ostensibly aimed at curbing the illegal cannabis market and leveling the playing field for licensed operators, the measure is drawing criticism from within the legal cannabis industry itself. The concern isn't that illegal operations won't be taxed - they currently avoid taxes altogether - but that the tax will be difficult, if not impossible, to collect, and will further disadvantage legal businesses struggling to compete with lower-priced, unregulated products.

"It's a feel-good measure that won't solve the problem," argues Sarah Lee, owner of GreenLeaf Dispensary, a licensed cannabis retailer. "Unlicensed operators aren't going to magically start paying taxes. This will simply add another layer of cost and complexity for legal businesses already burdened by regulations and high operating expenses." Lee points to the need for increased enforcement of existing laws, rather than relying on a tax that targets entities operating outside the legal framework. Many legal cannabis businesses fear the tax will incentivize unlicensed operators to go even further underground, making them harder to track and regulate.

This latest proposal builds on a history of attempts to navigate the complex world of cannabis taxation in Los Angeles. Previous efforts have been hampered by bureaucratic hurdles, legal challenges, and the inherent difficulties of regulating a rapidly evolving industry. The city has experimented with various tax structures, including gross receipts taxes and cultivation taxes, but has yet to find a sustainable solution that effectively balances revenue generation with the needs of the legal cannabis market.

The coming weeks will see a flurry of activity as both sides ramp up their advocacy efforts. Expect to see targeted advertising campaigns, town hall meetings, and increased media coverage. The outcome of the vote remains uncertain, but it's clear that Los Angeles voters are facing a difficult choice. They must weigh the potential benefits of increased revenue against the risks of harming two vital sectors of the city's economy. The decision will not only impact the city's budget but will also send a strong signal about Los Angeles' approach to economic development and regulation in the years to come.

Read the Full Los Angeles Daily News Article at:

[ https://www.dailynews.com/2026/02/10/will-la-voters-support-new-taxes-on-hotels-and-unlicensed-cannabis-businesses/ ]