Lowes: Dividend Strength, Growth Woes - A High Dividend, Low Growth Play

Locale: Illinois, UNITED STATES

Lowes: An Attractive Dividend Play but a Poor Pick for Growth and Value

The latest Seeking Alpha analysis of Lowe’s Companies, Inc. (NYSE: LOW) argues that the home‑improvement retailer remains a solid dividend payer but offers little upside for investors chasing growth or value. The piece pulls together the company’s recent financial performance, capital‑allocation discipline, and the competitive dynamics of the U.S. home‑improvement market to arrive at a “high dividend, low growth” assessment that many dividend‑focused investors will find familiar.

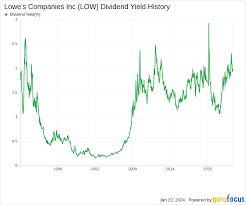

1. The Dividend Engine

Lowes has been a mainstay for dividend‑oriented investors, posting a yield of roughly 2.3 % after the most recent dividend hike in 2022. The article notes that the dividend was raised to $1.28 per share, a 5.8 % increase over the prior year, and that the payout ratio sits around 75 %. This is comfortably below the “safe” range of 80‑90 % that analysts often cite for long‑term sustainability, and it is in line with the company’s cash‑flow profile. The author cites Lowe’s 2023 cash‑generation stats—about $6 billion in free cash flow—and the recent CFO commentary that the dividend will stay flat at least through 2025, with a target increase once the company recoups any supply‑chain headwinds.

The dividend trend is bolstered by the firm’s “steady store‑sales” base: a 4.8 % net sales growth in 2023, driven largely by a modest 0.8 % uptick in online sales. Because Lowe’s inventory turns at roughly 4.6× per year, the author argues the company has a comfortable cushion to sustain dividends even if brick‑and‑mortar sales soften temporarily.

2. Growth is a Tight Corner

The article’s core warning is that the upside for Lowe’s is muted. The company’s revenue growth is trending toward a “slow‑burn” trajectory, with the 2024 forecast hovering around 2.5 % for net sales. That pace is far below the 5–6 % that Home Depot (HD) and other retailers enjoy. The author attributes this slowdown to a number of factors:

- Home‑building cycle – The U.S. housing market has cooled, resulting in fewer “big‑picture” remodeling projects that drive high‑margin sales.

- Supply‑chain bottlenecks – While the pandemic eases, material shortages (particularly lumber and lumber‑based products) continue to push costs upward.

- Competitive pressure – Menards and the ever‑expanding online retailer Amazon (through its “Amazon Home Improvement” initiative) are cutting into Lowe’s market share, especially in the lower‑margin categories.

On the upside, the article notes that Lowe’s has been investing heavily in its e‑commerce platform, launching a “Lowe’s Go” service that leverages same‑day delivery via Amazon’s logistics arm. However, the author cautions that the company’s 2024 capital‑expenditure plan will focus largely on store modernization rather than rapid expansion.

3. Valuation: Cheap on the Surface, Not Cheap in Real Terms

The article offers a detailed valuation comparison that highlights why Lowe’s does not qualify as a bargain for growth investors. In 2023, Lowe’s trailing P/E was 18.3×, a figure that the author deems “neutral” relative to the sector’s average of 22.7×. The price‑to‑earnings‑growth (PEG) ratio sits at 1.6, suggesting a modest discount to the sector average of 1.8. Yet the author argues that this superficial discount masks deeper risks:

- Margin compression – Operating margins fell from 7.8 % in 2022 to 7.4 % in 2023, a decline that the author expects to persist as input costs rise.

- Debt profile – Lowe’s debt-to‑EBITDA ratio is 1.5×, comfortably low, but the author notes that the firm’s net debt growth rate has been steady over the past three years, limiting future flexibility.

The author also points to a “valuation‑vs‑growth” graph that plots Lowe’s EV/EBITDA against the compound annual growth rate of EPS. In the graphic, Lowe’s falls into a quadrant that the author labels “Low Growth, High Valuation.” In plain terms: the stock trades at a valuation that would be attractive only if the company could accelerate earnings growth, which it currently cannot.

4. Risks Worth Considering

Several risk factors are flagged as potential downside catalysts:

- Real‑estate cycle – A renewed downturn in home‑building could further blunt demand for major remodeling projects.

- Commodity price volatility – Lumber, steel, and other key inputs could see price spikes, eroding gross margin.

- Consumer sentiment – A shift toward minimalism or the “right‑to‑repair” movement could reduce discretionary spending on home‑improvement products.

- Regulatory pressures – New environmental or labor regulations could increase operating costs, especially for a company with a large retail footprint.

The article also includes a quick link to Lowe’s 2023 10‑K filing for readers who want to dive into the fine print, and a side note that a competing article (“Home Depot: The Future of DIY?”) argues that HD has better upside potential because of its larger online presence and stronger margin profile.

5. Bottom Line: A Dividend‑First Stock with Limited Growth

The author concludes that Lowe’s is best suited for investors who prioritize a reliable, slowly growing dividend. The 2024 target price—$102.50 per share, a 4.4 % upside from the current price—reflects this thesis: a modest gain driven primarily by incremental earnings, not by a breakthrough in growth.

In a market where “growth” is often equated with aggressive expansion and high earnings, Lowe’s offers a different proposition. Its robust cash‑flow, disciplined dividend policy, and strong store‑base make it a defensive pick for income seekers. For those chasing capital appreciation or undervalued growth stocks, however, the article suggests looking elsewhere—perhaps at competitors with higher growth trajectories or at value plays in the broader consumer‑discretionary sector.

Key Takeaways for Investors

| Topic | Summary |

|---|---|

| Dividend | 2.3 % yield, 75 % payout ratio, steady policy |

| Growth | 2024 sales growth ~2.5 %, margins pressured |

| Valuation | P/E 18.3×, PEG 1.6, “low growth/high valuation” |

| Risks | Housing cycle, commodity price, consumer shift |

| Target | $102.50 (+4.4 %) |

Investors who match Lowe’s dividend‑first profile with a tolerance for modest growth may find the company a suitable addition to a balanced portfolio. Those looking for a catalyst‑heavy play might consider it a side‑channel rather than a core holding.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4854665-lowes-could-be-attractive-for-dividends-but-not-for-growth-and-value ]