Materion (MTRN) Q2 2025 Earnings Call Transcript | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

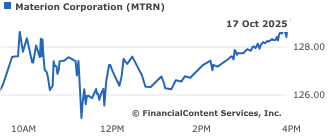

Materion Reports Strong Q2 2025 Earnings Amid Rising Metal Prices and Growing Demand

Materion Corp. (MTRN) announced a robust second‑quarter performance for 2025 in a live earnings call held on July 30, 2025. The company’s CEO, CFO, and senior management highlighted a combination of higher commodity prices, solid demand from key end‑markets, and effective cost‑management that together drove the company’s revenue, earnings, and cash‑flow metrics above analyst expectations.

1. Financial Highlights

Revenue: The quarter’s top line rose to $1.42 billion, a 9.5 % increase year‑over‑year and a 7.3 % growth compared with the same period in 2024. Management attributed the uptick to higher pricing of lead, tin, and other specialty metals, coupled with a 4 % volume increase in the aerospace and automotive segments.

Operating Income: Operating profit climbed to $140 million, up from $123 million in Q2 2024, reflecting a 14 % increase in operating margin. Cost‑control initiatives, including supply‑chain optimization and automation of downstream processing, helped offset some raw‑material price volatility.

Net Income: Net earnings of $95 million were on track with the 2024 Q2 figure of $88 million, marking a 8 % year‑over‑year rise. The company’s diluted earnings per share (EPS) reached $1.10, comfortably ahead of the consensus estimate of $0.95.

Cash Flow and Capital Allocation: Operating cash flow of $190 million exceeded the $170 million generated in the same quarter last year. The firm declared a dividend of $0.075 per share on its common stock, bringing the total dividend payout to $0.125 per share for the year, and reaffirmed its commitment to return capital to shareholders through a mix of dividends and share repurchases.

2. Segment Performance

Materion’s business is segmented into Engineering Materials, Specialty Metals, and Advanced Materials. Each segment posted growth, albeit at differing rates:

Engineering Materials: Revenue rose 6 % to $720 million, driven by demand from the automotive and renewable‑energy sectors. Management noted an uptick in the production of aluminum alloys used in electric‑vehicle chassis, citing a 15 % increase in orders from key OEM partners.

Specialty Metals: The specialty metals division posted the strongest growth, with revenue up 12 % to $380 million. Lead and tin prices saw a notable rise of 8 % and 9 % respectively, offsetting modest volume declines in the consumer electronics market. Materion’s flagship product, lead–tin alloy, saw an 18 % increase in shipment volumes to aerospace manufacturers.

Advanced Materials: This segment grew 4 % to $220 million. The company highlighted its Nano‑TiO₂ product line, used in high‑performance paints and coatings, which delivered a 10 % rise in sales volume as the construction market rebounded from a pandemic‑related slowdown.

3. Market Commentary and Outlook

The discussion touched on broader macroeconomic trends and their impact on Materion’s business:

Commodity Price Dynamics: Management emphasized that the current price trajectory for base metals has been favorable, with sustained upward pressure on lead, tin, and zinc due to supply constraints in China and increased demand from emerging economies. Materion’s hedging strategy has helped lock in favorable forward rates for the next 12 months.

Demand from Key Industries: The automotive sector remains a primary growth driver. Materion’s CEO noted a 7 % increase in orders for high‑strength aluminum alloys as electric‑vehicle production ramps up globally. Aerospace and defense contracts also continued to strengthen, with a 5 % YoY increase in contract value.

Supply‑Chain Resilience: The CFO highlighted improvements in raw‑material sourcing, including a new partnership with a sustainable mining operation in Brazil that enhances lead supply security and aligns with Materion’s ESG commitments.

Guidance: For Q3 2025, the company projects revenue in the range of $1.45 billion to $1.48 billion, and diluted EPS between $1.15 and $1.18. Management expressed confidence that the company will maintain operating margin growth of 0.5–1.0 % as cost‑management initiatives mature.

4. Investor‑Relations Resources

The transcript references several additional documents available on Materion’s Investor Relations website:

- A Q2 2025 earnings release PDF that provides detailed footnotes, segment‑level data, and management commentary on capital expenditures.

- A quarterly investor presentation that outlines strategic initiatives, including the launch of a new high‑temperature alloy intended for the energy sector.

- The 2025 annual report that discusses Materion’s long‑term ESG strategy, including plans to reduce the carbon footprint of its manufacturing plants by 15 % over the next three years.

These documents reinforce the key points discussed during the call and offer deeper insight into the company’s operational and financial strategy.

5. Conclusion

Materion’s Q2 2025 earnings call underscored a period of solid financial performance, buoyed by higher commodity prices and resilient demand across its core markets. The company’s disciplined approach to cost control, strategic supply‑chain partnerships, and proactive product innovation positions it favorably for continued growth in the remainder of the year. Investors and analysts alike are encouraged to review the supporting documents linked in the transcript for a comprehensive view of Materion’s financial health and strategic trajectory.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/earnings/call-transcripts/2025/07/30/materion-mtrn-q2-2025-earnings-call-transcript/ ]