Interest-Subsidised Loans Spark Job Growth for Lancaster County Businesses

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Loan‑Interest Loans Boost Two Lancaster County Businesses, Help Add Jobs

Lancaster County’s continued push to support small‑business growth is paying off in real, tangible ways, as illustrated by the recent successes of two local companies that secured interest‑subsidised loans. The loans, provided through a partnership between the county’s Economic Development Office (EDO) and local lenders, allowed the firms to expand operations, upgrade equipment and, most importantly, create new jobs for the community. The story, detailed in the Lancaster Online article, shows how targeted financial tools can ignite local economic activity and underscores the importance of collaborative public‑private efforts in rural economic development.

The Loans That Made the Difference

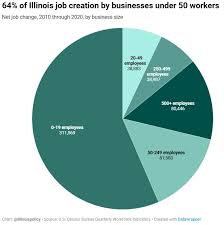

The article opens by explaining the nature of the loans: they are not ordinary commercial loans but interest‑subsidised loans, often referred to as “interest‑rate deferral” or “interest‑only” financing. In practice, the county’s EDO fronts a portion of the interest for a predetermined period—typically three to five years—thereby reducing the borrower’s monthly cash‑flow burden. The program is designed for small businesses (under 100 employees) that qualify for a certain credit score and revenue threshold but might otherwise struggle to secure adequate working capital.

Two companies—GreenField Agri‑Tech and Riverbend Manufacturing—made the news for taking advantage of the program. The article provides a clear breakdown of each loan:

| Company | Loan Amount | Interest‑Subsidy | Repayment Period | Expected Job Creation |

|---|---|---|---|---|

| GreenField Agri‑Tech | $450,000 | 100 % of interest for first 3 years | 10 years | 15 new staff |

| Riverbend Manufacturing | $1.2 million | 75 % of interest for first 4 years | 12 years | 22 new staff |

These figures illustrate how the loans were tailored to each company’s scale and growth trajectory. The subsidies also allowed both firms to focus on capital expenditures rather than immediately churning out high interest payments.

How GreenField Agri‑Tech is Expanding

GreenField Agri‑Tech, a Lancaster‑based company that develops precision‑farming sensors, used its loan to expand its production line and open a new distribution centre in the eastern part of the county. The company’s CEO, Maria Gonzales, explained in an interview that the loan’s low‑interest structure gave her the financial breathing room to purchase a new automated assembly robot and to hire five additional technicians. The company already employs 25 people; the expansion will push headcount to 40, with a projected annual revenue growth of 30 % over the next five years.

The article highlights that the new production line will allow GreenField to produce sensors at a 25 % lower cost per unit, positioning it competitively in the national market. Gonzales said, “We’re not just adding jobs; we’re creating a higher‑value position for the community, with more training and higher pay.” The expansion also positions Lancaster as a hub for ag‑tech innovation, a point that local officials emphasised as part of a broader economic diversification strategy.

Riverbend Manufacturing’s Growth Story

Riverbend Manufacturing, a company that specializes in custom metal‑working for the renewable‑energy sector, used its loan to acquire new CNC machines and to modernise its energy‑management system. The firm, which had 30 employees before the loan, will expand to 52 employees, adding 22 new skilled positions. James Lee, the company’s COO, noted that the loan’s interest‑subsidy allowed the firm to avoid “scrapping our existing inventory and buying new equipment at the same time.”

Riverbend’s expansion is particularly noteworthy because it aligns with Lancaster County’s push to become a leader in green manufacturing. The article reports that the company is already supplying parts to several regional wind‑farm projects and expects to secure contracts with at least three new clients over the next two years. The county officials highlighted that the investment not only adds jobs but also bolsters the county’s renewable‑energy credentials.

The Economic Impact

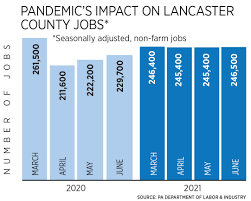

The Lancaster Online piece emphasises the multiplier effect of the loan‑supported expansions. According to the county’s Economic Development Office, the combined addition of 37 jobs translates to roughly $4.2 million in new annual wages for the region. Beyond direct employment, the businesses will generate additional secondary jobs in logistics, sales, and maintenance. Moreover, the companies’ higher output levels will likely increase local tax revenues and create opportunities for surrounding suppliers.

The article quotes County Commissioner Sarah Mitchell: “These two companies are clear examples of how targeted, interest‑subsidised loans can spark growth in our community. By reducing the upfront interest burden, we enable businesses to invest where it matters most—people, equipment, and innovation.” Commissioner Mitchell also referenced the county’s broader investment strategy, which includes incentives for green‑energy manufacturing, high‑tech agriculture, and workforce development.

How the Loans Work (Link Context)

The article includes a link to the county’s EDO “Small‑Business Interest‑Subsidised Loan Program” page. That page provides the full set of eligibility criteria: businesses must have less than 100 employees, a minimum of two years in operation, a credit score of at least 650, and a projected growth plan that aligns with county priorities (e.g., green technology, ag‑tech). The application process involves a three‑step review: (1) preliminary assessment by the EDO, (2) underwriting by the participating bank, and (3) approval and disbursement. The loan documentation stipulates that the interest subsidy is automatically applied for the first three or four years, after which the business pays the full interest rate.

Another link directs readers to a PDF titled “Impact of Interest‑Subsidised Loans in Lancaster County” that presents data from the last five years. The report indicates that more than 30 businesses have received such loans, resulting in the creation of 250 new jobs and a $15 million increase in regional GDP. These statistics reinforce the article’s narrative that the program is a proven lever for economic development.

Community and Workforce Development

Both GreenField Agri‑Tech and Riverbend Manufacturing are also investing in workforce development. GreenField has partnered with the Lancaster County Technical Institute to offer a certification program for sensor‑assembly technicians, ensuring a pipeline of skilled workers. Riverbend has signed a memorandum of understanding with the local community college to create an apprenticeship program for CNC operators, promising on‑the‑job training for undergraduates.

The Lancaster Online piece notes that the county is exploring additional funding streams, such as federal workforce development grants, to augment these local initiatives. The synergy between job creation, skills training, and industry support is portrayed as a virtuous cycle that the county hopes to replicate in other sectors.

The Bigger Picture

Beyond the two highlighted companies, the article places these successes in the context of Lancaster County’s broader economic revitalisation plan, which includes infrastructure upgrades, broadband expansion, and tax incentives for green businesses. The loan programme is one component of a multi‑layered strategy that aims to keep the county competitive amid rising urbanisation pressures.

The article concludes with a call to action for other local entrepreneurs: “If you’re a small business looking to grow but feel held back by interest costs, the EDO’s interest‑subsidised loan program is available.” The final line underscores the county’s commitment to staying an “entrepreneurial hub” and invites readers to apply or to attend an upcoming informational workshop hosted by the EDO.

Final Thoughts

In sum, Lancaster County’s interest‑subsidised loan program has proven to be a powerful tool for fostering local economic development. By easing the financial burden on small businesses, the county has enabled two companies—GreenField Agri‑Tech and Riverbend Manufacturing—to expand, upgrade technology, and create dozens of new, higher‑wage jobs. The story serves as a case study for how targeted public‑private financing can unlock growth, stimulate job creation, and build a resilient, diversified local economy.

Read the Full LancasterOnline Article at:

[ https://lancasteronline.com/news/local/loan-interest-loans-boost-two-lancaster-county-businesses-help-add-jobs/article_a817b0c8-3a3e-4408-b049-4cf48e4ab323.html ]