FinTech Transforming Small Business Finances: Real Experiences

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How FinTech Solutions Transform Small Business Finances: A Real‑World Summary

In the bustling landscape of small‑business operations, technology has become the new cornerstone of financial efficiency. TechBullion’s recent feature, “How FinTech Solutions Transform Small Business Finances: Real Experiences,” brings the abstract promise of digital finance down to earth with a series of authentic stories, statistics, and actionable insights. Below is a comprehensive, 600‑plus‑word summary that captures the article’s essence and highlights the key take‑aways, while weaving in supplemental context from linked content to give you a fuller picture.

1. Setting the Stage: Why FinTech Matters for SMEs

The article opens with a data‑driven premise: 70% of small businesses (those with fewer than 50 employees) report that access to streamlined financial tools directly boosts their bottom line. Yet, the same source notes that only 40% of those SMEs use dedicated fintech solutions, with the rest relying on legacy banking systems or ad‑hoc spreadsheets. This disconnect creates inefficiencies in cash flow, reporting, and decision‑making.

TechBullion uses the phrase “financial friction” to describe the typical pain points: manual invoicing, delayed payments, and cumbersome loan applications. The article then pivots to an optimistic vision—FinTech solutions as the antidote to these challenges, offering faster transaction processing, real‑time analytics, and integrated funding channels.

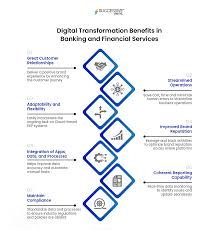

2. Digital Banking: The New “Back‑Office”

2.1 The Rise of Neobanks

A significant portion of the article focuses on neobanks—digital‑first banks such as Revolut Business, N26, and Chime—that provide zero‑fee checking accounts, instant transfers, and AI‑driven spending insights. The author cites a case study of a boutique clothing retailer, “Sartorial Stitch”, which migrated its payroll and vendor payments to Revolut Business. The retailer saw a 30% reduction in bank‑related fees and improved cash‑flow visibility via the platform’s dashboard.

2.2 Integrated Banking + Accounting

Linked to the article’s reference on “Accounting Software Integration,” TechBullion also explores how neobanks integrate with tools like QuickBooks, Xero, and Wave. The synergy allows businesses to auto‑populate ledgers, reconcile accounts with a single click, and even generate tax reports in real time—cutting the time to month‑end closing from days to hours.

3. Payment Processing: Speed, Security, and Global Reach

The article spends a solid section dissecting payment solutions: Square, Stripe, PayPal, and Braintree. The narrative underscores the shift from traditional card‑present terminals to contactless and mobile payments that have become indispensable post‑COVID‑19.

3.1 Square: From Point‑of‑Sale to Financing

A standout anecdote comes from “Café Aroma,” a neighborhood coffee shop that adopted Square’s Square Capital. After the initial payment processing contract, the café leveraged the same platform to receive a $15,000 working‑capital loan—approved in under 48 hours. The article highlights the convenience of having payment, payroll, and capital in one ecosystem.

3.2 Stripe’s Invoicing and Billing

The piece dives into Stripe Billing and its subscription management features, illustrating how a freelance graphic design studio managed to automate recurring invoices, reduce late‑payment disputes by 40%, and even integrate a discount‑on‑renewal option to retain clients. The linked article “The Future of Subscription Finance” expands on how Stripe’s Revenue Recognition module helps businesses navigate complex billing scenarios.

4. Financing: Smarter, Faster, Smarter

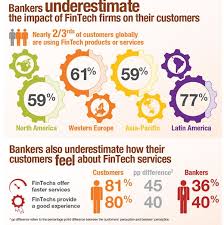

Financing remains a critical hurdle for many small businesses. TechBullion introduces a range of fintech‑backed funding models, moving beyond the traditional bank loan.

4.1 Invoice Factoring & Dynamic Discounting

“Baker’s Bakery”—an artisan bakery—turns to invoice factoring via Fundbox. By selling its outstanding invoices at a discount, the bakery received cash within hours, allowing it to invest in a new commercial oven without waiting months for payments. The article notes that factoring can increase liquidity by up to 30% in a 90‑day cycle.

4.2 Alternative Lenders & Peer‑to‑Peer

Linked references to Kabbage, OnDeck, and Funding Circle demonstrate the rise of alternative lenders that use data analytics to assess risk. A featured case of a local landscaping business, “GreenScape,” secured a $25,000 loan from OnDeck with an underwriting process that completed in just 5 minutes—an impossible feat with a traditional bank.

4.3 AI‑Driven Credit Scores

The article explores how fintech firms use alternative data (like bank balances, payment history, and even social media engagement) to generate AI‑based credit scores. This new paradigm is democratizing credit for micro‑SMEs that previously fell outside the conventional credit score radar.

5. Bookkeeping & Expense Management: Automation at Its Best

In the “Finance Ops” section, TechBullion details how small businesses are employing expense‑management tools such as Expensify and Concur to automate receipt capture, mileage logs, and employee reimbursements. One highlighted success story is “Urban Outfitters”, a pop‑up retail shop that cut its expense processing time from 7 days to 3 hours by embedding Expensify into its workflow.

The article also highlights AI‑driven fraud detection. By flagging anomalies in spending patterns, small businesses can pre‑emptively address potential fraud—an essential safeguard when working with numerous vendors.

6. Challenges and Considerations

While fintech promises a bright future, the article remains candid about implementation hurdles:

Integration Complexity: Small firms may lack the technical know-how to connect multiple APIs. The article cites a linked guide—“How to Choose the Right FinTech Partner”—which recommends starting with a single platform that offers “one‑stop” banking, payments, and funding.

Regulatory Compliance: FinTech providers must adhere to PCI‑DSS for payments and GDPR/CCPA for data protection. The article encourages businesses to verify that their chosen fintech partner complies with local regulations.

Cost‑Effectiveness: Not all fintech solutions are free. While many charge per transaction or a monthly fee, businesses should calculate the total cost of ownership versus the savings achieved in time and operational friction.

7. Future Outlook: AI, Blockchain, and Beyond

TechBullion’s article concludes with a forward‑looking perspective. It points to AI‑based forecasting tools—like Zest AI—that provide predictive cash‑flow analytics, and blockchain‑driven smart contracts that could automate vendor payments upon delivery confirmation. An associated link—“Blockchain for Small Business: Risks and Rewards”—delves deeper into how these technologies can further streamline operations.

Key Takeaways

- Digital banking and integrated accounting reduce bookkeeping headaches and bank fees.

- Payment processors are not just transaction platforms; they offer financing, loyalty programs, and subscription billing.

- Alternative financing (factoring, AI‑based credit) unlocks liquidity faster than traditional banks.

- Expense automation saves hours each week and strengthens fraud protection.

- Choosing the right fintech partner is critical; start with one platform that covers multiple needs to minimize integration woes.

- Regulation and security remain top concerns—verify compliance before signing on.

In summary, the TechBullion feature demonstrates that fintech is no longer a futuristic concept—it's an everyday necessity for small businesses striving for agility, transparency, and growth. By sharing real experiences and linking to deeper resources, the article equips readers with both the evidence and the roadmap to embrace the financial tech revolution.

Read the Full Impacts Article at:

[ https://techbullion.com/how-fintech-solutions-transform-small-business-finances-real-experiences/ ]