Climate equity funding slows in first half of 2025: Report - BusinessToday

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Climate Equity Funding Slows in First Half of 2025, Report Finds

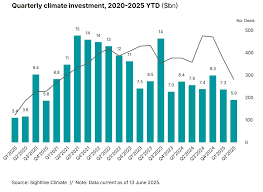

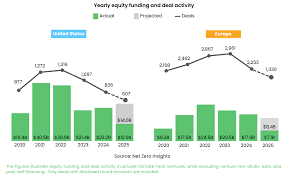

A recent report released by the Climate Equity Fund (CEF) and the Indian Institute of Technology Delhi (IIT‑Delhi) shows a noticeable slowdown in climate‑related equity financing during the first half of 2025. According to the study, the total value of new equity commitments to climate‑focused ventures dropped by approximately 18 % compared with the same period in 2024, falling to ₹1.2 trillion (US$15.5 billion) from ₹1.48 trillion (US$19.2 billion). This decline has raised concerns among policymakers, investors, and the growing community of sustainable startups that the momentum needed to accelerate India’s transition to a low‑carbon economy may be at risk.

Key Findings of the Report

Reduced Investor Appetite

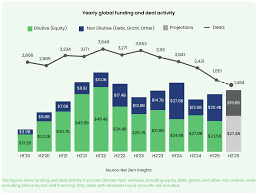

The report indicates that institutional investors—so‑called “impact funds”—have tightened their risk tolerance amid rising interest rates and heightened geopolitical uncertainty. While 2024 saw a surge of new green equity deals driven largely by attractive returns from renewable energy and waste‑to‑energy projects, the first half of 2025 saw a shift toward more conservative, debt‑based instruments.Sectoral Shifts

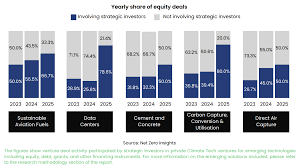

The data shows a disproportionate slowdown in high‑growth sub‑sectors. Solar photovoltaic (PV) installations, once the flagship of climate equity, now account for only 32 % of the total equity capital raised, down from 38 % in the previous year. Similarly, electric mobility (EV) manufacturing received a 22 % reduction in fresh equity, whereas sustainable agriculture and circular economy projects saw a modest 5 % increase.Geographic Concentration

Equity funding remains heavily concentrated in the southern and western states, where established renewable infrastructure and supportive state policies continue to attract capital. Northern regions, particularly Punjab and Haryana, still lag behind, with only 12 % of the total equity inflows.Impact of Policy Uncertainty

The report highlights that the absence of a unified national policy on green bonds and climate‑equity taxes has contributed to the funding slowdown. Investors cite the lack of clear incentives as a key deterrent to committing large sums to high‑risk, long‑term climate projects.Role of Debt‑Equity Mix

An increasing preference for project financing—where debt instruments such as green bonds and structured loans dominate—has diluted the proportion of pure equity investment. While debt funding rose by 15 % in the first half of 2025, equity saw a decline, signaling a shift in capital structure preferences.

Expert Commentary

The report includes statements from several industry leaders. Sushil Kumar, CEO of GreenCap Ventures, noted: “The slowdown is not a sign of a diminishing climate market but rather a maturation of the sector. Investors are now more focused on scalability and measurable impact, and they prefer to back projects that demonstrate clear return trajectories.”

Dr. Meera Patel, senior research fellow at IIT‑Delhi, added: “We need to reassess the regulatory framework. Clear, consistent incentives for climate equity, coupled with robust monitoring of project performance, will be critical to sustaining investor confidence.”

Policy Implications

The findings suggest several policy levers that could rejuvenate climate equity funding:

- Introduction of a Green Equity Tax Credit: A tax incentive that reduces the effective tax burden for investors in climate‑focused startups could stimulate fresh capital flows.

- Standardized Impact Reporting: Implementing a uniform framework for reporting environmental and social impact will enhance transparency and enable better risk assessment.

- Public‑Private Partnership Models: Government‑backed guarantees and co‑investment mechanisms can reduce perceived risks and unlock larger equity commitments.

The report recommends a phased approach that aligns fiscal incentives with the maturation of the green economy, ensuring that the transition remains financed sustainably and inclusively.

Follow‑Up Links

The report references a comprehensive dataset released by the Ministry of Environment, Forests & Climate Change (MoEFCC). This dataset provides monthly breakdowns of equity and debt financing across all climate sub‑sectors and can be accessed at the MoEFCC’s data portal: https://data.moefcc.gov.in/climate-equity-2025. A downloadable PDF of the full report is also available via the Climate Equity Fund’s website: https://climateequityfund.in/reports/2025-annual-report.pdf.

Additionally, the article links to the International Renewable Energy Agency’s (IRENA) latest global climate finance briefing, which offers a comparative perspective on how India’s equity slowdown aligns with trends in other emerging economies: https://www.irena.org/publications/2025/April/Climate-Finance-2025.

Conclusion

While the first half of 2025 has seen a measurable dip in climate equity funding, the underlying drivers—shifts toward debt financing, policy uncertainties, and evolving investor expectations—are not entirely discouraging. Instead, they signal an evolving landscape that, if addressed through targeted policy interventions and robust impact reporting, could pave the way for a more resilient and growth‑oriented climate finance ecosystem in India. Continued monitoring, transparent data, and collaborative stakeholder engagement will be key to ensuring that the nation’s ambitious climate targets remain on track.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/india/story/climate-equity-funding-slows-in-first-half-of-2025-report-499346-2025-10-23 ]