The Future of Finance: How AI Trading is Transforming Global Markets

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The Future of Finance: How AI‑Driven Trading is Reshaping Global Markets

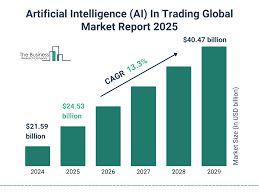

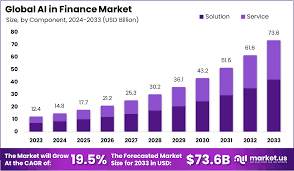

The financial world is in the midst of a technological revolution. A recent piece on TechBullion—“The Future of Finance: How AI Trading is Transforming Global Markets”—charts the trajectory of this shift, offering a concise yet thorough overview of how artificial intelligence (AI) is redefining the way capital flows around the globe. The article underscores that AI is not merely a buzzword; it is a tangible, high‑impact driver of efficiency, risk management, and competitive advantage for institutional investors and retail traders alike.

1. From Rule‑Based Algorithms to Machine‑Learning Models

Historically, algorithmic trading was built on deterministic rules—simple if‑then statements codified in high‑frequency trading (HFT) desks. The TechBullion piece traces how these rules have evolved into sophisticated, data‑driven machine‑learning (ML) models that learn from historical and real‑time market data. It highlights:

- Deep Neural Networks that identify subtle, non‑linear patterns in price movements, volume spikes, and even alternative data such as news sentiment.

- Reinforcement Learning systems that continually adapt their strategies based on market feedback, improving over time without human intervention.

- Ensemble Models that combine multiple approaches, reducing over‑fitting and enhancing robustness.

The article cites firms like Renaissance Technologies, Two Sigma, and Citadel as trailblazers that have integrated these advanced AI models into their core trading engines. By leveraging vast data sets—everything from corporate filings to social media feeds—AI systems can spot market micro‑arbitrage opportunities that would be invisible to traditional models.

2. Speed, Accuracy, and New Market Paradigms

Speed remains a hallmark of AI‑powered trading. HFT firms now execute thousands of orders in milliseconds, slashing execution costs and narrowing bid‑ask spreads. The article emphasizes how AI reduces latency by:

- Predicting Liquidity Needs: Forecasting where and when the market will absorb large orders.

- Pre‑emptive Order Placement: Anticipating order book movements to avoid adverse selection.

Beyond speed, AI enhances accuracy in two critical dimensions:

- Signal Detection: Using natural language processing (NLP) to parse earnings reports, macroeconomic releases, and geopolitical news, allowing traders to act before the market fully digests the information.

- Risk Management: Employing stochastic models that simulate thousands of future market scenarios, providing real‑time VaR (Value at Risk) estimates and stress‑testing portfolios against sudden shocks.

These capabilities have given rise to new market paradigms such as algorithmic market making and predictive market microstructure. The TechBullion article notes that these practices are becoming the default for most institutional traders, blurring the lines between traditional market makers and sophisticated AI bots.

3. The Regulatory Landscape

With great power comes great scrutiny. The article reviews the evolving regulatory environment, focusing on:

- MiFID II (EU) and the Regulatory Technology (RegTech) push in the United States, which demand greater transparency and reporting from algorithmic traders.

- The SEC’s “Algorithmic Trading Oversight” initiative, aimed at curbing flash crashes and ensuring fair market access.

- CFTC’s “Artificial Intelligence and Machine Learning in Futures Markets” guidance, which outlines risk mitigation protocols for algorithmic derivatives trading.

Regulators are grappling with the challenge of enforcing compliance in a system that is constantly learning and adapting. The TechBullion piece argues that this has prompted a surge in AI‑driven compliance tools, which automatically flag suspicious trading patterns and ensure adherence to market rules.

4. Risks and Ethical Considerations

AI’s strengths are mirrored by its pitfalls. The article outlines several risk vectors:

- Flash Crashes: Highly leveraged AI systems can trigger cascading sell‑offs if a single erroneous signal is amplified across the market.

- Market Manipulation: Bots may engage in quote stuffing or spoofing, undermining fair price discovery.

- Bias and Explainability: Machine‑learning models can inherit bias from training data, and their opaque decision processes raise questions about accountability.

To mitigate these risks, the article highlights best practices such as:

- Robust Back‑Testing: Validating models against out‑of‑sample data and stress scenarios.

- Explainable AI (XAI): Implementing tools that provide human‑readable rationales for automated decisions.

- Human Oversight: Maintaining “human‑in‑the‑loop” controls for critical trade decisions.

5. The Future Outlook

Looking ahead, the TechBullion article paints an optimistic but cautious picture. AI will continue to penetrate all layers of finance—from asset management to retail brokerage—driven by democratized data access and increasingly affordable cloud computing. Key trends include:

- Decentralized Finance (DeFi): AI will help manage liquidity pools and yield‑optimizing strategies on blockchain platforms.

- Cross‑Asset AI: Integrated trading across equities, fixed income, commodities, and cryptocurrencies will become routine.

- Sustainable Investing: AI models will evaluate ESG (Environmental, Social, Governance) metrics in real time, allowing investors to align portfolios with climate goals.

At the same time, the article stresses that the human element remains indispensable. As AI automates routine tasks, traders and portfolio managers will shift toward higher‑value activities such as strategy design, risk oversight, and client advisory.

Bottom Line

The TechBullion article provides a balanced narrative: AI trading is already transforming global markets by accelerating execution, enhancing predictive power, and lowering costs. Yet it also warns of systemic risks, regulatory hurdles, and ethical challenges that must be addressed as the technology matures. For investors, technologists, and policymakers alike, the takeaway is clear—embrace the opportunities AI offers, but invest equally in robust governance frameworks that safeguard market integrity.

Key Takeaways

- AI trading has moved beyond deterministic rules to deep, adaptive ML models.

- Speed, accuracy, and real‑time risk management are the main competitive advantages.

- Regulatory bodies are tightening oversight, but the AI market continues to innovate.

- Ethical and risk concerns—flash crashes, manipulation, bias—require ongoing vigilance.

- The future will see deeper integration across asset classes, including DeFi and ESG investing.

With AI at the helm, the global financial ecosystem is poised for a new era of efficiency, insight, and responsibility.

Read the Full Impacts Article at:

[ https://techbullion.com/the-future-of-finance-how-ai-trading-is-transforming-global-markets/ ]