UK Credit Scoring Overhaul to Benefit Borrowers

Locales: England, UNITED KINGDOM

London, UK - February 27th, 2026 - A significant overhaul of credit scoring practices in the United Kingdom is poised to reshape the lending landscape, offering potentially substantial savings for responsible borrowers. After years of focusing primarily on negative financial data, credit reference agencies (CRAs) are now mandated to incorporate positive payment history into creditworthiness assessments. This change, spearheaded by the Financial Conduct Authority (FCA), is expected to unlock access to cheaper loans, mortgages, and credit cards for millions of consumers.

For decades, the UK credit system has been largely defined by what has gone wrong with an individual's finances. Missed payments, defaults, County Court Judgments (CCJs) - these negative markers have dominated credit scores, often overshadowing consistent responsible financial behaviour. This system, while effective at identifying high-risk borrowers, has frequently penalized those who diligently meet their financial obligations. The FCA recognized this imbalance and initiated a review aimed at creating a fairer and more accurate credit assessment process.

The Shift to a Holistic View of Creditworthiness

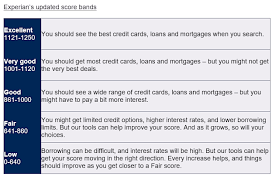

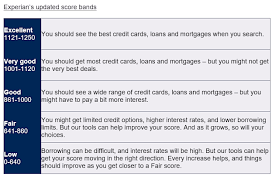

The core of the change lies in the increased sharing of 'positive data'. Previously, CRAs like Experian, Equifax, and TransUnion primarily collected and disseminated information about missed payments and debt. Now, they are actively incorporating data demonstrating consistent on-time bill payments - including utilities, council tax, and rental agreements - into individual credit profiles. This provides lenders with a more comprehensive and nuanced understanding of a borrower's financial responsibility.

"This isn't just a tweak; it's a fundamental shift in how creditworthiness is evaluated," explains financial analyst Sarah Jenkins. "Previously, a spotless negative history wouldn't necessarily translate into a top-tier credit score. Now, consistently demonstrating positive financial habits will be actively rewarded."

How Will This Impact Consumers?

The benefits of this change are expected to be widespread. Consumers who consistently pay their bills on time and manage their debts responsibly should see a noticeable improvement in their credit scores. This, in turn, will translate into more favourable loan terms, including lower interest rates. The savings could be particularly significant for larger purchases like mortgages and car loans.

However, the impact extends beyond simply lowering interest rates. A better credit score opens doors to a wider range of financial products and services. Access to credit can be crucial for unexpected expenses, home improvements, or even starting a business. The change is also anticipated to encourage individuals with less-than-perfect credit histories to actively improve their financial behaviour, knowing that positive actions will be reflected in their scores.

Beyond the Big Three CRAs: Open Banking's Role

While Experian, Equifax, and TransUnion remain the dominant players, the rise of Open Banking is further accelerating the shift towards more comprehensive credit assessments. Open Banking allows consumers to securely share their banking transaction data with third-party lenders. This provides lenders with real-time insights into spending habits and income streams, allowing for even more accurate risk assessments. Several fintech companies are already leveraging Open Banking data to offer innovative lending products tailored to individual circumstances.

Challenges and Considerations

Despite the overwhelmingly positive outlook, some challenges remain. Ensuring data accuracy and security is paramount. The CRAs must invest heavily in infrastructure and data protection measures to prevent fraud and errors. Furthermore, consumers need to be educated about the changes and how to access and understand their credit reports. Several consumer advocacy groups are calling for improved financial literacy programs to help individuals navigate the evolving credit landscape.

There's also the question of inclusivity. While positive data sharing benefits those already engaged with the financial system, it's crucial to ensure that individuals with limited credit histories - such as young people or those new to the country - are not disadvantaged. Alternative data sources, such as rental payment history and utility bills, will be vital in building credit profiles for these individuals.

"This is a crucial step towards a fairer and more transparent credit system," concludes Andrew Hagger of Moneycomms. "But it's not a silver bullet. Continuous monitoring and refinement are necessary to ensure that the benefits are realized by all consumers."

Consumers are encouraged to regularly check their credit reports with all three major CRAs and take advantage of any free credit monitoring services offered by lenders.

Read the Full The Sun Article at:

[ https://www.thesun.co.uk/money/38333731/households-cheaper-loans-credit-score-shake-up/ ]