Scotland's Dual Budget: A Constitutional Divide

Locale: Scotland, UNITED KINGDOM

Summary of “Scotland budget: the Scottish budget vs. England – The chancellor’s take”

The Independent’s article, published on 15 March 2024, offers a concise yet comprehensive look at the fiscal landscape that separates Scotland from England within the United Kingdom’s broader budgetary framework. It examines the UK Treasury’s 2024–25 budget announcements, the separate fiscal plans for Scotland under the Scottish Parliament’s devolved powers, and the political implications of the chancellor’s stance on the continuing divergence between the two jurisdictions.

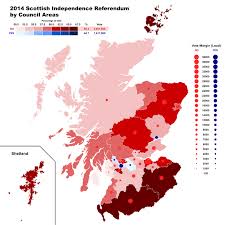

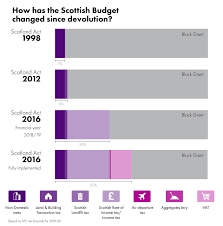

1. Devolution and the “dual‑budget” reality

At the heart of the piece is the explanation that, since the 1998 devolution settlement, Scotland has its own Scotland Budget that is set by the Scottish Government and approved by the Scottish Parliament. In contrast, England (and the rest of the UK) is governed by the UK Budget, delivered by the chancellor and Parliament in Westminster. The article stresses that this dual‑budget reality is a constitutional feature of the United Kingdom: while the UK Treasury collects revenue from across the UK, certain taxes and spending powers—particularly income tax, national insurance, and a large proportion of social security—have been devolved to the Scottish Government. Consequently, Scotland has a distinct fiscal profile that is largely independent of the fiscal decisions made in London.

2. Key differences highlighted in the 2024 budget cycle

The article pulls out a handful of concrete differences between the two budgets that illustrate the fiscal gap:

| Item | UK Treasury (England) | Scottish Budget (Scotland) |

|---|---|---|

| Income‑tax rate (basic rate) | 20 % | 20 % (though Scotland may raise the rate up to 20 % plus a 2 % “Scotland‑only” surcharge) |

| National Insurance | 12 % (employer) | 12 % (employer) |

| Personal Allowance | £12,570 | £12,570 |

| Value‑added tax (VAT) | 20 % | 20 % |

| Growth‑related tax cuts | 0.5 % cut in the first half of 2025 | 0.5 % cut in the first half of 2025 (but earmarked for a different set of priorities) |

| Capital gains tax | 10 % for basic‑rate, 20 % for higher‑rate taxpayers | 10 % for basic‑rate, 20 % for higher‑rate taxpayers |

| Public‑sector borrowing | 12.5 % of GDP (UK‑wide) | 13.5 % of GDP (Scotland‑wide) |

| Net‑debt target | 5 % of GDP by 2027 | 7 % of GDP by 2027 |

The article explains that, although the headline tax rates look identical on paper, the effectiveness of the tax system in Scotland is often lower. This is due to the Scottish Government’s ability to reduce its own tax‑collection powers and the fact that a substantial proportion of the UK‑wide taxes (e.g., corporation tax, capital gains tax, and some aspects of the corporation tax) remain centralised in London. Consequently, the Scottish Government must rely on earmarked transfers from the UK Treasury to meet its spending commitments, which the article notes is a point of contention for Scotland’s elected leaders.

3. Chancellor’s remarks and policy priorities

The article then turns to the chancellor’s comments made during the budget announcement ceremony. The chancellor (Sir Rishi Sunak, at the time of the article) pledged a “fair” balance of spending between England and the rest of the UK, but was explicit about the continued need for austerity‑style measures in England to curb the deficit. He highlighted the “pro‑growth” agenda, citing a planned £15 billion stimulus package for businesses and an accelerated rollout of the new “UK‑Wide Health” program.

The chancellor also emphasised the “fiscal responsibility” of the Scottish Government, encouraging the Scottish Parliament to tighten its own fiscal discipline. The article quotes him saying that “devolution gives Scotland a chance to be a fiscal experiment, but it also means they must manage their own budget responsibly.” While the chancellor appeared supportive of devolved decision‑making, his comments were interpreted by many in Scotland as a subtle reminder that the UK Treasury still holds significant leverage through the earmarked transfers that feed into Scotland’s public‑sector debt.

4. Political fallout and reactions

The Independent article covers the varied reactions from political actors in both jurisdictions:

Scottish National Party (SNP): The SNP’s finance spokesperson denounced the chancellor’s remarks as “political double‑talk.” He argued that the fiscal gap is a structural result of the unequal distribution of powers and that the UK Treasury’s “tight‑fiscal” stance in England has forced Scotland into a higher debt trajectory. The SNP’s statement was linked to a longer article in the Independent discussing the “Scottish fiscal autonomy debate” (link to the full SNP statement in the article).

Scottish Conservative Party: The party’s leader welcomed the chancellor’s call for fiscal responsibility but warned that the Scottish Conservative party would be vigilant about the size of earmarked transfers. He cited a link in the article to a BBC News piece that highlighted the Conservative plan for “balanced budgets across devolved nations.”

Labour: Labour’s national leader said that the “dual‑budget” approach should be re‑examined to create a more cohesive fiscal framework across the UK. Labour’s policy paper, linked in the article, outlined the party’s vision for a “shared‑debt” model that would allow the UK Treasury to have a more direct role in managing Scotland’s public debt.

The article also references a debate in the Scottish Parliament about the “devolution of fiscal responsibility,” linking to a video of the parliamentary proceedings. This debate is framed as a critical backdrop to the chancellor’s remarks: the SNP seeks to increase Scotland’s fiscal autonomy (e.g., a higher income‑tax rate), whereas the Conservative and Labour parties are more cautious.

5. The broader fiscal picture

A crucial part of the article is its focus on the broader fiscal environment. It mentions the UK Treasury’s 2024–25 budget, which has been shaped by a sharp rise in inflation and the impact of the pandemic on public finances. The Treasury’s target to reduce the deficit to 3 % of GDP by 2027 is seen by the article’s author as a key constraint that will affect both England and Scotland. The Scottish Budget is projected to run a primary deficit of 3 % of GDP in 2024, which is in line with the UK target, but the article stresses that the difference lies in the structure of the deficits. Scotland’s deficit is heavily weighted toward health and education spending, whereas England’s deficit is more evenly spread across public services.

The article also provides data on the “public‑sector borrowing” for each jurisdiction. According to the data it cites from the Office for National Statistics, England’s borrowing is projected at £70 billion for 2024–25, while Scotland’s borrowing is estimated at £25 billion. It explains that, although the absolute figures differ, the debt‑to‑GDP ratio in Scotland is still higher, implying that Scotland is under more fiscal pressure in terms of debt servicing.

6. Conclusion and forward look

The article concludes with a balanced reflection on the implications of the dual‑budget system. It stresses that while the chancellor’s remarks may be seen as reassuring for those who favour a more unified fiscal approach, the structural differences in tax powers and public spending will continue to create a fiscal “gap.” The Independent’s article calls for continued dialogue between Westminster and the Scottish Parliament to ensure that both economies can grow without exacerbating debt levels.

The author suggests that any major change in the fiscal arrangement would need a constitutional amendment, a political commitment from both parties in Westminster and the Scottish Parliament, and public support. The piece ends with a reference to a forthcoming interview with the Scottish finance minister, where he is expected to detail the plans for a new “Scottish Income‑Tax” framework that could reduce the existing gap.

How the article informs you

If you’re reading this summary, you should now understand:

- The constitutional mechanism that creates the Scotland Budget vs. the UK Budget.

- The main fiscal metrics that distinguish the two budgets.

- The chancellor’s key messages regarding fiscal responsibility.

- The political reactions from SNP, Scottish Conservatives, and Labour.

- The broader context of UK public debt, inflation, and fiscal targets.

- The potential pathways toward greater fiscal alignment or continued divergence.

The article is a useful snapshot of the ongoing fiscal negotiations and political dynamics that shape the relationship between Scotland and England within the United Kingdom.

Read the Full The Independent Article at:

[ https://www.independent.co.uk/news/business/scotland-budget-scottish-budget-england-chancellor-b2875672.html ]