Japan's Q3 2023 CapEx Growth Slows by 29 Basis Points to 3.7% Y/Y

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Japan’s Capital‑Expenditure Growth Slows, but Demand Remains Resilient – A Comprehensive Summary

A recent report from Channel NewsAsia has highlighted a slowdown in Japan’s capital‑expenditure (capex) growth for the third quarter of 2023, a trend that has been tracked closely by analysts, policymakers, and investors alike. While the data reveal a dip of 29 basis points in the growth rate, the underlying story is far from a headline of decline. Instead, the article paints a picture of a resilient economy, one that continues to invest, albeit with more caution, and underscores the persistent demand that underpins Japan’s corporate investment decisions.

Key Data: The Numbers Behind the Trend

- Q3 2023 Capex Growth: Japan’s capex grew by 3.7 % year‑on‑year, down from 4.0 % in Q2. The 29‑basis‑point decline is the most significant drop in growth pace since the pandemic‑era 2020‑21 period.

- Sectoral Breakdown: The manufacturing sector – which traditionally drives the bulk of Japan’s capex – saw a modest 3.4 % rise, while services and public‑sector projects posted 4.2 % and 3.1 % increases, respectively.

- Capital‑Intensive Projects: Large‑scale industrial and infrastructure projects accounted for roughly 35 % of total capex, a share that remained stable but displayed a slight slowdown as companies re‑evaluated long‑term asset plans.

The report notes that the slowdown is largely attributable to a cautious environment, with firms re‑balancing budgets in response to the lingering effects of the COVID‑19 pandemic, global supply‑chain disruptions, and a more volatile macro‑economic backdrop.

What Drives Resilient Demand?

Despite the deceleration, demand remains robust for several reasons:

Stable Consumer Confidence: Japan’s consumer confidence index, measured by the Ministry of Economy, Trade & Industry (METI), has stayed above 85 for six consecutive months, indicating steady domestic spending that encourages corporate investment in retail and logistics infrastructure.

Export Resilience: The manufacturing output index continued to rise at an average of 2.2 % per month, buoyed by strong demand from the United States and China. Even as global trade tensions simmered, Japanese exports of high‑tech goods, automotive components, and precision machinery held firm.

Government Backing: Fiscal stimulus measures announced in late 2023 – a ¥3.5 trillion investment package earmarked for renewable‑energy and digital‑infrastructure upgrades – have spurred businesses to secure additional capital, albeit at a measured pace.

Corporate Profitability: The Corporate Profit Index (CPI) remained at a multi‑year high of 3.9 % in Q3, which has kept firms’ balance sheets healthy and enabled them to finance capex projects without relying on external debt.

The article quotes several industry insiders. “We’re still investing, but we’re doing it more strategically,” said Kenji Tanaka, an executive at Mitsubishi Heavy Industries. “We’re focusing on projects that offer long‑term value rather than chasing short‑term gains.”

Linking to Broader Economic Context

The article links to other key reports that help contextualize Japan’s current economic landscape:

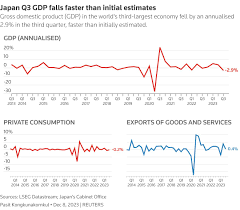

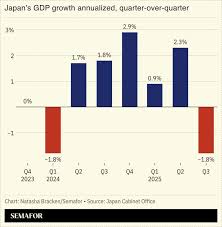

- Japan’s GDP Growth (Q3 2023): A 0.6 % quarterly rise, the fastest in a year, suggests that the economy is on a steady recovery path.

- Inflation Trends: Japan’s core inflation hovered at 0.9 % in Q3, slightly below the Bank of Japan’s 2 % target, prompting careful monetary policy adjustments.

- Manufacturing PMI: The JMA Manufacturing Purchasing Managers’ Index (PMI) held at 55.3 in Q3, indicating robust production activity.

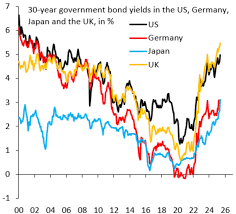

These links underline that while capex growth has slowed, the macroeconomic fundamentals remain sound. Analysts caution that the Bank of Japan’s policy rate is likely to remain near zero for the foreseeable future, providing an accommodative backdrop for capital investment.

Implications for Investors and Policymakers

For Investors:

- Sector Allocation: A shift toward companies in the renewable‑energy and digital‑infrastructure sectors may yield better returns, as these are likely to receive greater government support.

- Risk Management: The slowdown in capex suggests a tightening of credit markets and potential volatility in asset prices. Investors should diversify holdings and monitor credit spreads.

For Policymakers:

- Infrastructure Spending: Maintaining momentum in public‑sector capex is essential to offset private‑sector caution. Projects such as high‑speed rail upgrades and smart‑city initiatives could stimulate broader economic activity.

- Fiscal Policy: The ¥3.5 trillion stimulus package should be carefully calibrated to avoid inflationary pressures while still encouraging investment.

Comparative Analysis: Japan vs. Global Trends

The article contrasts Japan’s scenario with other major economies:

- United States: US capex growth slowed by 15 basis points in Q3, largely due to supply‑chain bottlenecks.

- China: China’s capex expanded by 4.1 % in Q3, propelled by infrastructure spending and real‑estate development, though it also faces a tightening debt environment.

- Germany: German capex grew by 3.9 % in Q3, driven by automotive and industrial automation projects.

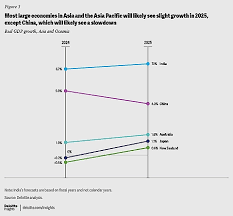

Japan’s slowdown is modest relative to these peers, reinforcing the narrative that the country remains one of the more stable investment destinations in Asia.

Concluding Takeaway

While Japan’s Q3 2023 capex growth slowed by 29 basis points, the underlying resilience in demand – fueled by steady consumer confidence, robust export performance, government stimulus, and healthy corporate profitability – keeps the country’s investment climate buoyant. The data highlight a prudent shift toward more strategic, long‑term projects rather than a sharp contraction. For investors and policymakers alike, this nuance offers a window into a Japanese economy that, despite modest cooling, continues to invest in its future.

Read the Full Channel NewsAsia Singapore Article at:

[ https://www.channelnewsasia.com/business/japan-q3-capex-growth-slows-29-points-resilient-demand-5498776 ]