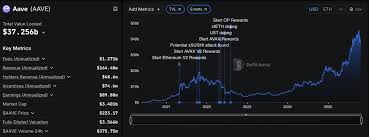

Aave expands consumer DeFi footprint with Stable Finance acquisition

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The Acquisition Deal

At its core, the transaction involves Aave Labs purchasing the rights to use Stable Finance’s stablecoin tokens. Stable Finance, known for issuing a range of fiat‑backed cryptocurrencies, had developed several stablecoins pegged to major currencies, including the US Dollar, Euro, and British Pound. While the precise financial terms of the agreement were not disclosed, Aave’s spokesperson emphasized that the acquisition aligns with its long‑term strategy of expanding its DeFi lending products.

The stablecoins at the center of the deal—such as USDC, DAI, and Tether’s USDT—are among the most widely used in the crypto ecosystem. These tokens serve as the backbone of many DeFi protocols, providing a reliable, low‑volatility medium of exchange that enables borrowing, lending, and staking activities across the network. By integrating Stable Finance’s stablecoins, Aave aims to offer users an expanded array of collateral choices, thereby enhancing liquidity and reducing the risk of undercollateralization.

Why Aave Wants More Stablecoins

Aave’s current product lineup already supports a variety of stablecoins, including USDC and DAI, which are listed as top lending assets on the protocol’s official site. The addition of Stable Finance’s stablecoins will complement Aave’s existing offerings and could drive further adoption among institutional and retail participants who value diversification across multiple stablecoin providers. Moreover, Aave has long positioned itself as a leader in decentralized lending, and the expansion of its stablecoin portfolio is a natural fit for its mission to democratize finance.

According to the Cointelegraph article, Aave’s CEO noted that the partnership will enable “more flexible borrowing options” and “improved liquidity for users.” By providing a larger set of collateral types, Aave can lower the borrowing costs for users and reduce the protocol’s overall risk exposure. This is particularly relevant in a market where stablecoin prices can occasionally diverge from their peg, a phenomenon that can create volatility for DeFi protocols that rely heavily on stablecoin collateral.

The Stable Finance Background

Stable Finance has built a reputation for issuing stablecoins backed by diversified fiat assets. Their tokens are collateralized by reserves stored in reputable custodial accounts, and the company employs rigorous auditing practices to maintain transparency. By acquiring Stable Finance’s stablecoins, Aave can tap into a well‑established ecosystem of stablecoins that are already trusted by a broad user base.

The acquisition also dovetails with a broader trend of consolidation in the stablecoin market. While USDC and USDT dominate market share, newer stablecoins such as BUSD, FRAX, and others are gaining traction. Aave’s expansion into Stable Finance’s stablecoins could help it stay competitive as the DeFi space continues to mature.

Implications for the DeFi Community

The deal could have several ripple effects throughout the DeFi community:

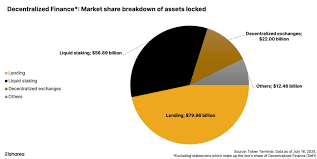

- Increased Liquidity – By offering more stablecoin options, Aave can attract additional liquidity providers, which could lower borrowing rates and increase overall platform usage.

- Risk Management – Diversification across stablecoins can reduce the protocol’s exposure to a single issuer’s risk. In the event of a peg failure, Aave can rely on its broader set of collateral options.

- Cross‑Chain Opportunities – Stable Finance has expressed interest in cross‑chain deployments. Aave could leverage these capabilities to bring stablecoins onto other blockchains, enhancing interoperability.

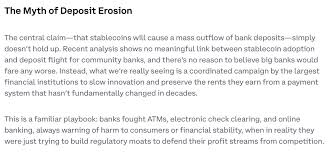

- Regulatory Alignment – Stable Finance’s compliance‑heavy approach could provide Aave with a stronger regulatory footing, a critical factor as global regulators intensify scrutiny of crypto markets.

Future Steps and Integration Plans

While the article did not disclose the timeline for the integration, it indicated that Aave will start listing the newly acquired stablecoins on its lending market within the next few months. The platform will also update its user interface to allow borrowers to use these tokens as collateral or to earn interest. Aave’s developers are reportedly working on smart‑contract upgrades that will support the new stablecoins while maintaining the protocol’s security and efficiency.

Additionally, the acquisition opens doors for collaborative projects with Stable Finance’s existing partners. Aave could explore joint ventures that provide staking rewards or yield‑optimizing strategies for stablecoin holders. The collaboration could also foster innovations in algorithmic stablecoin design, offering more efficient or secure pegging mechanisms.

Key Takeaways

- Aave Labs has acquired the stablecoins issued by Stable Finance, including major tokens like USDC, DAI, and USDT.

- The deal is positioned as a strategic move to diversify collateral options, improve liquidity, and reduce risk exposure for Aave’s users.

- Stable Finance’s reputation for rigorous auditing and diversified fiat backing enhances the stability and trustworthiness of the integrated stablecoins.

- The acquisition aligns with broader consolidation trends in the stablecoin market and could give Aave a competitive edge as DeFi continues to grow.

- Future integration plans include listing the stablecoins on Aave’s lending market, updating user interfaces, and potentially exploring cross‑chain and collaborative initiatives.

In summary, Aave’s acquisition of Stable Finance’s stablecoins is a significant development that underscores the protocol’s commitment to expanding its stablecoin ecosystem and strengthening its position as a premier decentralized lending platform. The move not only enhances user experience by offering more collateral choices but also bolsters the protocol’s resilience in a market where stablecoins play an indispensable role.

Read the Full CoinTelegraph Article at:

[ https://cointelegraph.com/news/aave-labs-acquires-stable-finance-stablecoins ]