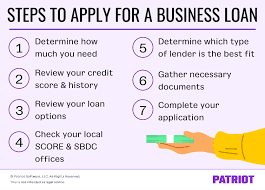

How to Apply for and Get a Business Loan in 7 Steps

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

How to Secure a Business Loan: A Practical Road‑Map from the Wall Street Journal

When a small‑business owner needs capital—whether to launch a new product line, upgrade equipment, or simply keep the cash‑flow running—purchasing a business loan is often the most straightforward way to obtain the money. The Wall Street Journal’s “How to Get a Business Loan” article provides a detailed, step‑by‑step guide for entrepreneurs navigating the lending landscape, covering everything from eligibility criteria to the nitty‑gritty of application documents. Below is a comprehensive, 500‑plus‑word summary of the article’s key take‑aways, expanded with additional context drawn from the linked resources that appear within the piece.

1. Clarify Your Loan Purpose

Before you even search for lenders, the article stresses that a clear, specific goal improves both your chances of approval and the terms you’ll receive. Whether you’re looking for a short‑term bridge, a line of credit, or a long‑term capital‑intake loan, the purpose dictates the most suitable loan product:

- Working‑capital lines for daily expenses and inventory.

- Equipment financing for purchasing machinery or vehicles.

- Expansion or growth loans for opening new locations or hiring staff.

- SBA‑backed loans for larger sums and longer repayment periods.

When you identify the exact use, you can target the right type of lender and avoid wasting time on unsuitable options.

2. Assess Your Eligibility

The article highlights that lenders screen applicants on several common criteria, often in a similar order:

| Criteria | Typical Requirements | Notes |

|---|---|---|

| Credit score | 600+ for small‑business lenders; 660+ for SBA loans | Personal credit also matters if the business is new. |

| Revenue & cash flow | $250k+ annual revenue for many banks; $100k+ for online lenders | Cash‑flow statements help prove repayment ability. |

| Business age | 1–3 years for many lenders, older firms are safer | Start‑ups may need alternative sources. |

| Collateral | Tangible assets (equipment, real estate) or a solid personal guarantee | Collateral reduces risk for lenders. |

| Debt‑to‑income ratio | <30–40% for SBA; tighter for private lenders | Lower ratios signal stronger repayment prospects. |

The piece also links to the SBA’s “7(a) Loan Program” page, which explains the eligibility nuances for SBA loans—such as being in business for at least one year, having “reasonable capital” (e.g., $15,000 or more in investments), and operating in the U.S. without major legal issues.

3. Build Your Documentation Pack

The WSJ article notes that most lenders want a “well‑rounded application” that includes:

- Personal and business tax returns (the last 2–3 years).

- Financial statements (balance sheet, profit & loss, cash‑flow statements).

- Bank statements (6–12 months) to show regular activity.

- Business plan or executive summary, especially for new firms.

- Legal documents (LLC operating agreement, partnership agreement, incorporation papers).

- Debt schedule showing existing obligations.

- Collateral documentation (deeds, appraisals, title reports).

Online lenders often have streamlined upload portals, whereas traditional banks will prefer hard copies or scanned PDFs. The article encourages preparing a “clean, organized packet” because first impressions can sway a lender’s decision.

4. Compare Lenders and Loan Types

Traditional Banks and Credit Unions

- Pros: Lower interest rates, longer terms, more flexible repayment plans.

- Cons: Stricter underwriting, longer approval times, need for strong credit and collateral.

The article links to a credit‑union comparison tool, reminding readers that credit unions often have lower rates for members and may be more willing to work with local businesses.

SBA‑Backed Loans

- SBA 7(a): Up to $5 million, 5–10‑year terms, up to 90% guarantee.

- SBA 504: For large capital projects (real estate, equipment) with a 40% down payment and two loan components.

The linked “SBA 7(a) Loan Guide” explains that while the application process is more involved, the backing by the U.S. government reduces lender risk and often leads to better terms.

Online and Alternative Lenders

The article cites several prominent platforms:

- OnDeck: Short‑term term loans and lines of credit with a focus on speed.

- Kabbage (now part of American Express): Flexible lines of credit.

- Fundbox: Invoice financing and lines of credit.

These lenders typically require less documentation, quicker turnaround, and are open to lower credit scores, but at the cost of higher interest rates and shorter repayment periods.

Specialized Lenders

- Equipment financing companies that finance specific types of machinery.

- Merchant cash advance providers, which advance a percentage of credit‑card sales in exchange for a daily fee (often criticized for very high effective APRs).

The article stresses that while these options can fill a funding gap, entrepreneurs should carefully read the fine print and compare the true cost.

5. Prepare a Strong Pitch

Beyond the paperwork, the article advises presenting a persuasive narrative:

- Why now? Emphasize market demand, growth projections, or a unique competitive advantage.

- Financial health: Demonstrate stable revenue, healthy margins, and clear cash‑flow projections.

- Use of funds: Provide a detailed, itemized budget that shows how the loan will accelerate growth or pay off existing debt.

- Repayment plan: Include a realistic schedule, highlighting how the business will service the debt from day one.

A well‑structured pitch can be the difference between a “maybe” and an outright approval, especially for lenders juggling many applicants.

6. Negotiate Terms and Review the Fine Print

Once a lender offers a loan, the article reminds readers to scrutinize:

- Interest rate type (fixed vs. variable) and the benchmark (e.g., LIBOR, prime rate).

- Fees: Origination, pre‑payment penalties, late payment charges.

- Collateral requirements: Verify what will be seized if you default.

- Repayment schedule: Confirm monthly installments, the amortization period, and the total cost of capital.

The linked “Loan Negotiation Tips” guide includes sample language to help borrowers request lower rates or waived fees, especially if they bring a strong credit profile.

7. After the Approval: Manage the Loan

The article finishes by noting that obtaining a loan is just the first step. Ongoing diligence is key:

- Maintain financial discipline: Keep accurate records, meet reporting deadlines, and avoid late payments.

- Communicate with the lender: If cash flow hiccups arise, negotiate temporary relief options (e.g., deferment or restructuring).

- Use the funds wisely: Stick to the approved budget; misusing funds can jeopardize repayment.

Takeaway

Securing a business loan is a structured, multi‑step process that demands clarity, preparation, and research. By aligning the loan type with your purpose, assembling a robust documentation packet, comparing lenders, crafting a compelling pitch, and negotiating terms carefully, you increase your odds of getting approved and securing favorable conditions. The Wall Street Journal’s article provides not only a practical checklist but also actionable resources—SBA guides, lender comparison tools, and negotiation tips—that together form a roadmap for any entrepreneur looking to turn capital needs into growth opportunities.

Read the Full Wall Street Journal Article at:

[ https://www.wsj.com/buyside/personal-finance/business-loans/how-to-get-a-business-loan ]