50/30/20 Rule: Simple Budgeting for Financial Security

Locales: Scotland, N/A, UNITED KINGDOM

London, UK - February 12th, 2026 - In an era of rising costs and economic uncertainty, many individuals are finding it increasingly difficult to manage their personal finances. Debt is a pervasive issue, and the dream of financial security feels further out of reach for many. However, financial experts are advocating a surprisingly simple, yet effective, budgeting method - the 50/30/20 rule - as a key to regaining control and building a secure financial future.

This rule, gaining significant traction in financial literacy campaigns throughout 2025 and early 2026, offers a straightforward framework for allocating income, helping individuals prioritize essential spending, enjoy life's pleasures, and crucially, save for the future. It's designed to be adaptable, acknowledging that life isn't always predictable, but provides a valuable baseline for responsible money management.

Breaking Down the Rule: Needs, Wants, and Savings

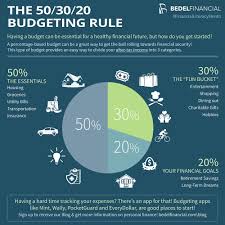

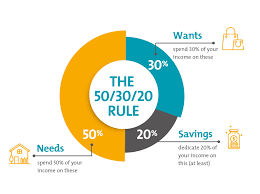

The 50/30/20 rule operates on a simple principle: divide your after-tax income into three distinct categories. Let's explore each one in detail:

50% Needs: This category encompasses all the essential expenses necessary for maintaining a basic standard of living. These are non-negotiable costs that directly impact your ability to function. Examples include housing costs (rent or mortgage payments), utilities (electricity, water, gas, internet), groceries, transportation (public transport, car payments, fuel), healthcare expenses, and essential insurance premiums. In 2026, with ongoing inflationary pressures in certain sectors, accurately assessing 'needs' is more critical than ever. The increasing cost of home energy, for instance, requires careful budgeting within this 50% allocation.

30% Wants: This portion of your income is dedicated to discretionary spending - the things you enjoy but aren't strictly necessary for survival. This includes dining out, entertainment (movies, concerts, streaming services), hobbies, vacations, new clothes (beyond essential replacements), and non-essential subscriptions. While cutting back on 'wants' is often the first step towards financial recovery, completely eliminating them can lead to burnout and a feeling of deprivation. The 30% allocation allows for enjoyable spending within a sustainable framework.

20% Savings and Debt Repayment: This is arguably the most crucial component of the 50/30/20 rule. This 20% should be directed towards building an emergency fund (aim for 3-6 months of living expenses), paying off existing debt (credit cards, loans), and investing for long-term goals like retirement or a down payment on a house. With interest rates remaining relatively high in 2026, prioritizing debt repayment can yield significant savings. Utilizing high-yield savings accounts or exploring diversified investment options within this category is also recommended.

Putting it into Practice: A Real-World Example

Let's consider an individual earning GBP2,500 per month after taxes. Applying the 50/30/20 rule, their budget would look like this:

- Needs (50%): GBP1,250

- Wants (30%): GBP750

- Savings & Debt Repayment (20%): GBP500

Flexibility and Adaptation

It's important to remember that the 50/30/20 rule isn't a rigid dogma. Life happens, and unexpected expenses arise. Some months, you may need to allocate more to 'needs' due to a car repair or medical bill. In such cases, consider temporarily reducing spending in the 'wants' category or adjusting your savings goals. The key is to remain aware of your overall spending and strive to stay as close to the 50/30/20 guideline as possible.

The Growing Appeal in 2026

Financial advisors are seeing a surge in interest in the 50/30/20 rule, particularly among younger generations burdened with student loan debt and facing an increasingly competitive housing market. The simplicity of the rule is a major draw. Unlike complex budgeting spreadsheets or restrictive financial plans, it's easy to understand and implement. Furthermore, its emphasis on both enjoying life and planning for the future resonates with individuals seeking a balanced approach to financial wellness.

While it may not be a magic bullet, the 50/30/20 rule offers a powerful starting point for anyone looking to take control of their finances, avoid debt, and build a more secure future. It's a testament to the idea that even small, consistent changes can have a significant impact on long-term financial health.

Read the Full Daily Record Article at:

[ https://www.dailyrecord.co.uk/lifestyle/money/follow-simple-money-spending-rule-36477532 ]