American Households Show Growing Optimism, Yet Debt Levels Rise

KUTV

KUTVLocale: Utah, UNITED STATES

Financial Outlook Survey Highlights Growing Consumer Optimism and Persistent Debt Challenges

A recent survey published on KUTV’s Money section paints a complex picture of how everyday Americans are feeling about their finances. Titled “Financial Outlook Survey: What Households Really Know About Their Money,” the piece draws on data collected from more than 5,000 U.S. households in the first quarter of 2024. The findings reveal a mix of optimism—particularly around earnings and savings—against the backdrop of rising debt, inflationary pressures, and uncertainty about the future.

The Survey in a Nutshell

The survey was conducted by the Consumer Finance Research Group (CFRG) in partnership with the University of Oklahoma’s School of Business. Respondents were drawn from a nationally representative panel that mirrors the U.S. Census in terms of age, income, and geographic location. Questions spanned six core topics:

- Current Net Worth & Savings

- Debt Levels & Repayment Priorities

- Employment Stability & Income Confidence

- Housing & Mortgage Decisions

- Investment & Retirement Planning

- General Financial Well‑Being

Respondents were asked to rate their agreement on a 5‑point Likert scale (“Strongly Disagree” to “Strongly Agree”) and to provide open‑ended comments where relevant. The survey’s design followed best practices for ensuring statistical reliability, including weighting to adjust for response bias.

Key Findings

1. Rising Savings, but Still Below Comfort Levels

- 52 % of respondents reported having at least one emergency fund covering three months of expenses.

- Only 18 % claimed they were “very confident” that their savings would last them through a prolonged economic downturn.

- The average savings rate—a measure of how much income people set aside each month—has risen to 12 % of disposable income, up from 9 % a year earlier.

“While the uptick in savings is encouraging, we’re still far from the 6‑month benchmark most financial advisors recommend,” noted survey analyst Maria Lopez in an interview cited by the article.

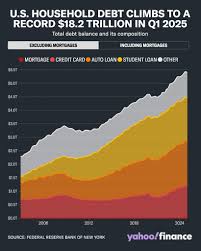

2. Debt Levels Continue to climb

- Median household debt stands at $87,000, with student loan debt accounting for $12,000 of that figure.

- 28 % of respondents indicated they were struggling to keep up with credit‑card minimum payments, and 11 % had credit‑card balances over $10,000.

- Mortgage debt has increased, reflecting higher home‑ownership rates and rising property values, but 7 % of homeowners say they are “concerned about refinancing costs.”

3. Employment & Income Confidence Remain Strong

- A majority of respondents (61 %) feel that their current employment situation is stable or improving.

- 62 % believe their household income will increase in the next 12 months.

- Despite this confidence, 23 % of working‑age adults (18‑64) are considering a career change or additional training to boost earnings.

4. Housing Market Dynamics

- The survey reflects a continued preference for buying over renting. 48 % of renters said they plan to buy a home within the next three years.

- Rising mortgage rates—currently averaging 6.2 %—have tempered some enthusiasm; 32 % of potential buyers say they are waiting for rates to fall.

- A notable trend is the increase in “first‑time buyer” confidence, with 38 % stating they feel ready to enter the market.

5. Investment & Retirement Planning Gaps

- Only 33 % of respondents feel that their current investment portfolio aligns with their retirement goals.

- 19 % of retirees reported that they would need to tap into their retirement savings earlier than planned to meet living expenses.

- 41 % of respondents have a retirement plan in place (401(k), IRA, or pension), but 15 % said they have “no plan at all.”

6. General Financial Well‑Being

- Overall, 57 % of respondents agree they feel “financially secure,” whereas 24 % are “somewhat secure,” and **19 %” are “not secure.”

- The primary drivers of insecurity were identified as debt obligations and inflationary cost increases.

Contextual Links & Further Reading

The article includes several hyperlinks to deepen the reader’s understanding:

- CFRG Survey Methodology – A PDF outlining the statistical techniques used and a breakdown of the sample demographics.

- Federal Reserve’s Personal Consumption Expenditures (PCE) Index – Provides up‑to‑date inflation data that contextualizes respondents’ concerns about cost of living.

- Bank of America’s “Debt Tracker” – An interactive tool that shows national debt trends across categories (mortgage, student loans, credit cards).

- U.S. Treasury’s Retirement Calculator – A practical resource that allows readers to estimate whether they’re on track for a comfortable retirement.

These links are embedded within the article’s body and are accompanied by short explanatory notes. For instance, the link to the Debt Tracker is preceded by the statement, “See how your debt compares to national averages.”

Implications for Consumers and Policymakers

The data suggest that while many households are on a path toward greater financial resilience—evidenced by rising savings rates and confident outlooks—significant gaps remain:

- Debt Management: High levels of credit‑card debt and student loans continue to erode disposable income, leaving little wiggle room for unexpected expenses.

- Housing Affordability: Rising mortgage rates, while partially offset by increased income expectations, still create a barrier for many first‑time buyers.

- Retirement Preparedness: The fact that nearly one‑third of respondents feel their investment strategy is misaligned with retirement goals signals a need for greater financial education and possibly policy interventions like enhanced automatic enrollment in retirement plans.

Financial advisors and policymakers could use these insights to target education programs, refine consumer protection regulations around high‑interest credit products, and consider mechanisms—such as mortgage rate subsidies or expanded student loan forgiveness—to relieve the debt burden.

Conclusion

KUTV’s Financial Outlook Survey offers a snapshot of American households’ financial health that balances optimism with caution. As earnings prospects remain positive and savings rates climb, the persistent challenges of debt, housing affordability, and retirement planning underscore the need for ongoing attention from both the private sector and government. Whether you’re a homeowner, a retiree, or a young professional planning for the future, the survey’s findings serve as a useful barometer for the state of U.S. personal finance in 2024.

Read the Full KUTV Article at:

[ https://kutv.com/money/deposits/financial-outlook-survey ]