Understanding Portfolio Risk: Key Takeaways from the 2025 Sentinel Guide

Locale: Florida, UNITED STATES

Portfolio Risk: What You Need to Know (Orlando Sentinel, November 26, 2025)

— A detailed, 500‑plus‑word summary of the Sentinel’s most recent guide to managing the uncertainties of investing.

1. Why Portfolio Risk Matters

The Sentinel’s “Portfolio Risk” feature opens with a clear reminder: “Risk is the price you pay for the possibility of a higher return.” It underscores that every investment carries some form of uncertainty—whether that’s market volatility, a company’s creditworthiness, or even geopolitical shocks that can wipe out a sector in a single day. For individual investors, the article stresses that understanding risk is not about avoiding all losses, but about matching risk exposure to one’s financial goals, time horizon, and comfort level.

2. The Main Types of Risk Explored

| Risk Type | What It Is | Sentinel Take‑away |

|---|---|---|

| Market (Systemic) Risk | The overall movement of the market that affects most assets. | “Diversification is your first line of defense,” the article notes, pointing out that a well‑diversified portfolio can reduce the impact of a sharp market dip. |

| Credit Risk | The possibility that a bond issuer fails to meet its obligations. | “High‑yield bonds carry higher credit risk; if your credit spread widens, you’ll need to review your exposure.” |

| Liquidity Risk | The chance that an asset can’t be sold quickly without a big price concession. | “During market stress, liquidity dries up; consider assets with a strong secondary market.” |

| Country & Currency Risk | Risks tied to political, economic, or regulatory changes in a particular nation or its currency. | The piece cites the recent volatility in emerging‑market currencies as a prime example. |

| Operational Risk | Internal failures such as fraud or technology glitches. | While hard to quantify, the article reminds investors to stay informed about the governance of the firms they invest in. |

| Regulatory / Systemic Risk | New regulations or systemic failures that can affect large sectors. | “The ‘new normal’ after the 2023 banking crisis means regulators are more vigilant.” |

The article intersperses these categories with real‑world illustrations—how the 2023 collapse of two regional banks exposed a cascade of credit and liquidity risk, and how the sudden spike in U.S. Treasury yields in early 2025 rattled equity portfolios worldwide.

3. Measuring Risk: From Volatility to Value‑at‑Risk

The Sentinel breaks down the most common quantitative tools used by professionals, while keeping the explanations accessible:

- Standard Deviation (Volatility) – “A higher standard deviation signals greater price swings.”

- Beta – “Beta compares your portfolio’s movement to a benchmark like the S&P 500.”

- Value‑at‑Risk (VaR) – “VaR estimates the maximum loss you’re likely to incur over a set period with a given confidence level.”

- Conditional VaR (CVaR) – “A deeper look at tail risk.”

- Stress Testing & Scenario Analysis – “What if the Fed hikes rates by 0.75%? What if a major geopolitical event disrupts supply chains?”

The article stresses that while these metrics are useful, they rely on historical data, and past performance is not always indicative of future risk. The piece also links to the Securities and Exchange Commission (SEC) guidance on risk disclosure for mutual funds, giving readers a resource for further reading.

4. The Role of Asset Allocation and Diversification

One of the Sentinel’s core messages is that “risk can be tamed by balance.” The article recommends a layered approach to diversification:

- Across Asset Classes – Stocks, bonds, real estate, commodities, and alternative investments.

- Geographically – Developed markets, emerging markets, and frontier markets.

- Sectorally – Technology, healthcare, consumer staples, energy, etc.

- By Investment Style – Value, growth, momentum, and income.

The piece provides a visual of a classic “60‑40” portfolio, then shows how adding alternatives like private equity or infrastructure can tilt the risk profile. It also cites recent data that the “risk‑parity” approach has become increasingly popular among institutional investors seeking lower volatility.

5. Managing Risk in the Current Climate

The Sentinel takes a timely look at 2025’s macro backdrop:

- Fed Policy – The Fed’s “tapering cycle” and its effect on bond yields and equity valuations.

- Inflation – Persistent price pressures and how they influence real‑return investments.

- Geopolitical Tensions – The U.S.–China trade friction, the Russia‑Ukraine conflict, and their ripple effects on energy and tech.

- Climate Change – Transition risk in fossil‑fuel‑dependent industries and the growing focus on green bonds.

The article features a short interview with Dr. Emily Chen, a portfolio risk analyst at the University of Florida’s College of Business, who argues that “investors need to incorporate climate‑related risk metrics into their models—just as they do with credit risk.” She points to the Task Force on Climate‑Related Financial Disclosures (TCFD) as a framework that is becoming standard for many funds.

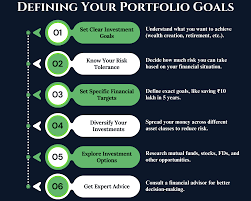

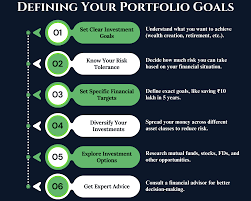

6. Practical Tips and Tools

The Sentinel offers concrete take‑aways for everyday investors:

- Set a Risk Tolerance Framework – Use questionnaires or online calculators to quantify how much volatility you can stomach.

- Rebalance Regularly – Whether it’s quarterly or annually, rebalancing realigns your asset allocation to your target risk level.

- Use Stop‑Loss Orders – For more aggressive traders, a stop‑loss can limit downside, but the article warns of “slippage” during market panics.

- Consider Hedging Strategies – Options, futures, and ETFs can serve as insurance against market downturns.

- Stay Informed – Subscribe to the Sentinel’s “Finance Alerts” and read weekly market summaries.

- Review Fees and Expenses – High expense ratios can erode returns and magnify risk over time.

It also highlights free online tools such as Morningstar’s Portfolio Risk Tool and the FINRA Investor Protection Site for additional education.

7. Expert Voices

- John Martinez, chief investment officer at a regional bank, notes that “in 2025, portfolio managers are looking at ESG (Environmental, Social, Governance) metrics as part of their risk model.”

- Laura Green, a retirement planner, explains how “young investors can tolerate more risk, but as you approach 60, you should gradually shift toward lower‑volatility assets.”

- Sabrina Lee, a data scientist at a fintech startup, describes how machine learning is now used to detect early signs of market stress—though the article cautions that models need constant supervision.

8. Key Take‑aways

- Risk is not a bad thing—it’s the engine of growth.

- Diversification and proper asset allocation are your best defense against sudden shocks.

- Quantitative tools help, but they’re not infallible—understand their assumptions.

- Macroeconomic factors (Fed policy, inflation, geopolitics) will keep shaping risk—stay ahead of the curve.

- Review and adjust your portfolio regularly—risk tolerance can change as your life situation evolves.

- Educate yourself—the more you know, the better your decisions will be.

9. Where to Go Next

The article concludes by linking to a suite of resources: the Sentinel’s own “Investing 101” series, a PDF guide on “Understanding Value‑at‑Risk” from the SEC, and a webinar titled “Navigating Portfolio Risk in a Post‑Pandemic World” hosted by the University of Central Florida’s School of Finance. Readers are also directed to the S&P 500 page for up‑to‑date index data, and to the Bloomberg Terminal for real‑time risk analytics—though the article notes that Bloomberg is a subscription service.

Bottom line: Orlando Sentinel’s “Portfolio Risk” is more than a jargon‑filled primer—it’s a practical roadmap that walks investors through the anatomy of risk, the tools to measure it, and the strategies to tame it. Whether you’re a seasoned portfolio manager or a 30‑year‑old looking to start a retirement account, the article offers actionable insights backed by recent data, expert commentary, and a host of online resources. By integrating these lessons, you can build a portfolio that not only aims for higher returns but also stands resilient in the face of the uncertainties that the next decade will bring.

Read the Full Orlando Sentinel Article at:

[ https://www.orlandosentinel.com/2025/11/26/portfolio-risk/ ]